A rising variety of publicly traded corporations have added $XRP to their stability sheets, committing greater than $2,000,000,000 ($2 billion) mixed to their introduced treasury methods.

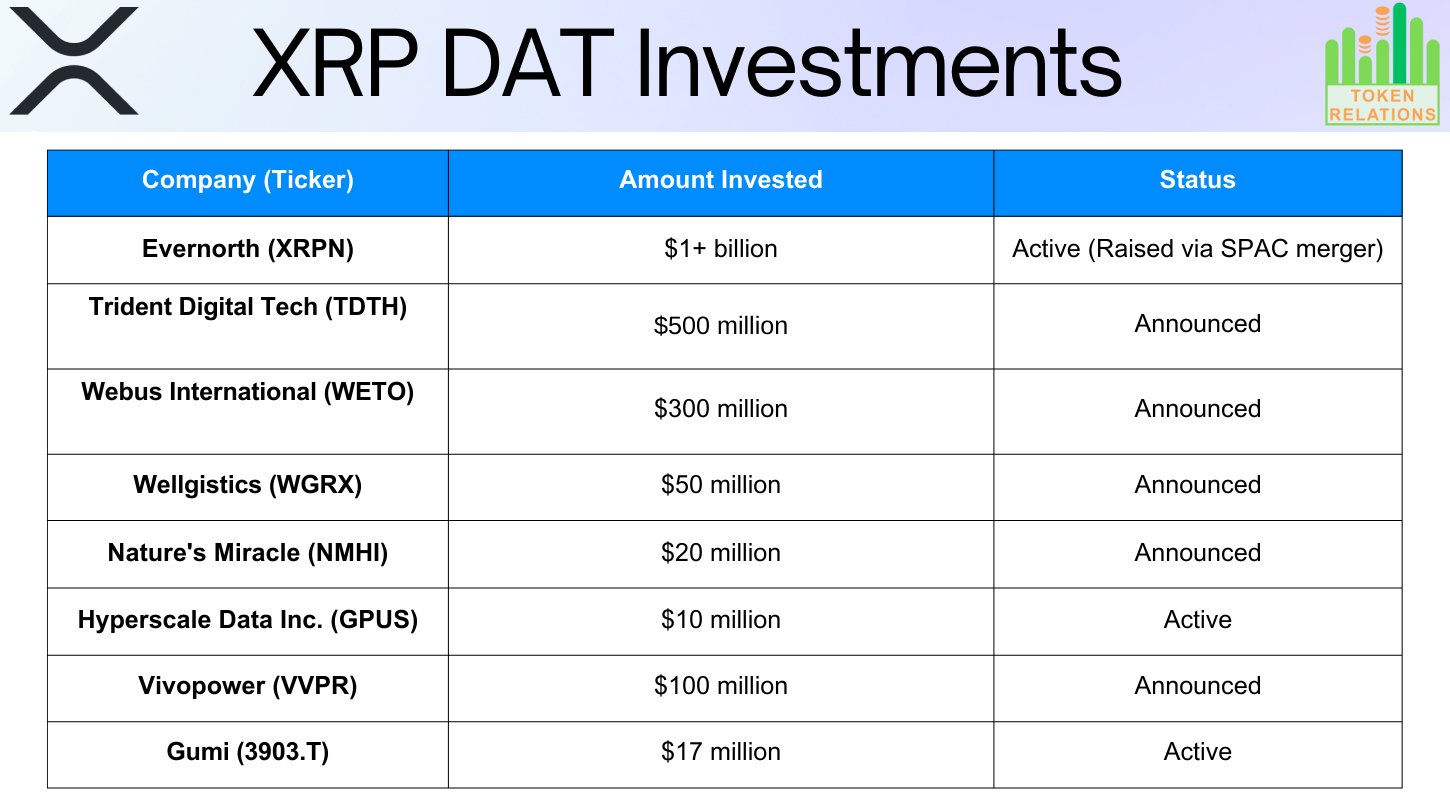

In response to a breakdown shared by crypto educator X Finance Bull, not less than eight public companies have disclosed $XRP treasury allocations by way of public filings or official bulletins. The info was attributed to TokenRelations and compares the development to MicroStrategy’s early Bitcoin treasury technique, this time centered on $XRP.

Key Factors

- Over $2B dedicated throughout eight publicly traded corporations

- Establishments are positioning early forward of regulatory readability

- $XRP might shift from a fee device to a treasury reserve asset

- Market watching filings, timelines, and balance-sheet influence

$XRP From Hypothesis to Stability Sheets

X Finance Bull argues that the transfer indicators a shift in how establishments view $XRP, from a short-term commerce to a long-term treasury asset. He confused that the companies usually are not personal funds or enterprise capital, however public corporations throughout a number of industries, together with healthcare, power, gaming, expertise, and agriculture.

Certainly, a number of of the companies have already begun deploying capital, whereas others have formally introduced future allocations.

Largest Allocation: Evernorth Leads With Over $1B

The most important reported $XRP treasury dedication comes from Evernorth (XRPN).

- Funding: $1+ billion

- Standing: Lively through SPAC merger

In response to the report, Evernorth has already raised the funds and begun deploying capital, making it the most important $XRP treasury technique disclosed up to now.

$500M–$300M Commitments

Different companies are additionally making sizable balance-sheet choices. Trident Digital Tech (TDTH) has disclosed a $500 million funding, whereas Webus Worldwide (WETO) has additionally introduced a $300 million funding in $XRP.

These nine-figure allocations counsel $XRP is being thought-about at scale, not as an experimental publicity.

Power, Healthcare, and Logistics Be part of In

Past tech companies, conventional industries are additionally showing on the record

Vivopower (VVPR)

- Funding: $100 million

- Sector: Sustainable power

Wellgistics (WGRX)

- Funding: $50 million

- Sector: Healthcare logistics

X Finance Bull famous that these are typical companies making formal treasury choices, quite than crypto companies chasing short-term tendencies.

Smaller Allocations Broaden Trade Variety

A number of extra corporations spherical out the reported record:

- Nature’s Miracle (NMHI) – $20 million (AgTech)

- Gumi (3903.T) – $17 million (Japanese gaming firm, lively holding)

- Hyperscale Information Inc. (GPUS) – $10 million (Information infrastructure, lively holding)

Whereas smaller in dimension, the allocations additional broaden the vary of sectors and areas adopting $XRP as a reserve asset.

$2B Whole, Spanning A number of Sectors

In whole, the report cites over $2 billion dedicated throughout eight publicly traded corporations. X Finance Bull says establishments are positioning early, forward of clearer laws and market situations. The transfer indicators a shift for $XRP, from primarily a fee asset to a treasury reserve held by public companies.