The Ethereum value is down greater than 5% over the previous few days and has now slipped under a key short-term construction. On February 10, $ETH fell beneath $1,980 after failing to carry a slender rebound channel. This transfer adopted a pointy decline in DeFi exercise and weakening institutional flows. But, regardless of the strain, giant holders have began including once more.

The query is easy: is that this early accumulation, or only a non permanent pause earlier than one other leg decrease?

Sample Break Confirms Weak ‘Large Cash’ Help

Ethereum’s current rebound from early February shaped inside a bear flag. This construction acted like a short-term restoration try, not a development reversal. On February 10, the worth slipped under the decrease boundary of the flag, triggering a sample break with over 50% crash potential, as predicted in a earlier Ethereum evaluation.

This transfer mattered as a result of it occurred alongside weak cash circulate.

The Chaikin Cash Stream, or CMF, measures whether or not capital is getting into or leaving an asset utilizing value and quantity. When CMF strikes above zero, it usually exhibits large-scale institutional-style shopping for. When it stays under, it indicators weak participation.

Between February 6 and February 9, $ETH bounced, however CMF by no means crossed above zero. It additionally failed to interrupt its descending trendline. This meant the rebound lacked sturdy backing from giant buyers.

Breakdown Construction Activated: TradingView

Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto E-newsletter right here.

In easy phrases, the worth moved up, however severe cash didn’t observe strongly sufficient. When rebounds occur with out sturdy CMF backing, they have an inclination to fail. That’s precisely what occurred right here. As soon as shopping for momentum stalled, sellers regained management and pushed $ETH decrease.

This confirms that the sample break was not random. It was probably supported by fading large cash flows. However technical weak point alone doesn’t clarify the total image.

DeFi TVL and Change Flows Reveal a Structural Downside

A deeper subject sits inside Ethereum’s DeFi exercise.

Complete Worth Locked, or TVL, measures how a lot cash is saved inside decentralized finance platforms. It displays actual utilization, capital dedication, and long-term confidence. When TVL rises, customers are locking funds. When it falls, capital is leaving.

