Ethereum co-founder Vitalik Buterin and different outstanding “whales” have offloaded tens of millions of {dollars} in $ETH for the reason that starting of February, including narrative gas to a market rout that noticed the world’s second-largest cryptocurrency tumble beneath $2,000.

Whereas the high-profile gross sales by Buterin served as a psychological set off for retail panic, a more in-depth examination of market information means that the first strain got here from a systemic unwind of leverage and record-breaking promoting exercise throughout the community.

Nonetheless, these disposals, mixed with vital promoting by different trade insiders, have prompted traders to query whether or not undertaking leaders are dropping confidence or just managing operational runways amid excessive volatility.

Why is Buterin promoting his Ethereum holdings?

Previously 3 days, Buterin bought 6,183 $ETH ($13.24M) at a median worth of $2,140, in response to blockchain evaluation platform Lookonchain.

Nonetheless, the specifics of Buterin’s transactions reveal a calculated, slightly than panic-driven, technique.

Notably, Buterin publicly disclosed that he had put aside 16,384 $ETH, valued at roughly $43- $45 million on the time, to be deployed over the approaching years.

He acknowledged the funds are earmarked for open-source safety, privateness expertise, and broader public-good infrastructure because the Ethereum Basis enters what he described as a interval of “gentle austerity.”

On this gentle, essentially the most defensible clarification for “why he bought” is mundane. It seems to be the conversion of a pre-allocated $ETH funds into spendable runway (stablecoins) for a multi-year funding plan slightly than a sudden try and time the market high.

Nonetheless, the channel via which these gross sales have an effect on the market is extra narrative-driven than liquidity-based. When traders see founder wallets lively on the promote facet throughout a downturn, it tilts sentiment and deepens the bearish resolve of an already shaky market.

Nonetheless, Buterin stays an $ETH whale, holding over 224,105 $ETH, which is equal to roughly $430 million.

Did Buterin’s $ETH gross sales precipitate a market crash?

The central query for traders is whether or not Buterin’s promoting mechanically pushed $ETH beneath $2,000.

From a structural perspective, it’s tough to argue that Buterin’s $13.24 million promote program, by itself, breaks a serious market degree, given $ETH‘s multi-billion-dollar each day buying and selling quantity.

So, a promote order of this magnitude is small relative to typical turnover and lacks the amount required to eat order guide depth and drive costs down considerably by itself.

Nonetheless, Buterin was not promoting in a vacuum. He was a part of a broader exodus of enormous holders that collectively weighed in the marketplace.

On-chain trackers flagged vital exercise from Stani Kulechov, the founding father of the DeFi protocol Aave. Kulechov bought 4,503 Ethereum (valued at about $8.36 million) at a worth of round $1,857 simply hours earlier than $ETH‘s slide accelerated.

