Ethereum is sliding towards the $2,100 space, the place a significant liquidity cluster and a long-tested help zone align. With value already below strain, this stage now stands out as a essential level that would form the following directional transfer.

Ethereum Faces Main Liquidity Zone Close to $2,100

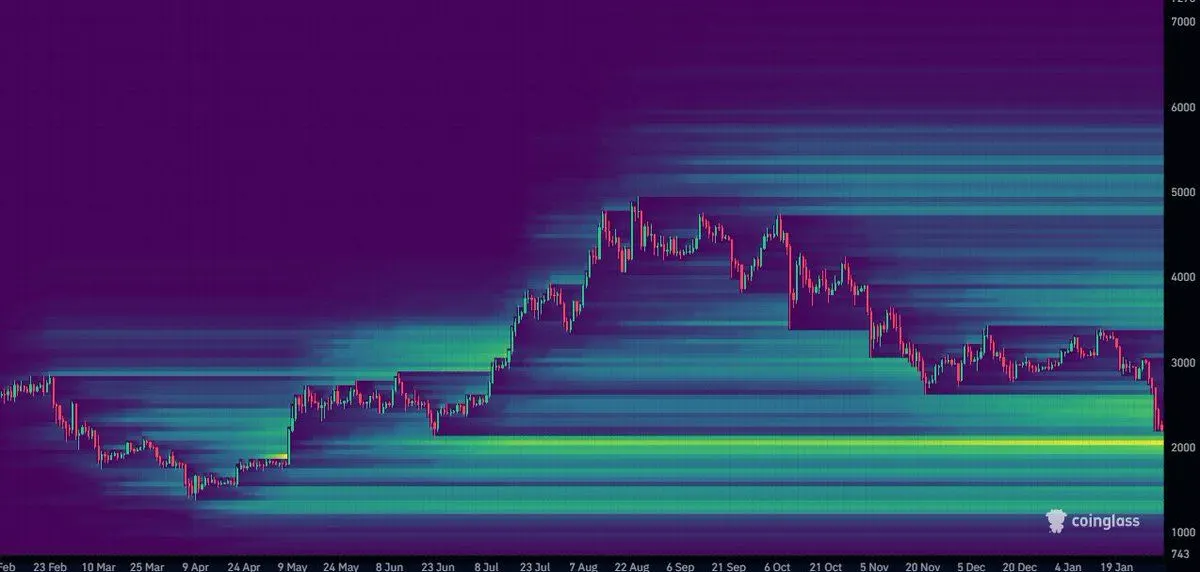

Ethereum is buying and selling decrease as chart knowledge highlights a big liquidity focus across the $2,100 stage. A heatmap shared by market analyst Osemka reveals dense resting liquidity in that zone, suggesting it could act as a key value magnet in the course of the present pullback. Worth just lately slid from the low $3,000s towards the mid $2,000 vary, growing deal with that decrease band.

Ethereum liquidity heatmap and value motion. Supply: X (Osemka)

The liquidity map signifies that purchase and promote curiosity has constructed steadily round $2,100 over a number of months. Traditionally, such clusters have a tendency to draw value as markets transfer to check areas with deeper order stream. As Ethereum continues to weaken, that stage now stands out as the following main space the place buying and selling exercise might intensify.

On the identical time, overhead liquidity seems thinner in contrast with the decrease vary, which limits quick upside traction. This imbalance explains why rebounds have pale shortly throughout latest classes. Till value both reaches the $2,100 zone or liquidity situations shift, Ethereum stays susceptible to continued draw back strain.

Ethereum Exams Lengthy-Standing Help Zone Close to $2,100

Ethereum is urgent into a significant technical help band between $2,100 and $2,200 after an prolonged decline from late-2025 highs. The each day chart reveals value returning to an space that has repeatedly acted as a pivot level throughout prior cycles, with sharp reactions in each instructions. As ETH trades close to $2,326, strain continues to construct round that zone.

Ethereum each day value chart with RSI. Supply: StockCharts / X (Heisenberg)

Momentum indicators underline the significance of this stage. The each day RSI has dropped close to oversold territory, reflecting heavy draw back exhaustion relatively than acceleration. In previous cases, related RSI situations round this value space preceded sharp countertrend strikes, as promoting strain weakened and patrons stepped in close to structural help.

Worth historical past reinforces the technical sign. The $2,100–$2,200 vary served as a base earlier than main advances in earlier years and in addition restricted draw back throughout deeper corrections. If Ethereum stabilizes above this band, the construction favors a minimum of a short-term rebound pushed by imply reversion and quick protecting. A sustained break beneath it, nevertheless, would shift focus to decrease historic demand zones.