Bitcoin traded beneath the $67,000 stage amid heightened volatility, triggering a contemporary wave of liquidations throughout the derivatives market. Over the previous 24 hours, greater than $250 million in leveraged positions had been worn out, with lengthy merchants accounting for almost all of compelled closures as value slipped by key intraday help.

The liquidation spike displays mounting strain following Bitcoin’s breakdown on the day by day chart and lack of two-week help, reinforcing the broader technical weak point highlighted by analysts. In opposition to this backdrop, market members are actually intently watching whether or not $BTC can reclaim the $72,000 space, a stage analysts say may shift short-term momentum again in favor of the bulls.

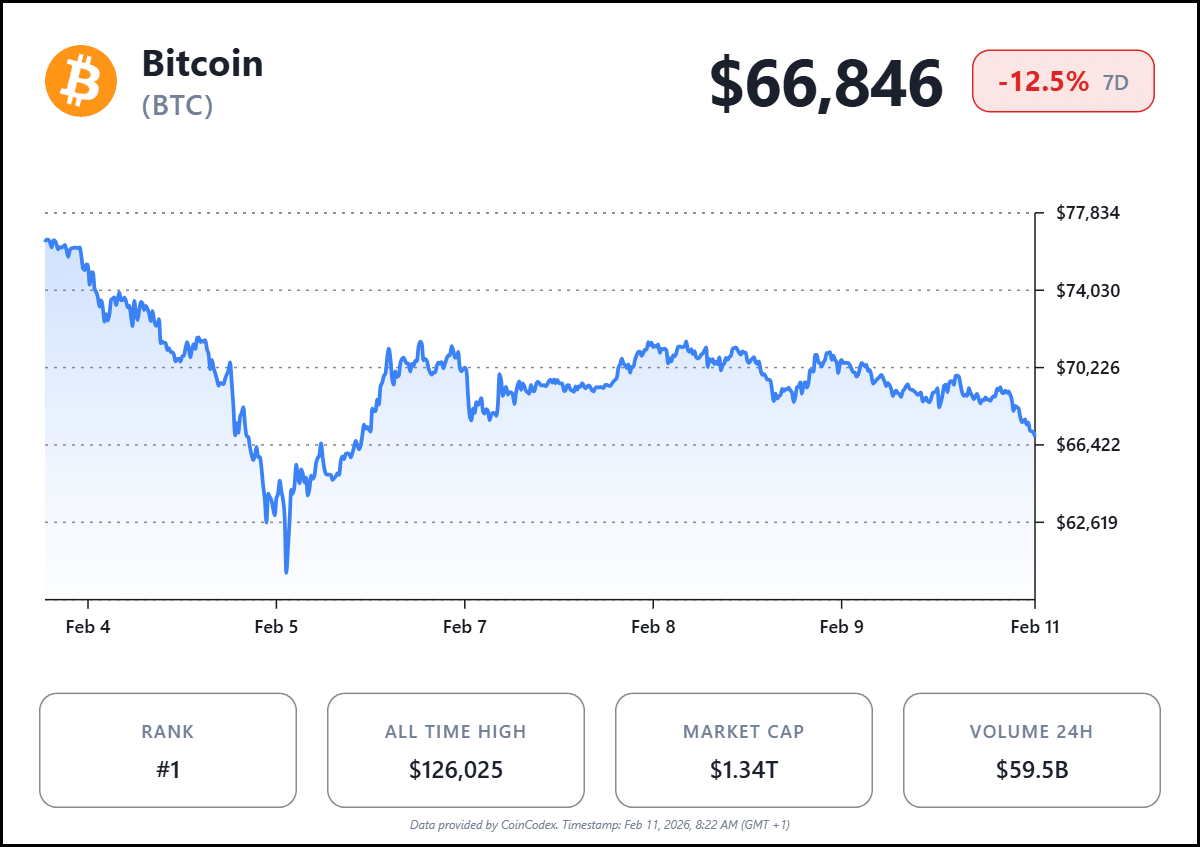

Bitcoin Breaks Key Assist After Double High, Chart Reveals Contracting Triangle

$BTC broke beneath a long-held help stage after forming a double-top sample on the two-week $BTC/USD chart, in response to a TradingView snapshot shared by crypto dealer Dealer Tardigrade (@TATrader_Alan) on X. The chart tracks Bitcoin’s value historical past throughout a number of cycles and marks repeated peaks that failed close to prior highs, adopted by breakdowns by a purple help band. In consequence, value slipped beneath the previous ground and moved right into a contracting triangle, a construction outlined by converging trendlines after a pointy decline.

Bitcoin 2 Week BTCUSD Contracting Triangle Chart. Supply: Dealer Tardigrade by way of X

On the chart, Bitcoin printed two rounded peaks close to prior cycle highs earlier than shedding the identical horizontal help zone that had held throughout earlier consolidations. In each historic cases, value fell by that base after which compressed inside a narrowing vary marked by downward-sloping resistance and rising help. Consequently, the construction shifted from growth to compression, which indicators a pause after heavy promoting strain moderately than a continuation of the prior advance.

On the similar time, the breakdown beneath the help band mirrors earlier cycle conduct proven on the left aspect of the chart, the place Bitcoin misplaced an identical ground earlier than forming a contracting triangle close to the lows. In that prior interval, value stabilized contained in the wedge-like construction earlier than transitioning into a brand new uptrend over the next months. Subsequently, the present sample locations Bitcoin in a comparable part of post-breakdown consolidation, primarily based on the historic analog offered within the chart.

