Bitcoin worth fell greater than 10% from its late-January highs, briefly dropping beneath $81,000 earlier than stabilizing above $82,300. In simply 24 hours, the market recorded over $1.7 billion in liquidations, with Bitcoin accounting for practically $800 million in lengthy liquidations. $BTC worth continues to be down over 6%, day-on-day.

Most merchants blamed leverage. However the information reveals that derivatives didn’t begin this crash. They solely accelerated it. The true breakdown started earlier, close to a vital on-chain and structural zone.

Heavy Quantity, Damaged Help, and the $84,600 Entice

The primary warning got here from the every day chart. Bitcoin printed its largest pink quantity candle since early December. A pink quantity candle means aggressive promoting stress, the place sellers overpower consumers.

The final time quantity reached this stage, in early December, Bitcoin dropped practically 9%.

Again then, consumers stepped in instantly. This time, they didn’t. As a substitute, the $BTC worth slipped beneath $84,600, a key help stage, and continued falling towards $81,000.

Bitcoin Value Crash: TradingView

On the similar time, Bitcoin entered considered one of its most vital on-chain zones.

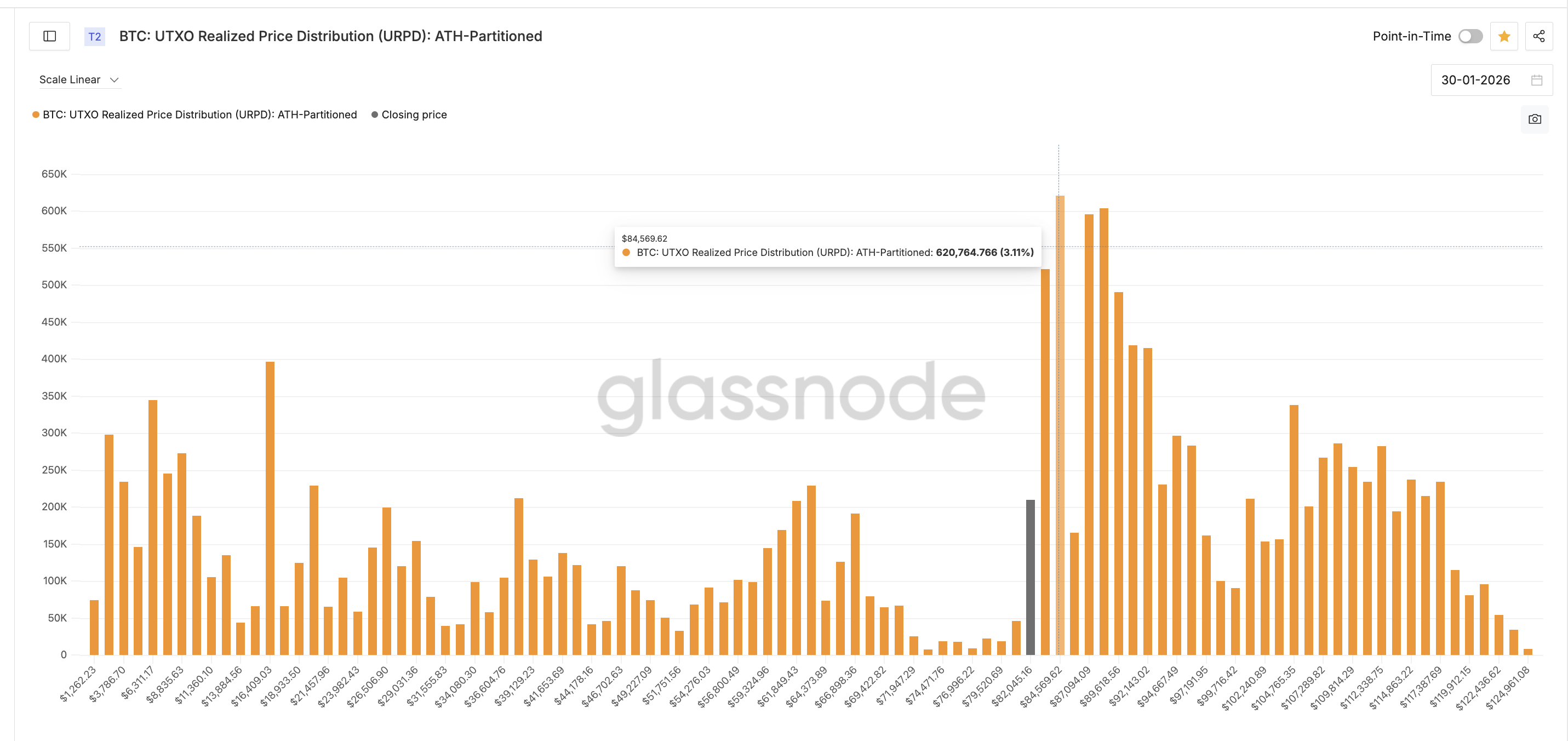

That is the place UTXO Realized Value Distribution (URPD) issues. URPD reveals the place the prevailing Bitcoin provide was final purchased. Giant clusters point out ranges the place many cash final modified arms, usually appearing as main help or resistance zones.

Two of the most important clusters, per the chart, sat at:

- $84,569 (3.11% of provide)

- $83,307 (2.61% of provide)

Key URPD Ranges: Glassnode

Collectively, they shaped one of many densest possession zones on this cycle.

When Bitcoin fell beneath $84,600, it entered this cluster zone. That’s the place hassle started as the primary cluster got here below menace.

