Desk of Contents

What Does The $ETH Worth Chart Present Proper Now?The place Are The Key $ETH Help Ranges?Why Is $ETH Falling Regardless of Document Community Exercise?How Are Establishments And Massive Holders Impacting $ETH Worth?What Is Taking place With BitMine And Why It Issues?Are ETFs Including Extra Draw back Strain?Is Anybody Accumulating $ETH Proper Now?How Low $ETH Can Go From HereResourcesFrequently Requested Questions

Ethereum can nonetheless fall towards the $1,500 to $1,800 vary if promoting strain continues and demand stays weak. $ETH is buying and selling under $2,000 after shedding about 30% over the past seven days. This drop is occurring even because the Ethereum community data its highest exercise degree thus far, creating a transparent hole between utilization and worth.

What Does The $ETH Worth Chart Present Proper Now?

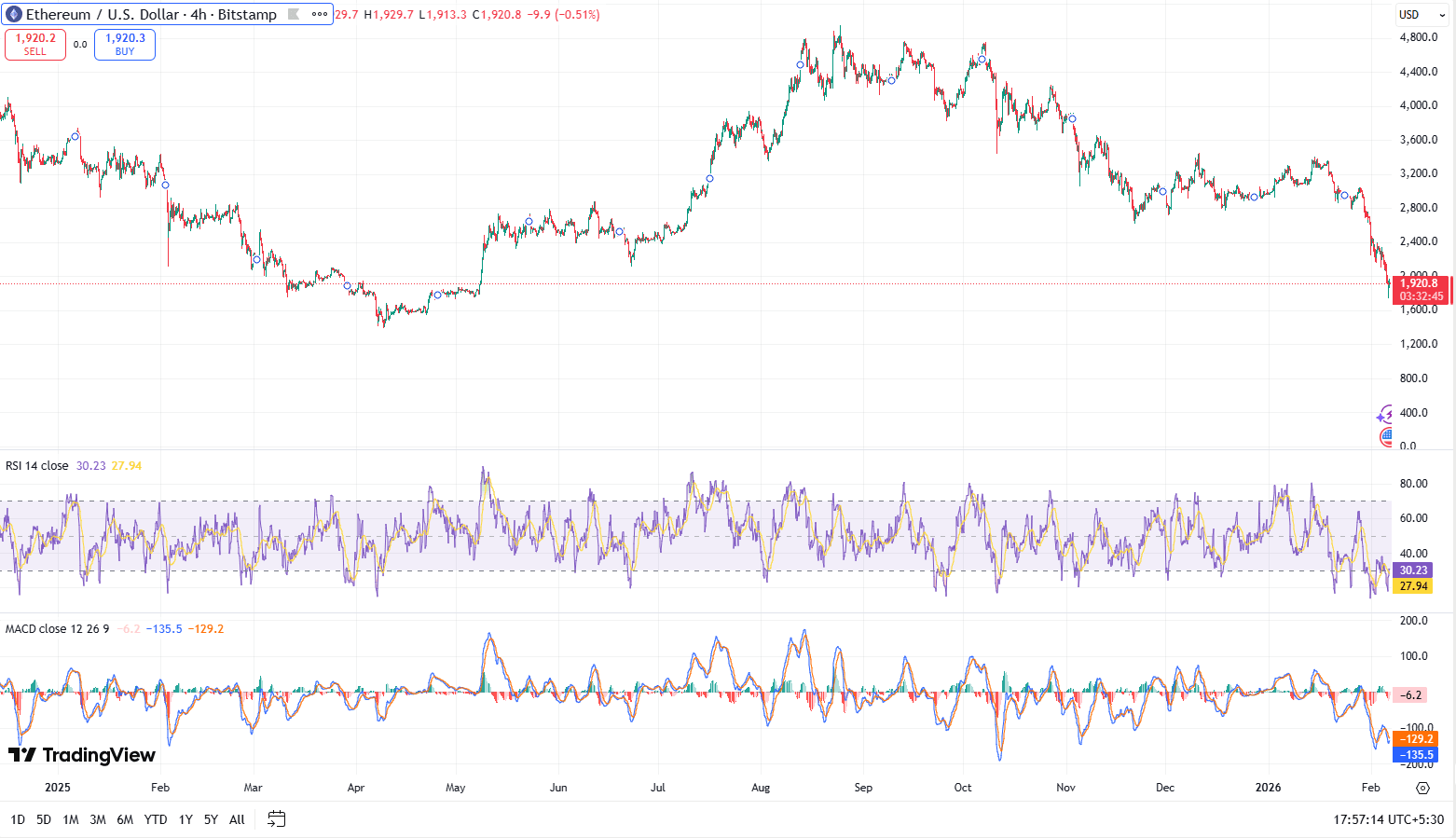

On the 4-hour chart, $ETH stays in a agency downtrend. Worth has damaged under the $2,000 assist zone and has didn’t reclaim it on a number of makes an attempt.