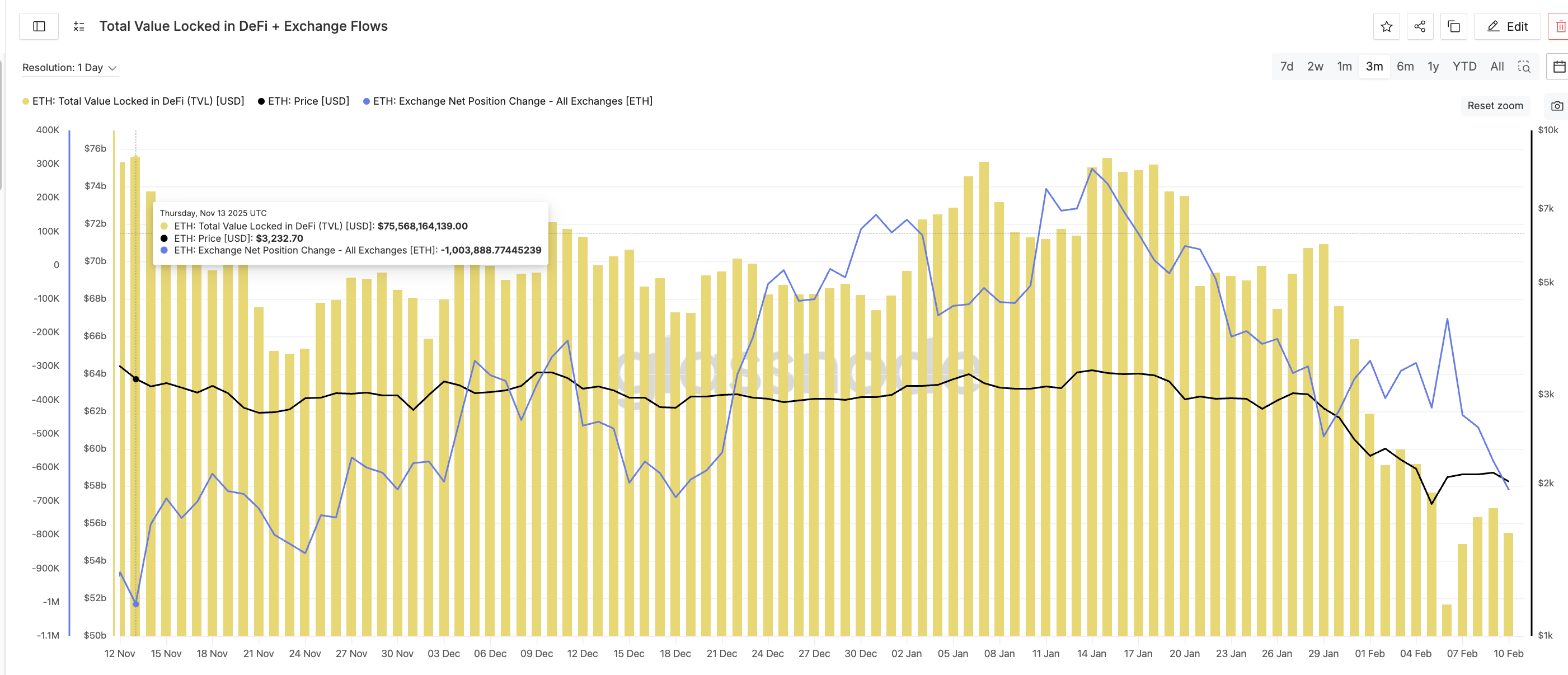

BeInCrypto analysts mixed the TVL and trade circulate dashboards to point out a transparent sample.

On November 13, DeFi TVL stood at $75.6 billion. On the identical time, $ETH traded round $3,232. The trade web place change was strongly detrimental, indicating extra cash had been leaving exchanges than getting into. Buyers had been probably transferring $ETH into self-custody.

TVL Impacts Change Flows And Worth: Glassnode

That was a wholesome setup.

By December 31, TVL had dropped to about $67.4 billion. $ETH fell to $2,968. Change flows flipped optimistic. Round 1.5 million $ETH moved onto exchanges. Promoting strain elevated. Now have a look at February.