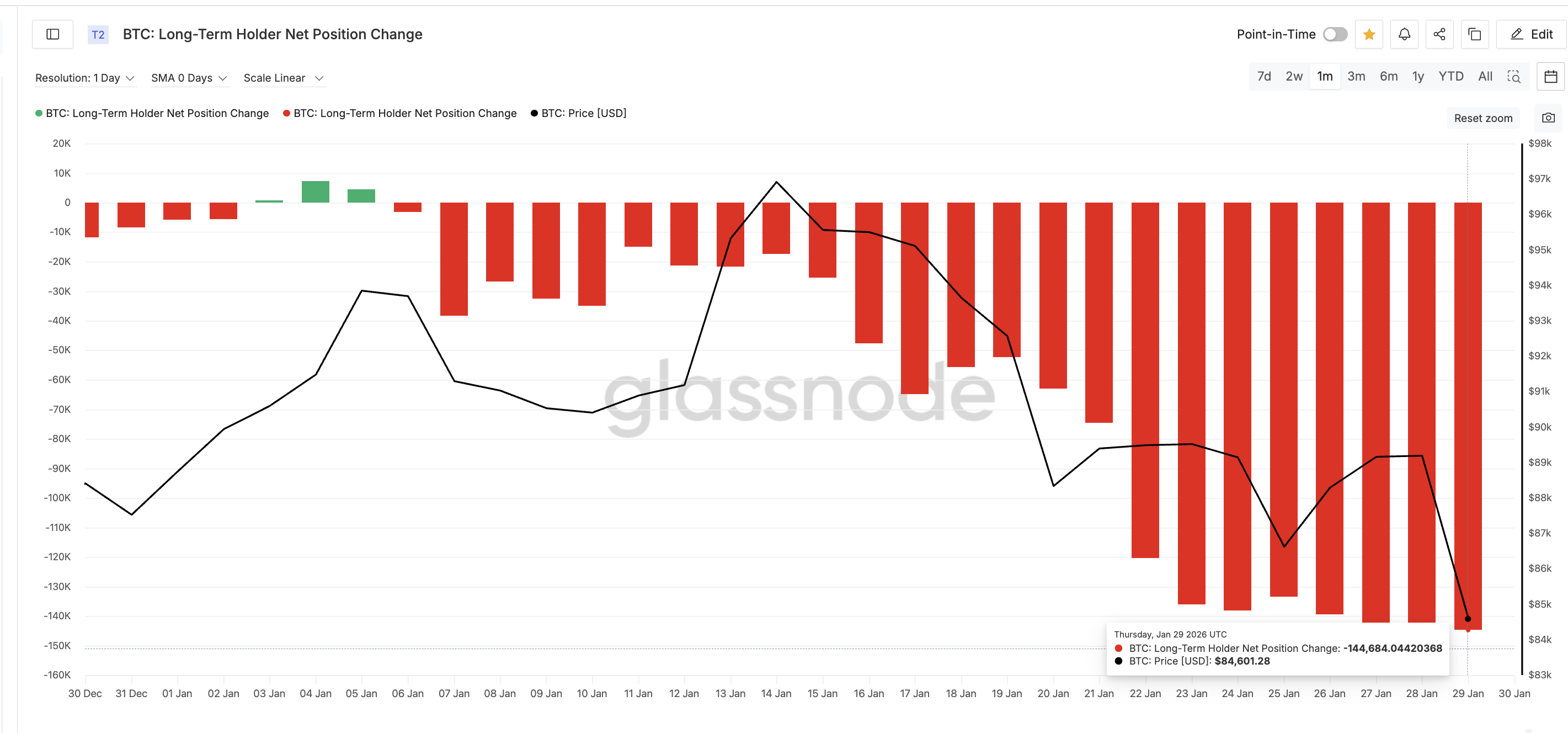

Glassnode information reveals that long-term holders, cash presumably held over a number of months to a yr, began promoting into this stage. On January 29, their 30-day web place change dropped to -144,684 $BTC, the most important month-to-month outflow of the interval.

Lengthy-Time period Holders: Glassnode

Lengthy-term holders bought close to $84,600, adjoining to the place the most important URPD cluster sat. When heavy promoting meets a significant price zone, help breaks. As soon as that flooring failed, a big portion of provide moved into loss. Solely after this breakdown did liquidation stress explode.

Why On-Chain Knowledge Regarded Wholesome Whereas Danger Was Constructing

This $BTC worth crash shocked many merchants as a result of surface-level metrics seemed secure.

