The cryptocurrency market has entered a risky “de-leveraging” section in early 2026. After a turbulent January, the $ethereum coin has seen its valuation sliced as an enormous liquidation cascade worn out over $1.9 billion in $ETH lengthy positions throughout main derivatives exchanges.

As of February 7, 2026, the Ethereum value is hovering round $1,950, making an attempt to stabilize after a swift drop from yearly highs of $3,300. This evaluation breaks down the technical “entice doorways” and restoration zones for Ethereum because the market navigates this 2026 crypto crash.

Can Ethereum Get better in 2026?

Sure, a restoration is technically potential, however the path is at the moment obstructed by heavy overhead resistance. Technical information suggests Ethereum is getting into a short-to-medium time period consolidation section. Whereas long-term targets for the ethereum coin stay bullish because of institutional ETF inflows, the instant outlook is neutral-to-bearish till the $2,300 resistance is flipped again into assist.

The Liquidation Cascade

Within the context of the present crypto crash 2026, a “liquidation cascade” happens when the value drops to a stage that forces leveraged merchants to promote their positions mechanically. This creates a suggestions loop of promoting stress, which is strictly what we noticed on the $ETH chart between $2,150 and $1,820.

Ethereum Worth Chart Evaluation: The $1,800 Flooring

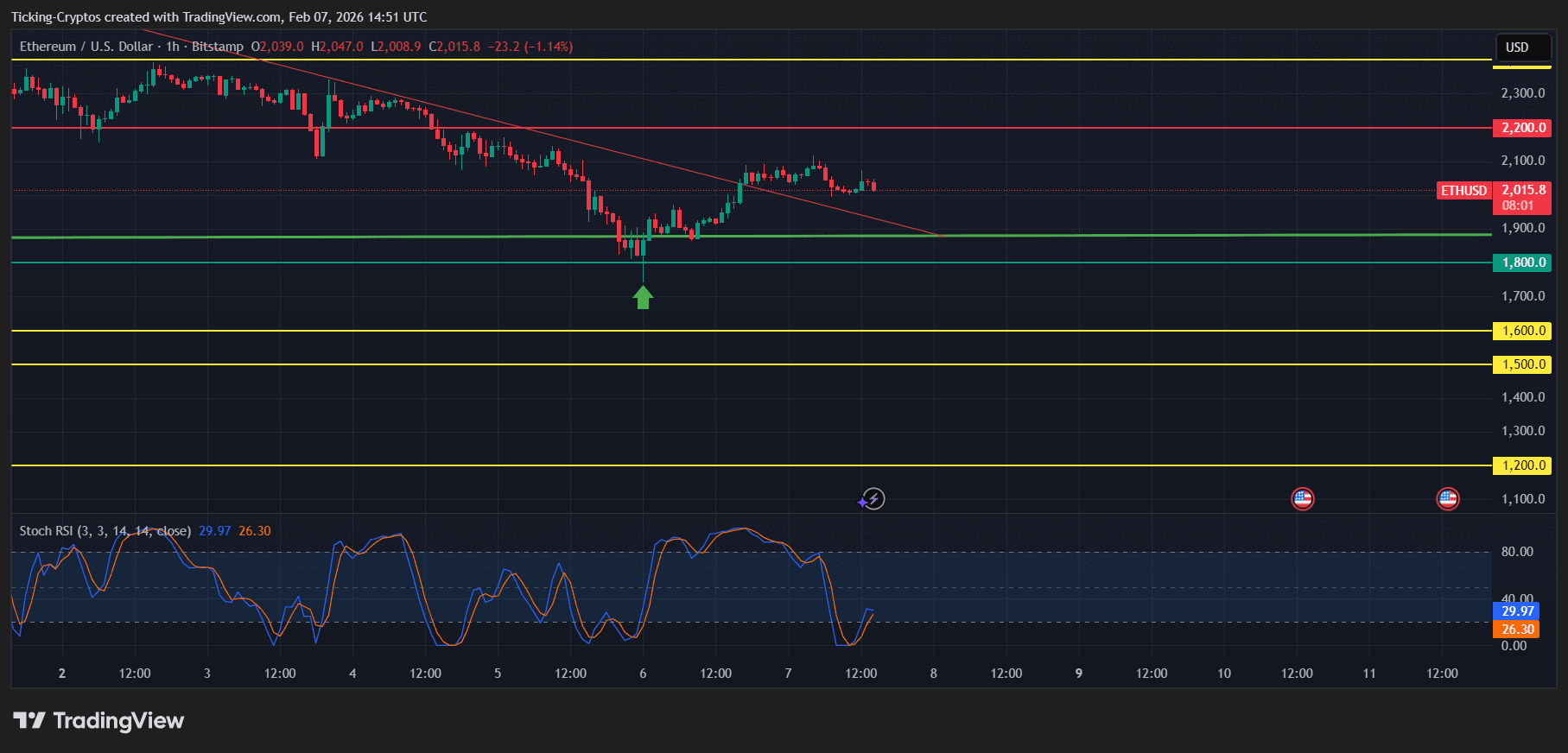

The supplied chart illustrates a pointy “V-shaped” try at $1,823. This stage is essential as a result of it aligns with the mid-2025 accumulation zone and the 0.618 Fibonacci retracement stage.

$ETH/USD 1H – TradingView

Key Technical Observations:

- The Liquidation Hole: The speedy drop from $2,400 to $1,800 created a “liquidity void.” Worth motion tends to “fill” these gaps with sideways motion earlier than a definitive pattern resumes.

- RSI Oversold Bounce: The 14-day Relative Energy Index (RSI) touched 28 on February 5, marking an oversold situation that usually precedes a reduction rally.

- Quantity Profile: Excessive promoting quantity in the course of the crash suggests a “climax” occasion, which regularly marks an area backside.

Ethereum Worth Prediction 2026: Decrease Targets and Bear Case

If the $1,800 assist fails to carry on a weekly closing foundation, the technical construction for the ethereum coin shifts towards a deeper correction. Macroeconomic headwinds proceed to stress threat property globally.

Future Decrease Targets:

- $1,600 (Major Assist): This represents the underside of the long-term uptrend channel. A contact right here can be a 50% correction from the current peak.

- $1,450 (Macro Demand): A historic pivot level from early 2024 that acted as a launchpad for the earlier bull run.

- $1,200 (Capitulation Goal): The “worst-case” situation if broader market contagion continues.

Ethereum Future: The “Boring” Center Floor

Our major Ethereum value prediction for the following 4–8 weeks is a consolidation vary between $1,850 and $2,250.

- The Resistance: The $2,400–$2,600 zone is now saturated with “trapped” consumers who might promote on any reduction rally, making a ceiling.

- The Assist: Huge purchase orders are sitting between $1,750 and $1,850, offering a brief ground.

Exterior evaluation from main monetary shops like Reuters means that institutional curiosity in Ethereum stays excessive regardless of the value drop, which might present the required liquidity to finish the crash.

Conclusion

Ethereum is at the moment at a crossroads. Whereas the crypto crash of 2026 has been painful, the technical protection of the $1,800 stage gives a basis for stability. Traders ought to look ahead to a breakout above $2,300 to verify a pattern reversal.

You’ll be able to monitor the reside $ETH value right here to see if the assist ranges talked about on this evaluation are examined in real-time.