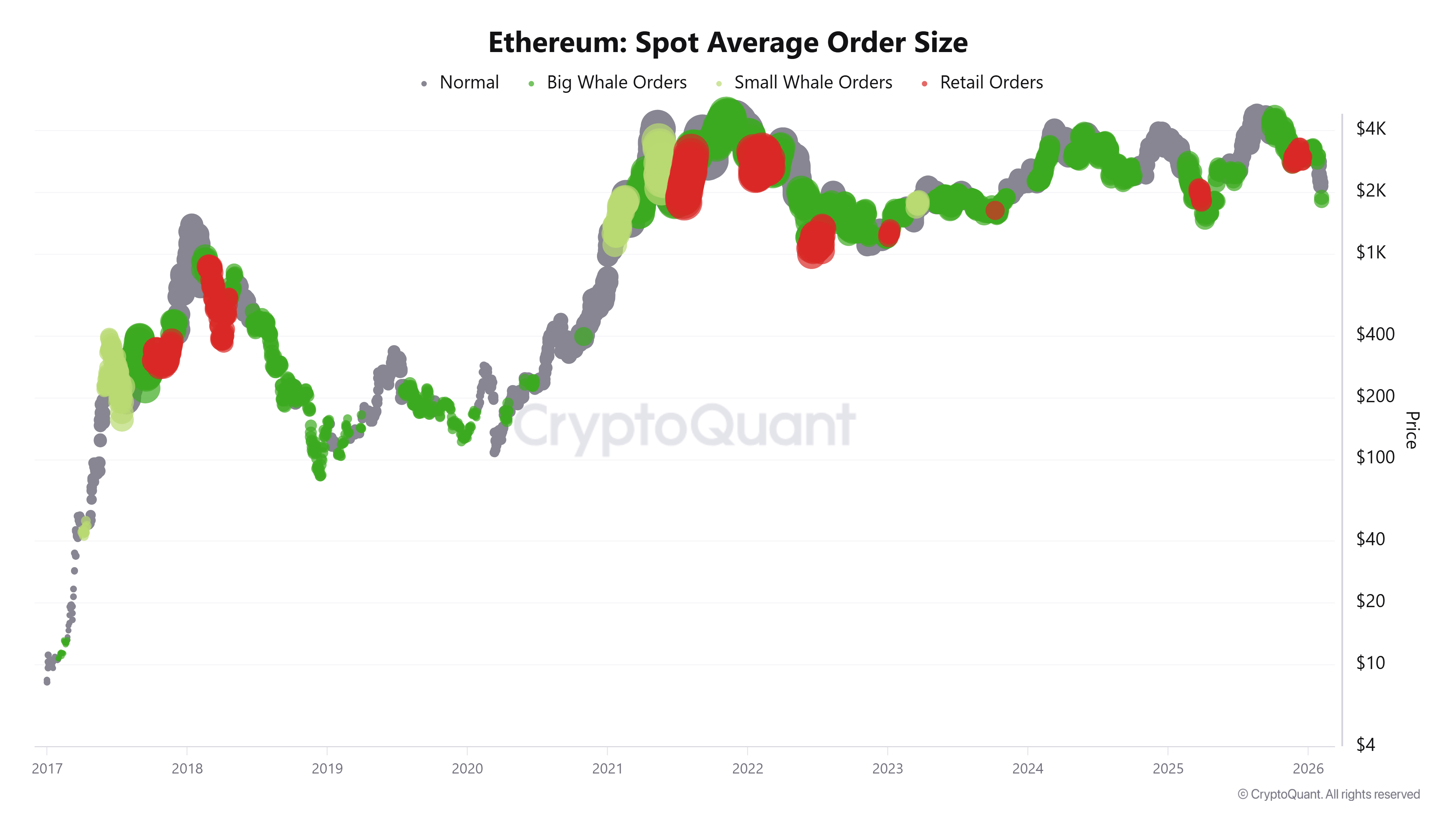

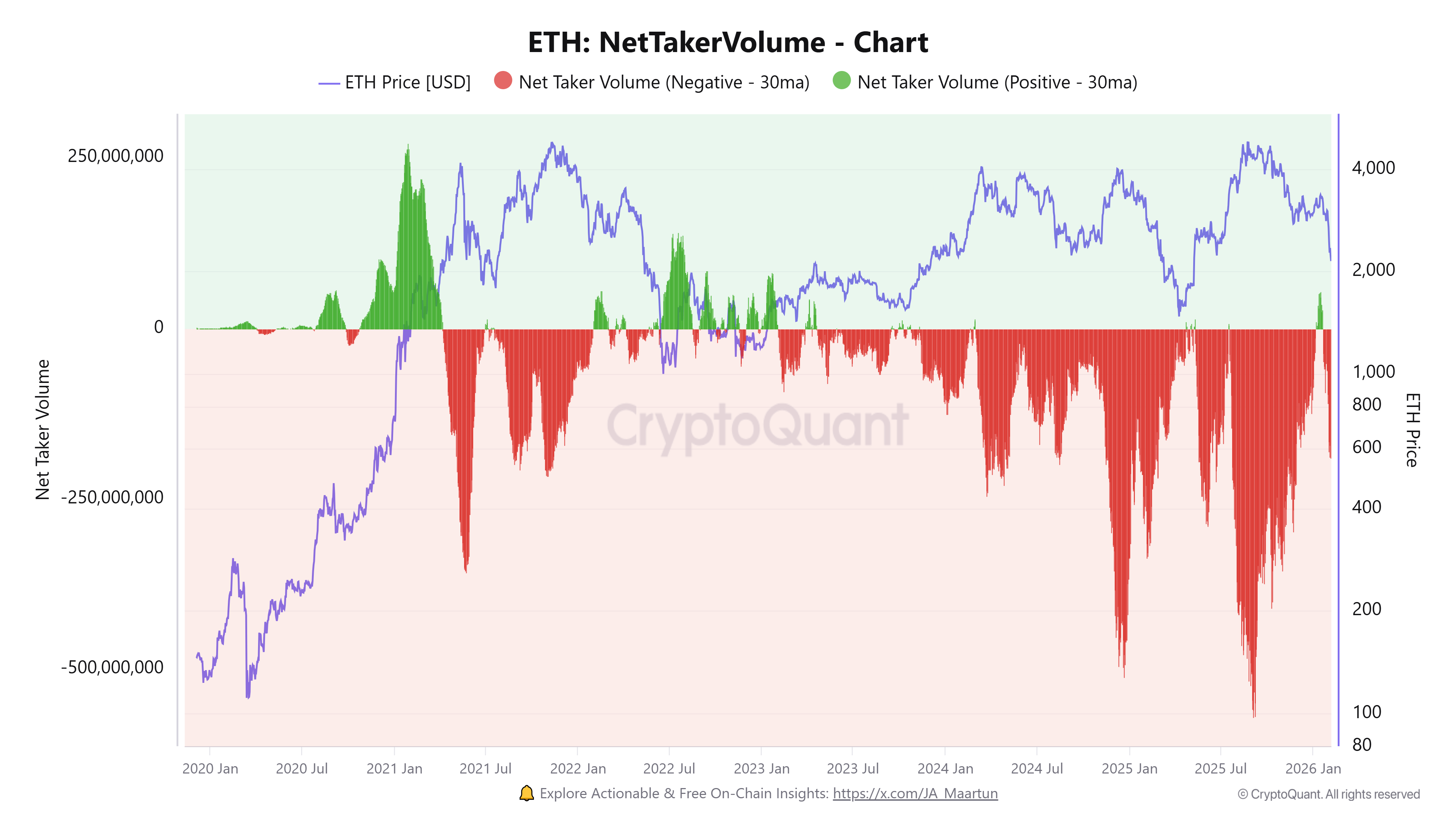

This exercise is symptomatic of a broader pattern. Information from CryptoQuant reveals that the community has confronted report promoting exercise this month.

The analytics agency famous that the community had seen a rise in giant whale order sizes in the course of the downturn, suggesting that high-net-worth people and entities have been actively de-risking into the liquidity supplied by the drop.

Whereas a single whale can’t crash the market, a synchronized exit by trade leaders can create a self-fulfilling prophecy.

When liquidity is skinny and leverage is stretched, these “headline flows” sign to the broader market that “sensible cash” is de-risking, prompting smaller merchants to comply with go well with in a bid to protect capital.

The true drivers behind $ETH‘s crash

Whereas the narrative centered on founder wallets, the majority of the crash was pushed by three distinct market forces: leverage unwinding, ETF outflows, and macroeconomic headwinds.

Information from Coinglass indicated a whole lot of tens of millions of {dollars} in $ETH liquidations over 24 hours in the course of the worst of the transfer, with lengthy liquidations dominating.

This created traditional cascading situations by which worth declines set off pressured gross sales from overleveraged positions, which in flip set off additional declines and extra pressured promoting.

Concurrently, institutional help evaporated. US spot $ETH ETFs have recorded about $2.5 billion of internet outflows over the previous 4 months, in response to SoSo Worth information.

This occurred alongside a lot bigger outflows from Bitcoin ETFs. This represents the sort of institutional de-risking that issues greater than anyone pockets when the market is already sliding.

Compounding these crypto-specific points is the macroeconomic backdrop.

