Bitcoin worth has tumbled sharply, falling from close to $69,000 to underneath $66,500 in simply 60 minutes. The sudden $BTC worth crash has liquidated greater than $79 million in lengthy positions, based on knowledge from Coinglass. Concurrently, the entire crypto market capitalization misplaced roughly $90 billion in the course of the drop, regardless of US inventory markets buying and selling in constructive territory.

Supply: X

Ethereum worth additionally declined throughout the identical window, falling under $2,000. In response to the liquidation map, heavy lengthy clusters have been stacked under $66,000, creating strain as costs approached key help zones. Regardless of the brief restoration in the present day, the Bitcoin worth is now ranging between $66,000 and $68,000 if the help holds.

In response to crypto analysts, IT Tech, the SuperTrend has flipped purple, signaling bearish momentum for the $BTC worth. The analysts famous that failure to reclaim $68,000 rapidly may expose $BTC to extra draw back, with liquidation threat rising under $65,500.

US Debt Forecast Provides Strain to Market Temper

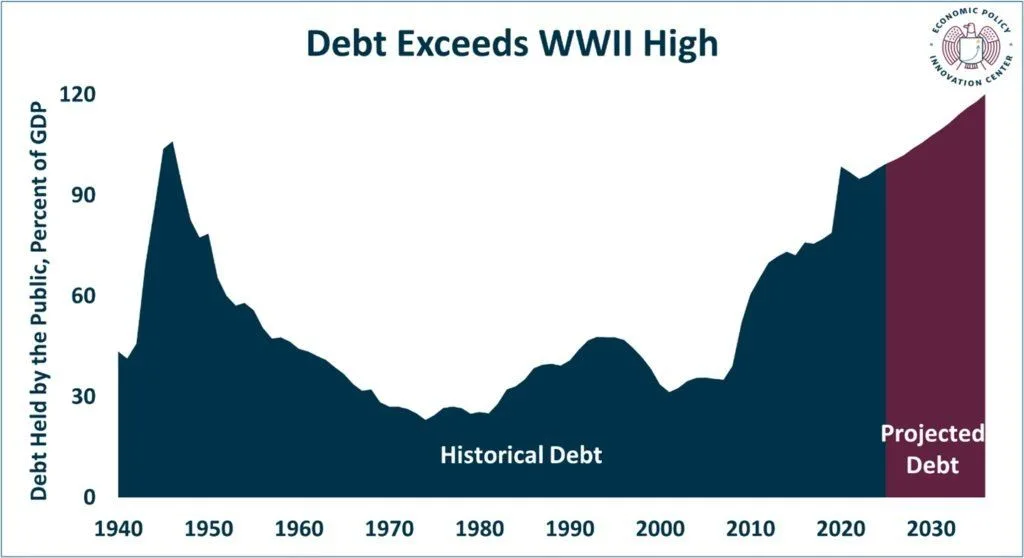

The selloff got here shortly after the Congressional Funds Workplace (CBO) launched its newest financial forecast, elevating issues concerning the long-term well being of US authorities funds. The company warned that the nationwide debt will surpass its World Conflict II peak by 2030, reaching 106% of GDP and probably climbing to 175% by 2056.

Supply: X

The up to date outlook raises the projected 10-year deficit by $1.4 trillion in comparison with final 12 months’s estimate. Internet curiosity funds are anticipated to double from $1 trillion in 2026 to $2.1 trillion by 2036, pushed by increased rates of interest and increasing borrowing wants.

CBO Director Phillip Swagel stated, “Our funds projections proceed to point that the fiscal trajectory isn’t sustainable.” The report additionally tasks the Social Safety belief fund will run out of reserves by 2032, a 12 months sooner than beforehand anticipated.

Trump Period Insurance policies Add to LongTerm Fiscal Burden

A lot of the rise in projected debt is linked to laws handed in 2025 underneath President Donald Trump. The everlasting extension of 2017-era tax cuts and enterprise incentives is anticipated to extend the deficit by $4.7 trillion via 2035.

Nevertheless, the CBO estimates that the administration’s expanded tariffs may generate about $3 trillion in new federal income by 2036. Regardless of that offset, the general fiscal image stays strained. The CBO additionally warned that increased tariffs might elevate inflation between 2026 and 2029.

The funds workplace famous {that a} discount in immigration may shrink the US inhabitants by 5.3 million by 2035. This transformation is forecast to cut back the working-age inhabitants by 2.4 million and sluggish common month-to-month job development to 44,000 between 2028 and 2036.

Is Bitcoin Worth Restoration Close to? Santiment Breaks Down

With the crypto market reacting to broader financial indicators, merchants are intently watching help close to $65,000 and resistance at $68,000.

On the similar time, social knowledge reveals retail sentiment stays bearish regardless of Bitcoin recovering from its drop under $60,000 final week. In response to Santiment, posts throughout main platforms nonetheless present a excessive ratio of fear-driven content material in comparison with bullish commentary.

Supply: Santiment

This stage of crowd pessimism means that many retail individuals are hesitant to re-enter, whilst worth stabilizes. Traditionally, elevated worry ranges have typically preceded rebounds, particularly when bigger holders accumulate with diminished resistance.

At press time, the Bitcoin worth was buying and selling at $66,655 after a short restoration however was nonetheless down 3.5% within the final 24 hours.