Dealer Tardigrade mentioned the transfer beneath help adopted a double-top formation and framed the current vary as a contracting triangle on the two-week timeframe. The projection on the appropriate aspect of the chart sketches a attainable restoration path after compression, though the chart itself solely reveals the structural comparability between previous cycles and the present setup. As of the snapshot, Bitcoin traded beneath the previous help space whereas value motion continued to coil contained in the narrowing vary, leaving the following directional break depending on how value resolves the triangle.

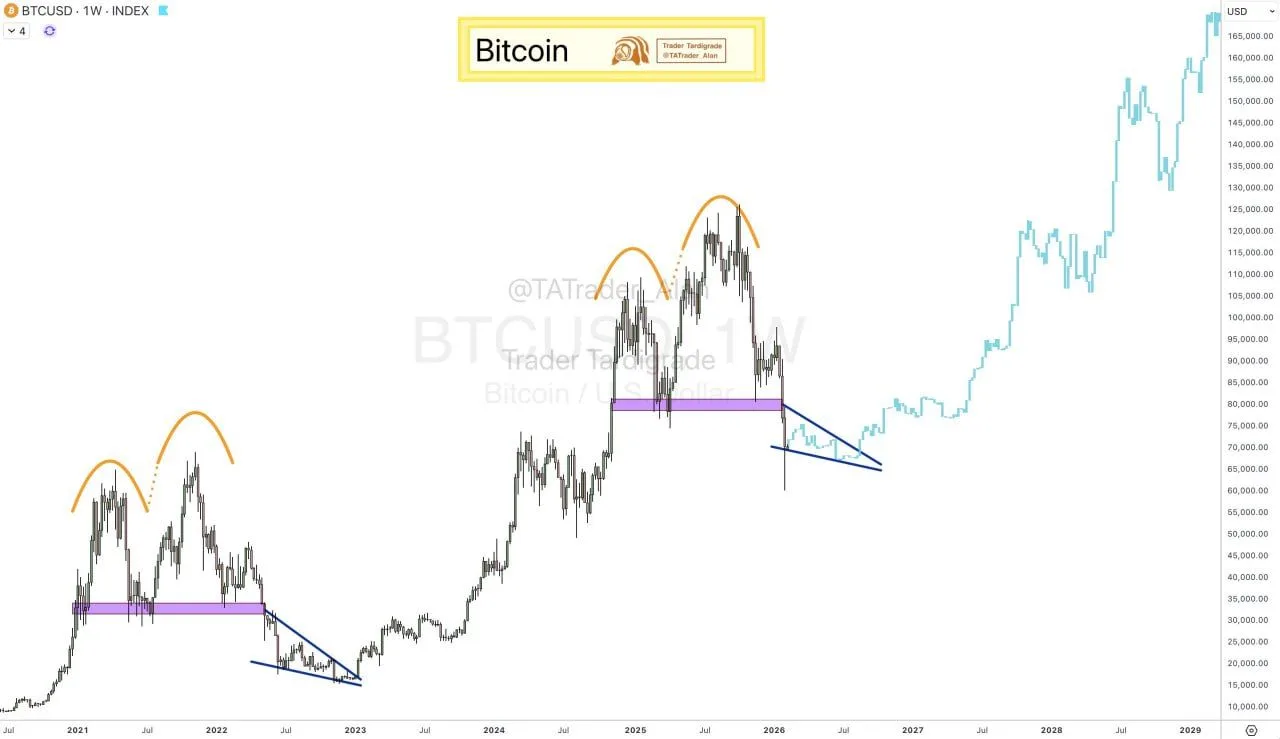

Bitcoin Slides Towards Key Fib Assist as Downtrend Holds on Day by day Chart

Bitcoin stayed beneath strain on the day by day $BTC/USD chart as value prolonged decrease after failing to carry a descending trendline, in response to a TradingView snapshot shared by analyst Dave the Wave (@davthewave) on X. The chart reveals Bitcoin breaking down from a short-term consolidation and sliding towards a decrease help band, with value buying and selling close to $69,364 on the time of the snapshot. In consequence, the broader short-term construction stored a draw back bias whereas value hovered close to a rising help line drawn from prior lows.

Bitcoin Day by day BTCUSD Chart. Supply: TradingView by way of Dave the Wave on X

On the chart, Bitcoin offered off by a horizontal stage close to the mid-$80,000s after which accelerated decrease, leaving a sequence of decrease highs and decrease lows throughout the day by day timeframe. Consequently, value moved nearer to a confluence space the place a rising diagonal help meets a Fibonacci retracement zone. The chart marks the 0.5 retracement close to $72,342, which sits above the present value, whereas a decrease reference band seems nearer to the low-$60,000s after the sharp wick decrease.

On the similar time, the descending trendline from the November highs stays intact and continues to cap rebounds. The chart labels a possible upside response level close to $86,466, which aligns with the falling resistance line and a previous breakdown space. Subsequently, any short-term restoration would first have to clear the rising help close to the low-$70,000s earlier than value can take a look at the overhead downtrend line proven on the chart.

Dave the Wave mentioned that, within the shorter time period, a transfer again above $72,000 would open room towards the mid-$80,000s. As of the snapshot, Bitcoin consolidated simply above the decrease boundary of the current drop, with value compressing beneath resistance and close to rising help, leaving the following transfer depending on whether or not value can reclaim the $72,000 space or stay capped by the descending trendline.