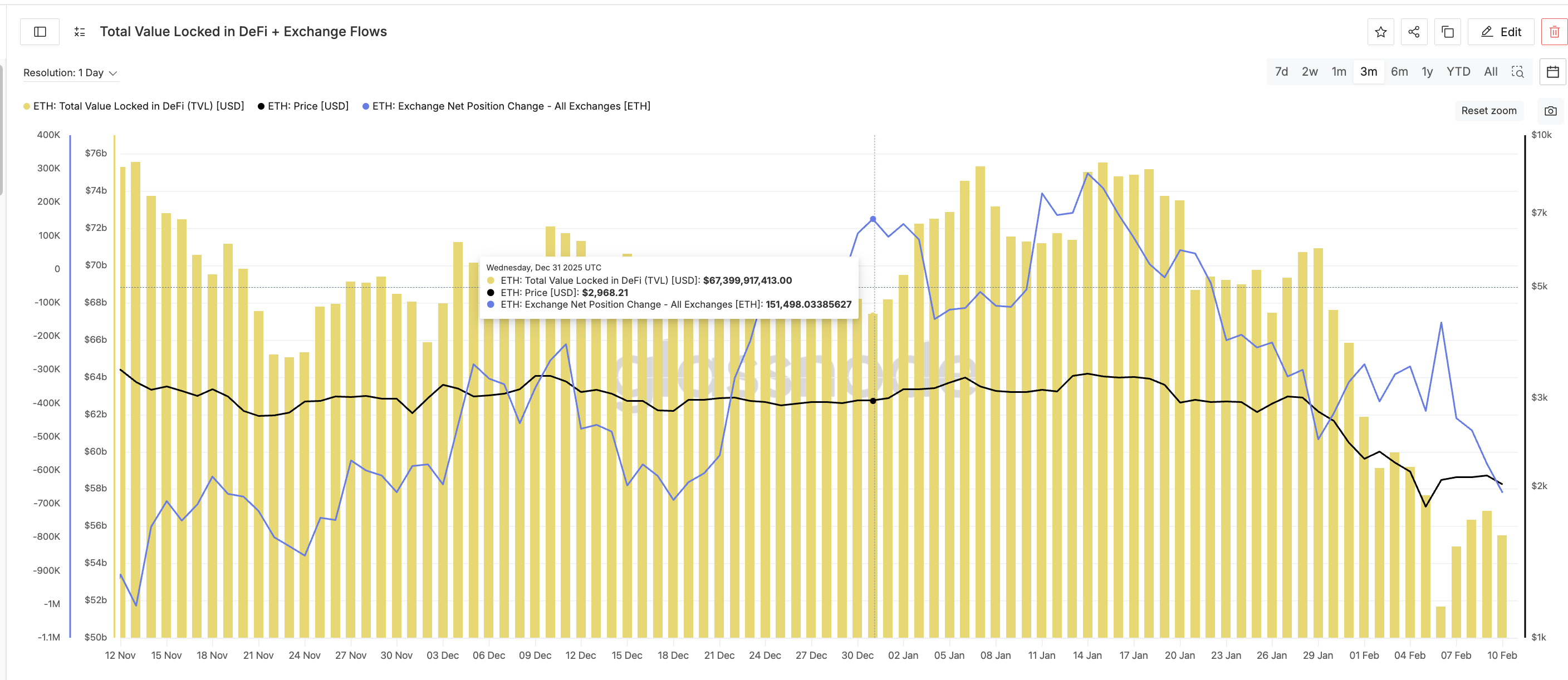

TVL Historical past And Rising Change Stream: Glassnode

On February 6, DeFi TVL touched a three-month low of $51.7 billion. $ETH was close to $2,060. Change outflows weakened sharply (the Internet Place line reached a neighborhood peak). Regardless that web flows stayed barely detrimental, shopping for strain collapsed, as defined by the February 6 peak. This exhibits a repeating relationship.

When TVL falls, trade inflows rise or outflows weaken. Which means capital is shifting from long-term use towards potential promoting.

As of February 10, TVL has solely recovered to round $55.5 billion, down virtually $20 billion from the mid-November ranges. That’s nonetheless near the three-month low. And not using a stronger restoration, exchange-side strain is prone to return. So the sample break is going on whereas Ethereum’s core utilization stays weak.

That could be a structural downside, not only a chart subject.

Whale Accumulation and Value Foundation Clarify the Ethereum Worth Help

Regardless of weak technicals and falling TVL, whales haven’t totally exited.

Whale provide tracks how a lot $ETH is held by giant wallets, excluding exchanges. Since February 6, whale holdings fell from about 113.91 million $ETH to almost 113.56 million. That confirmed the distribution in the course of the breakdown. However over the previous 24 hours, this development paused.

Ethereum Whales: Santiment

Holdings edged again up barely, from 113.56 million $ETH to 113.62 million, exhibiting small-scale accumulation. This means that whales are testing help moderately than committing totally.

