The cryptocurrency market is exhibiting indicators of life this Friday, February 6, 2026, because the Ethereum value efficiently reclaimed the psychologically important $2,000 mark. After per week of intense promoting stress that noticed $ETH plunge to lows not seen since Might 2025, consumers have lastly stepped in to stall the bleeding.

Nonetheless, whereas the inexperienced candles on the hourly chart supply short-term aid, technical indicators counsel that the hazard is way from over for the second-largest cryptocurrency.

Ethereum Coin Evaluation: The $2,000 Battleground

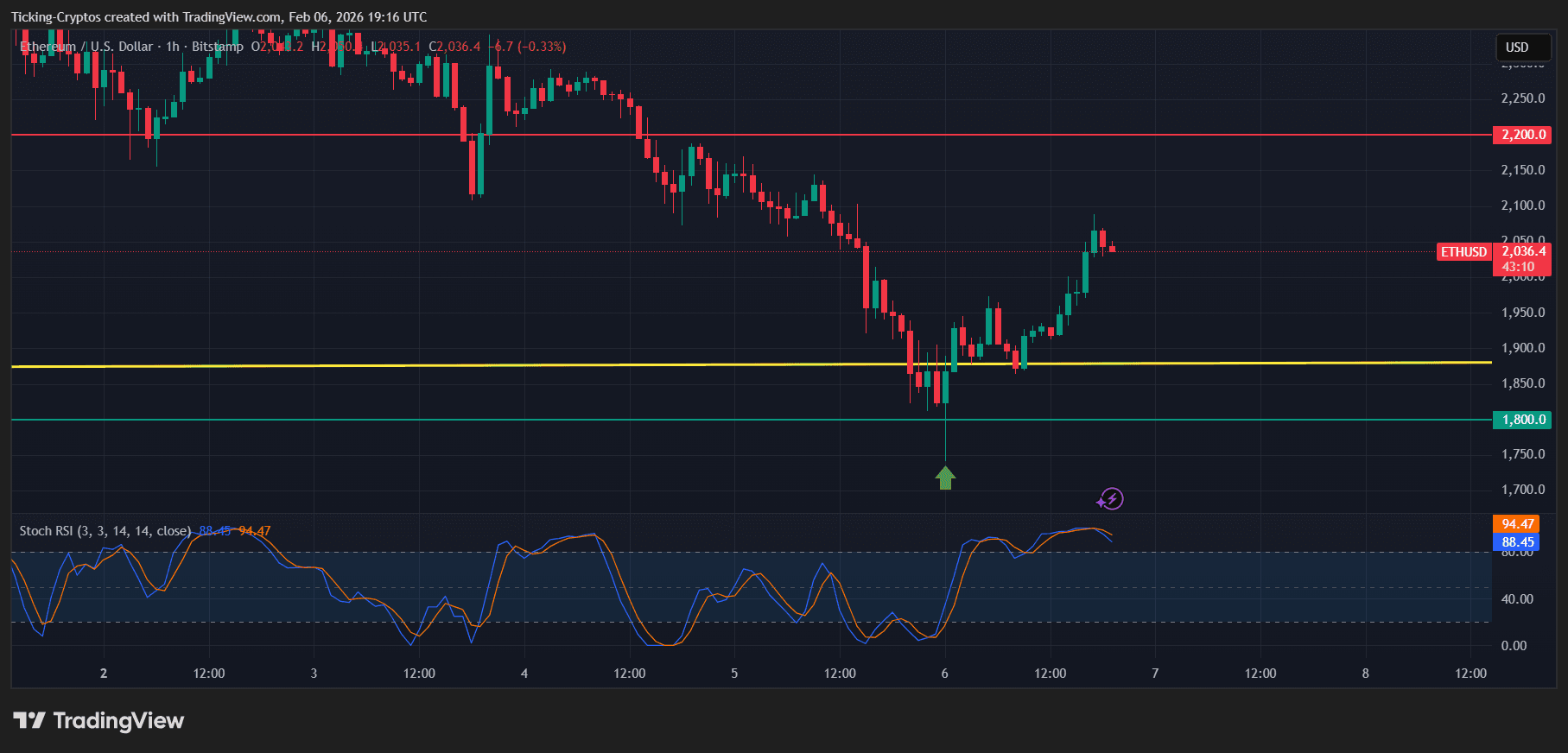

Wanting on the present $ETH/USD 1-hour chart, Ethereum has staged a notable restoration from the $1,850 help zone (highlighted by the yellow trendline). The bounce was signaled by a bullish divergence on the Stoch RSI, which has now surged into the overbought territory above 90.

Whereas the rapid momentum is upward, Ethereum is at present hovering round $2,036, going through a cluster of resistance. The rejection from the $2,200 purple resistance line earlier this week stays a contemporary reminiscence for merchants, and the present transfer could possibly be interpreted as a “useless cat bounce” earlier than a deeper correction.

$ETH/USD 1H – TradingView

Buying and selling Observe: The Stoch RSI is at present overextended. A crossover to the draw back at these ranges typically precedes an area prime.

Ethereum Worth Prediction: Decrease Targets Nonetheless in Play

Regardless of the climb again above $2,000, the broader market construction stays bearish. The latest liquidation of over 400,000 $ETH by main funding automobiles, as reported by some analysts, has left a niche in market liquidity that bulls are struggling to fill.

If Ethereum fails to consolidate above $2,050 and flip the earlier resistance into help, we might see a speedy descent towards the next draw back targets:

- $1,810: The first help degree that held the ground through the preliminary crash.

- $1,600: A significant historic liquidity zone.

- $1,450: The final word “macro backside” goal if $Bitcoin fails to carry its personal restoration at $70,000.

Buyers ought to stay cautious, because the Crypto Worry & Greed Index stays in “Excessive Worry” territory, typically a precursor to additional volatility.

Market Outlook and Technique

For these trying to enter the market, evaluating totally different platforms is important throughout excessive volatility. You possibly can examine our trade comparability to seek out the most effective liquidity suppliers. Moreover, given the latest trade outflows, securing your belongings in {hardware} wallets is very really helpful.

The following 48 hours will likely be CRITICAL for Ethereum. A every day shut above $2,100 might invalidate the rapid bearish thesis, however a slide again under the yellow line at $1,880 would possible set off a quick transfer towards the $1,600 area.