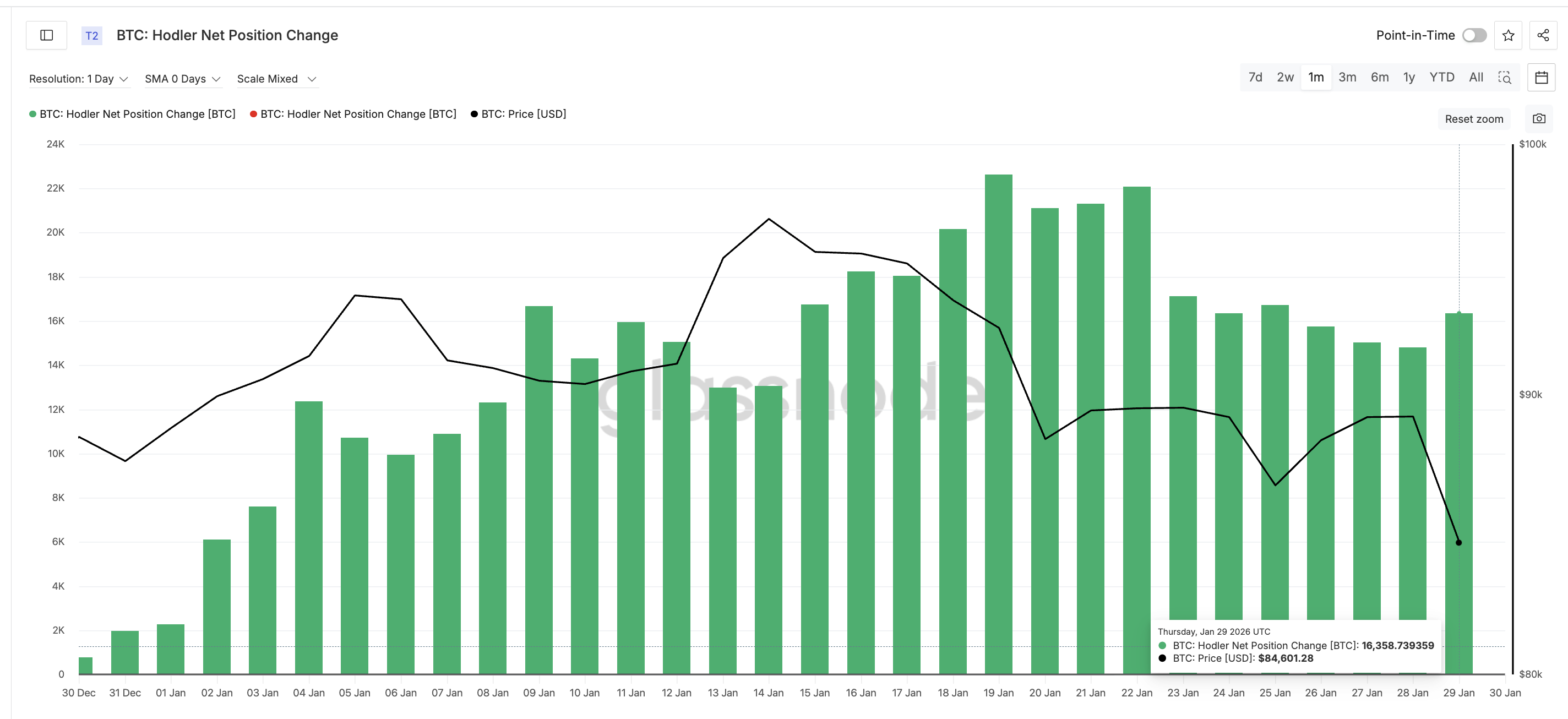

Hodler Web Place Change remained constructive, displaying about +16,358 $BTC added over 30 days.

HODlers Maintain Shopping for: Glassnode

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto E-newsletter right here.

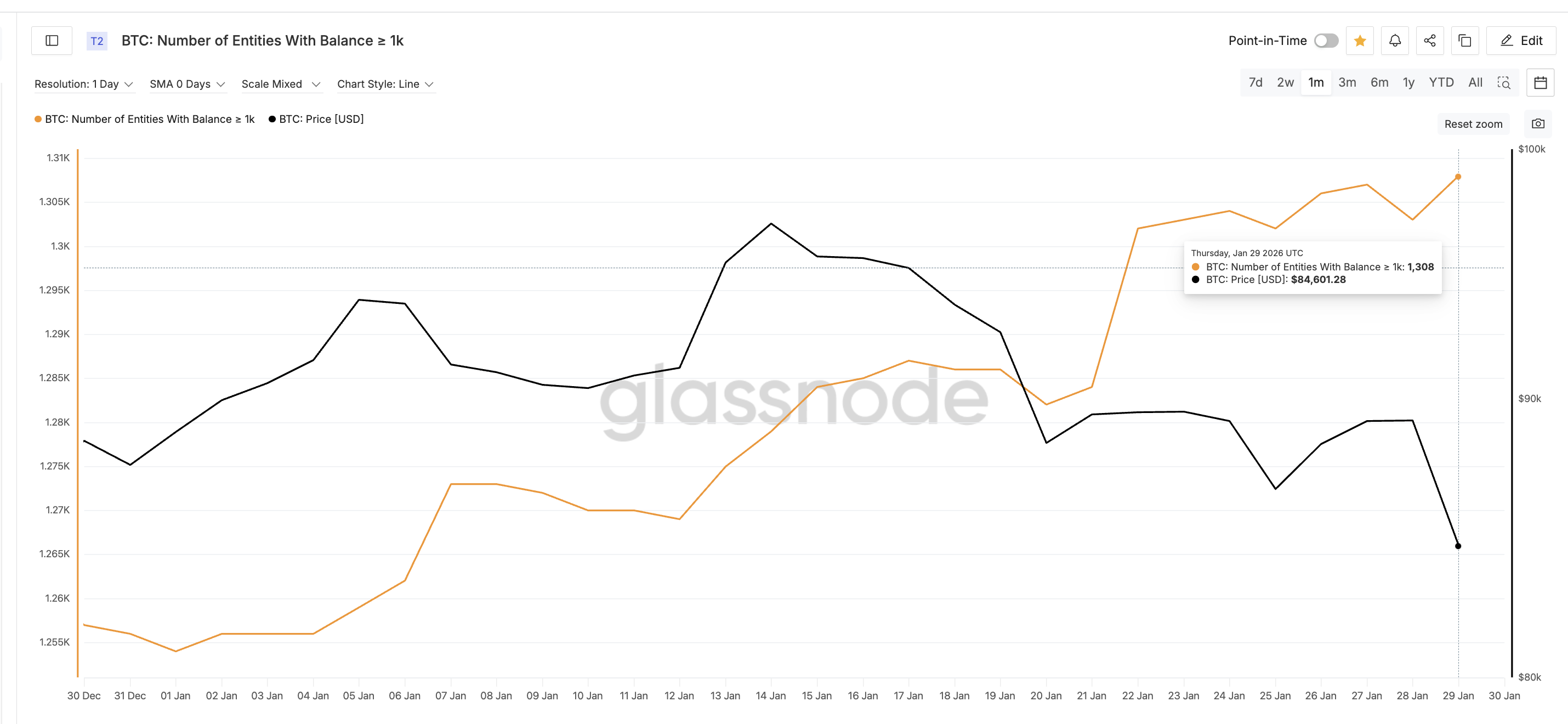

Whale balances have been additionally rising. Giant wallets weren’t dumping aggressively. On paper, accumulation was taking place.