Reuters tied the broader crypto drawdown to a cross-asset selloff and tighter liquidity fears. The crypto market has shed about $2 trillion from its peak in October 2025, with roughly $800 billion worn out within the final month alone, as traders diminished threat and leveraged positions unwound.

Indicators to look at

Because the market makes an attempt to discover a flooring, three indicators will matter greater than any whale alert.

First is liquidation depth. If pressured liquidations stay elevated, $ETH can proceed to “hole” decrease even with out further discretionary promoting.

A decline in liquidation totals alongside stabilization is usually the primary signal the cascade has burned out, in response to Phemex analysts.

Second is the ETF flows regime. Sooner or later of outflows is noise, however a multi-week streak modifications the marginal purchaser. $ETH‘s near-term path relies upon closely on whether or not institutional flows stabilize or proceed to bleed into broader risk-off habits.

Lastly, traders ought to watch alternate inflows and large-holder habits.

Founder wallets are seen, however the extra telling indicator is whether or not giant holders enhance deposits at exchanges (distribution) or whether or not cash transfer into chilly storage and staking (accumulation). When these indicators flip, the market normally follows.

The underside line stays that Vitalik Buterin’s gross sales are finest understood because the execution of a pre-announced funding plan tied to public items and open-source spending, not as a sudden lack of religion.

However in a collapse pushed by leverage liquidations, ETF outflows, and macro risk-off, even “small” founder gross sales can have disproportionate results.

They accomplish that not by supplying sufficient $ETH to interrupt $2,000, however by including narrative gas to a market already trying to find a motive to promote first and ask questions later.