The newly relaunched Ethereum DAO was funded by way of TornadoCash, as soon as once more pointing to Ethereum’s mission of privateness. The DAO can have a $220M reserve devoted to funding safety analysis.

The reserves for the brand new Ethereum DAO will undergo Twister Money, which means all subsequent transactions will probably be tainted. The primary objective is to make sure that non-public transactions are nonetheless accepted because the norm, fairly than an indication of hacking.

One of many new DAO’s co-founders, Griff Inexperienced, introduced the deposit of the meant 69,420 $ETH into the Beacon Contract. Inexperienced additionally arrange the stake by way of his griff.eth self-importance tackle.

.@thedaofund‘s 69,420 $ETH is Staking for Safety. https://t.co/5kEKRmo0V5

— griff.eth – $GIV Maxi (@griffgreen) February 1, 2026

The pockets tagged as deploying the funds of the DAO was initially funded by Twister Money, carrying an Etherscan tag. For now, rules on utilizing funds tainted by Twister Money are variable, and exchanges don’t essentially display for earlier mixing.

Nonetheless, linking the Ethereum DAO with Twister Money formally is one more assertion in favor of privateness. Beforehand, Ethereum supporters have proposed the creation of personal validator swimming pools, which can’t be linked to a depositor tackle.

DAO funds have to attend for greater than 70 days

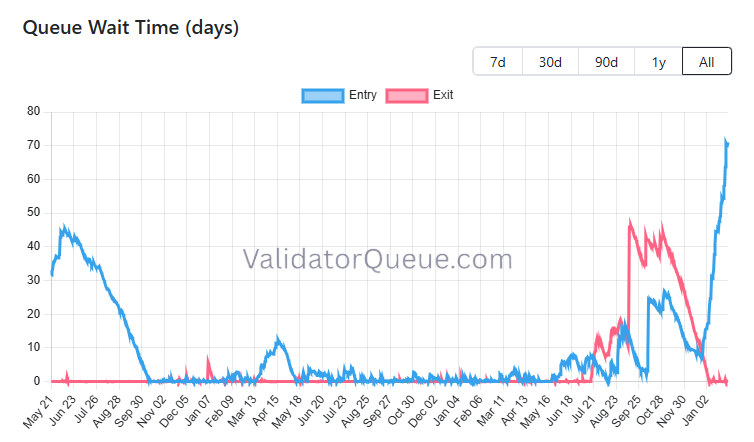

The potential passive earnings for the DAO could also be delayed, because the funds first have to be accepted into the Beacon Chain contract.

As a consequence of elevated demand for deposits, the DAO reserves might have to attend for over 70 days.

The DAO funds will probably be held within the queue for over 70 days earlier than producing passive earnings. | Supply: Validator Queue.

The validator queue holds over 4M $ETH ready to be deposited to the contract, with virtually no ready for withdrawals. The ready time accelerated to an all-time excessive and is now near 71 days.

The DAO will maintain the funds for a possible passive earnings, which will probably be used for grants and analysis. The DAO will probably be a part of the brand new spending schedule for the Ethereum Basis, which goals to spend its reserves extra conservatively within the coming years.