$ETH worth chart (Picture: TradingView)

Momentum indicators affirm continued weak point.

- RSI is close to 30, which alerts oversold situations however not a confirmed backside

- MACD stays unfavorable, exhibiting bearish momentum continues to be lively

- The market construction continues to kind decrease highs and decrease lows

Oversold readings alone don’t sign a reversal. In previous drawdowns, $ETH has stayed oversold for prolonged intervals whereas liquidity continued to exit the market.

The place Are The Key $ETH Help Ranges?

A number of worth ranges stand out primarily based on historic buying and selling exercise and liquidation knowledge.

- $1,800: A psychological degree and prior assist zone the place worth has reacted a number of occasions

- $1,650 to $1,700: A congestion space from earlier accumulation phases

- $1,500 to $1,550: A high-risk liquidation zone flagged by derivatives knowledge

Liquidation danger stays lively between $1,509 and $1,800. A transfer into this vary might set off pressured promoting from leveraged positions, rising draw back volatility.

Why Is $ETH Falling Regardless of Document Community Exercise?

Ethereum is presently experiencing its most lively section on-chain.

Based on CryptoQuant, Ethereum Switch Depend, measured by a 14-day transferring common, reached a report 1.1 million this month. Switch rely refers back to the complete variety of token actions on the community and is usually used as a proxy for utilization.

This knowledge factors to robust community adoption. Nonetheless, worth is pushed by capital flows, not utilization alone.

Retail demand has declined sharply. Many merchants are closing positions as a substitute of opening new ones. This shift is seen within the derivatives market, the place futures open curiosity dropped to $25.4 billion from $26.3 billion in a single day.

Excessive exercise mixed with weak demand usually results in worth compression relatively than instant restoration.

How Are Establishments And Massive Holders Impacting $ETH Worth?

Massive holders have added to near-term promoting strain.

Development Analysis, offered 170,033 $ETH ($322.5M) over the past day and nonetheless holds 293,121 $ETH ($563M), based on on-chain knowledge. Analysts linked the switch to promoting and mortgage repayments.

Different notable gross sales embrace:

- Stani Kulechov, founding father of Aave, promoting 4,503 $ETH at a mean worth of $1,857

- Vitalik Buterin promoting 2,961.5 $ETH for $6.6 million over three days at a mean worth of $2,228

These transactions usually are not indicators of panic, however they improve circulating provide at a time when demand is weak.

What Is Taking place With BitMine And Why It Issues?

BitMine Immersion Applied sciences is the biggest Ethereum-focused treasury firm. It holds roughly 4.285 million $ETH, or about 3.55% of Ethereum’s circulating provide.

The corporate accrued $ETH at an estimated value of $15.65 billion. At present costs, that place is value about $9 billion, leaving $6 billion to $8 billion in unrealized losses. BMNR inventory has fallen 88% from its July peak.

Key particulars present context:

- $ETH holdings had been acquired by means of fairness issuance, not debt

- About 2.9 million $ETH is staked, producing an estimated $188 million in annualized staking income

- BitMine holds $538 million in money and added 41,788 $ETH final week

CEO Thomas Lee acknowledged that unrealized losses throughout downturns are a part of a long-term treasury technique, just like index funds throughout market declines. Even so, giant treasury holders stay a danger issue if liquidity situations worsen.

Are ETFs Including Extra Draw back Strain?

Sure. Spot $ETH exchange-traded funds within the US have seen constant outflows since January 20.

SoSoValue knowledge reveals spot $ETH ETFs recorded a web outflow of $80.79 million on February 5. Constancy’s FETH accounted for $55.78 million of that complete.

ETF outflows characterize passive promoting relatively than discretionary buying and selling, including regular strain with out fast reversals.

Is Anybody Accumulating $ETH Proper Now?

Some long-term buyers and whales are accumulating $ETH selectively.

On-chain knowledge reveals accumulation throughout worth dips, whereas short-term merchants proceed to exit. This sample usually seems throughout mid-cycle corrections relatively than ultimate market bottoms.

Accumulation can restrict long-term draw back however doesn’t cease short-term drawdowns.

How Low $ETH Can Go From Right here

Based mostly on present chart construction, derivatives knowledge, and on-chain flows, $ETH can nonetheless take a look at the $1,500 to $1,800 vary if promoting strain persists. Momentum stays bearish, demand is weak, and enormous holders are including provide to the market.

On the identical time, Ethereum’s community exercise is at report highs, staking continues to scale back liquid provide, and a few long-term buyers are accumulating. These components assist stabilize the market over time however don’t stop additional draw back within the close to time period.

For now, $ETH worth is reacting to liquidity situations, not community utilization.

Assets

Ethereum on TradingView: $ETH worth motion

Report by CryptoQuant: Ethereum Switch Depend Surge: A Historic Warning Sign?

Vitalik pockets knowledge on Arkham: Particulars about $ETH motion

Report by Benzinga: Tom Lee’s BitMine Down $6B On Ethereum, However This is Why He Retains Shopping for