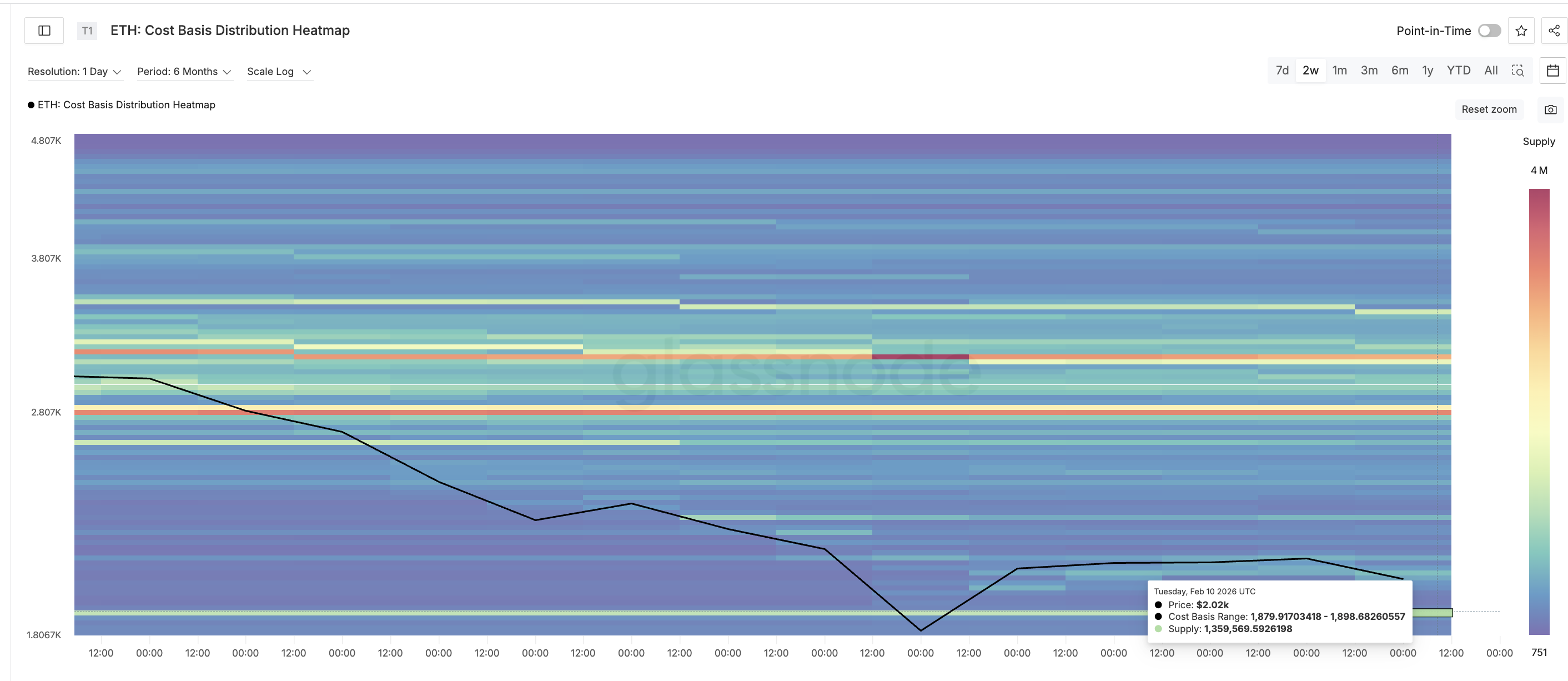

The explanation turns into clear when taking a look at value foundation knowledge.

Value foundation warmth maps present the place giant teams of buyers purchased their cash. These zones usually act as help as a result of holders defend their entry costs. For Ethereum, a serious cluster sits between $1,879 and $1,898. Round 1.36 million $ETH had been amassed on this vary. That makes it a powerful demand zone.

Value Foundation Heatmap: Glassnode

The present value is hovering simply above this space.

So long as $ETH stays above this band, whales have an incentive to defend it. Falling under would push many holders into losses and certain set off heavier promoting. This explains the cautious shopping for.

Whales should not betting on a rally. They’re probably defending a crucial value zone.

From right here, the Ethereum value construction turns into clear.

Help sits close to $1,960 after which $1,845. A day by day shut under $1,845 would break the primary value cluster and ensure deeper draw back threat. If that occurs, the subsequent main draw back zones sit close to $1,650 and $1,500.

Ethereum Worth Evaluation: TradingView

On the upside, $ETH should reclaim $2,150 to stabilize. Solely above $2,780 would the broader bearish construction weaken. Till then, rebounds stay weak.

The submit Ethereum ($ETH) Breaks Sample Amid $20 Billion DeFi Slide — Why Are Whales Nonetheless Shopping for? appeared first on BeInCrypto.