Twister Money unfold throughout Ethereum

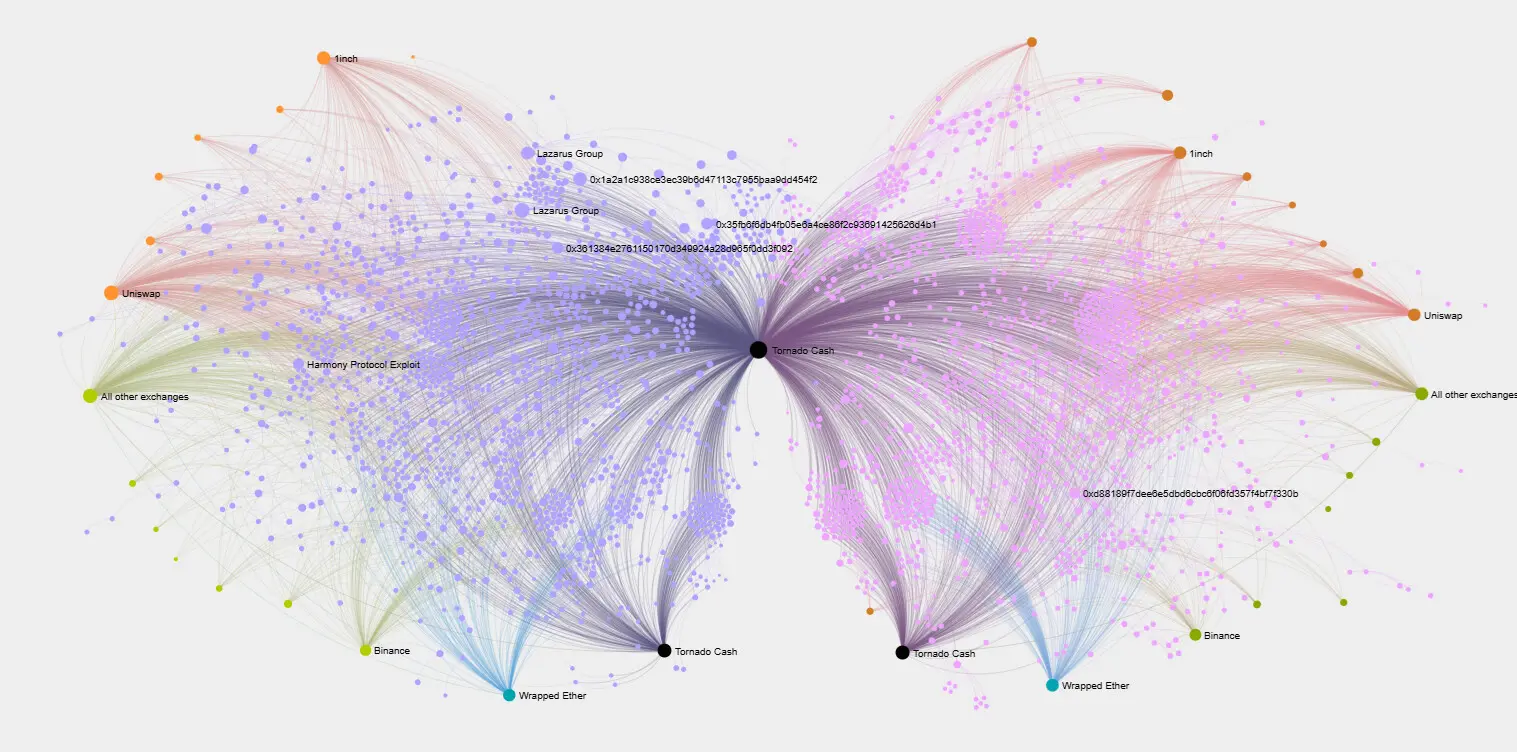

Twister Money has acquired warnings for carrying visitors from DPRK exploits and hacks. Nonetheless, the mixer has already unfold to a big a part of the Ethereum ecosystem, by way of common utilization and even ‘dusting’ from devoted wallets.

The mixer has drawn in visitors from your entire crypto ecosystem, together with centralized and decentralized exchanges, routers, and apps.

Twister Money is turning into a key a part of the decentralized Ethereum ecosystem, usually receiving transfers from the highest DEX. | Supply: Twister Community.

Twister Money additionally acquired a peak quantity of $ETH and stablecoins, bringing its whole worth locked to an all-time excessive. The mixer comprises over 361K $ETH, whereas exercise is recovering to ranges not seen since 2021.

The previous 12 months confirmed a gradual restoration of Twister Money from its low baseline exercise. The mixer drew in visitors from decentralized exchanges for a further layer of privateness. Vitalik Buterin has spoken in favor of veiled transactions as a supply of safety and never exposing whales or distinguished merchants.