Cryptocurrency prediction markets are forecasting that Ethereum’s ($ETH) February downturn will persist by way of the remainder of the month and that $ETH will crash a further 18% from its press time worth of $1,950.

Such an expectation is in step with the token’s current worth actions, as it’s arguably the largest loser among the many largest digital belongings by market cap. Since 2026 began, Ethereum is down 34.88%, whereas Bitcoin (BTC) fell 23.47% and XRP dropped 24.59%.

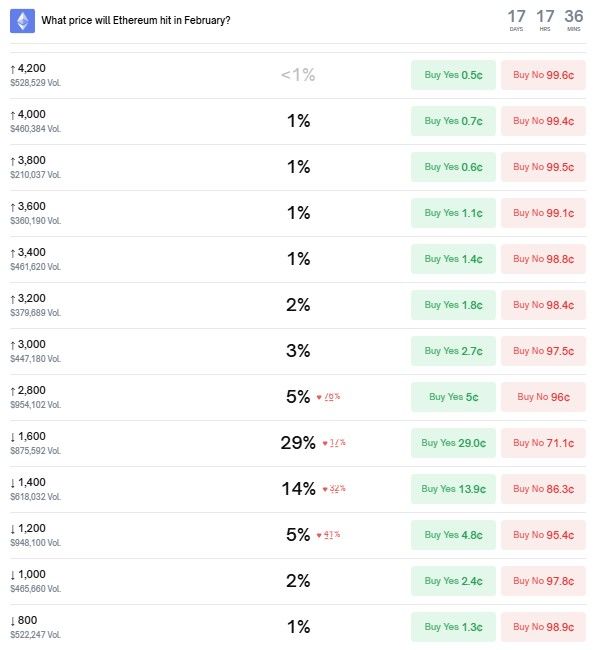

Crypto markets see 1/20 odds of $ETH rally to $2,800 in February

Nonetheless, it’s noteworthy that prediction merchants on Polymarket aren’t notably assured of their estimate for the place $ETH will land on the finish of February. Whereas it’s true {that a} 18% drop to $1,600 is essentially the most broadly anticipated, the percentages of truly hitting it are solely at 29% at press time on February 11.

Different comparatively standard forecasts are $1,400 – with 14% odds – $1,200 – with 5% – $2,800 – with 5% – and $3,000 – with odds of three%.

Moreover, all targets between $800 and $4,000 are thought of no less than considerably believable by the Polymarket cryptocurrency prediction markets, as all of them have an opportunity of no less than 1% of being reached.

In distinction, costs between $4,200 and $5,000 are, at press time, apparently thought of fully implausible with odds of lower than 1%.

Additionally it is attainable they’ve any backing as a result of varied buying and selling bot methods current in the marketplace, as ‘sure’ might need been bought for these merely as a result of huge payout attainable if $ETH climbs above $4,200 someway.

Equally, the whole unfold might simply be skewed by such methods, although it’s troublesome to quantify to which extent.

Ethereum worth prediction unfold exhibits huge crypto market uncertainty

What’s more easy to find out is that the very broad unfold of costs deemed no less than considerably believable for Ethereum exhibits the diploma of uncertainty prevalent within the cryptocurrency market on February 11.

On the one hand, the massacre that began in late January satisfied many merchants and analysts that the downward a part of the usual digital belongings cycle has begun in earnest and that the numerous cash and tokens are actually headed towards new lows.

Alternatively, there’s a sturdy sense that the scenario is dramatically completely different for the sector in earlier years because of heightened institutional adoption and acceptance, funding automobiles corresponding to spot exchange-traded funds (ETFs) for the biggest cryptocurrencies, and a extra favorable regulatory local weather.

Such bullish components have led some specialists and merchants to consider the newest worth crash is short-term and that digital belongings can nonetheless obtain new all-time highs later in 2026.

Featured picture through Shutterstock