$BTC Whales”>

$BTC Whales”>$BTC Whales: Glassnode

However these metrics combine completely different investor teams.

Mid-term holders and large wallets have been nonetheless shopping for. Lengthy-term holders have been quietly distributing. When skilled holders begin promoting close to main price clusters, it alerts conviction-led danger, even when general balances look sturdy.

That’s the reason most buyers missed the warning. BeInCrypto analysts highlighted this danger every week again. The market appeared wholesome. Beneath, its strongest help was being bought into.

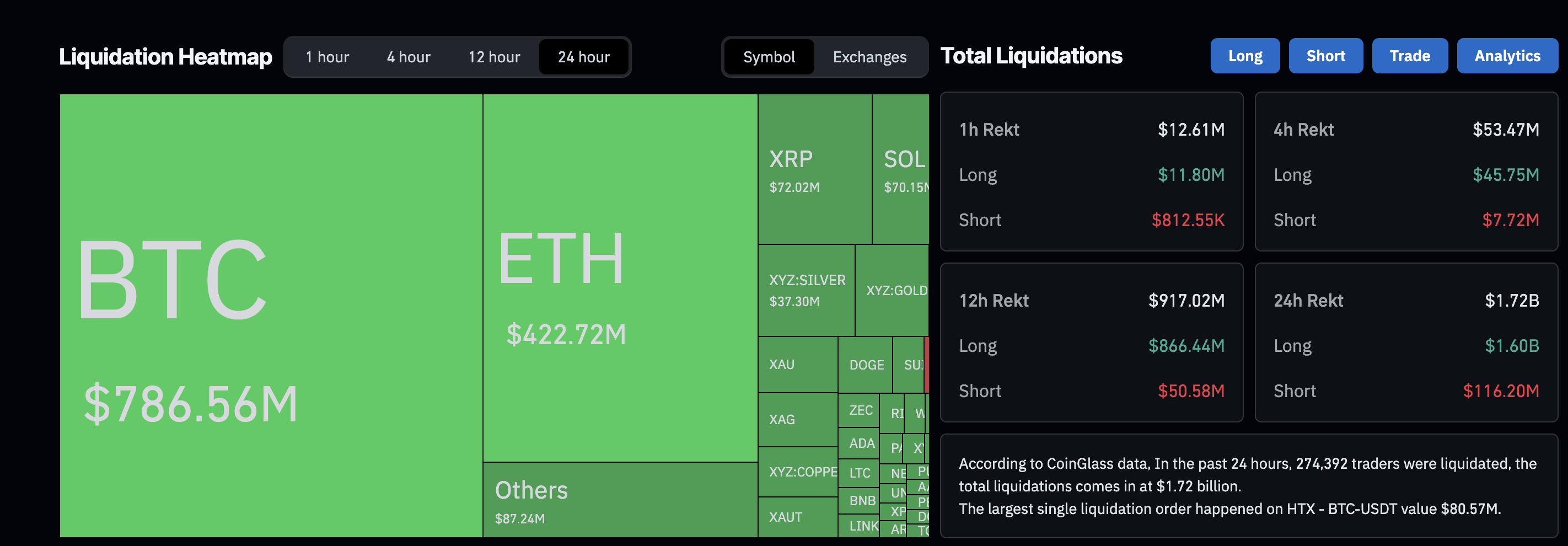

As soon as that promoting weakened the $84,600 zone, leverage grew to become weak. As the value dipped additional, lengthy positions began getting liquidated. CoinGlass information reveals practically $800 million in Bitcoin longs have been worn out in 24 hours.

Liquidation Numbers: Coinglass

Derivatives didn’t create weak point. They reacted to it.

Damaged Construction, Draw back Danger, and Key Bitcoin Value Ranges

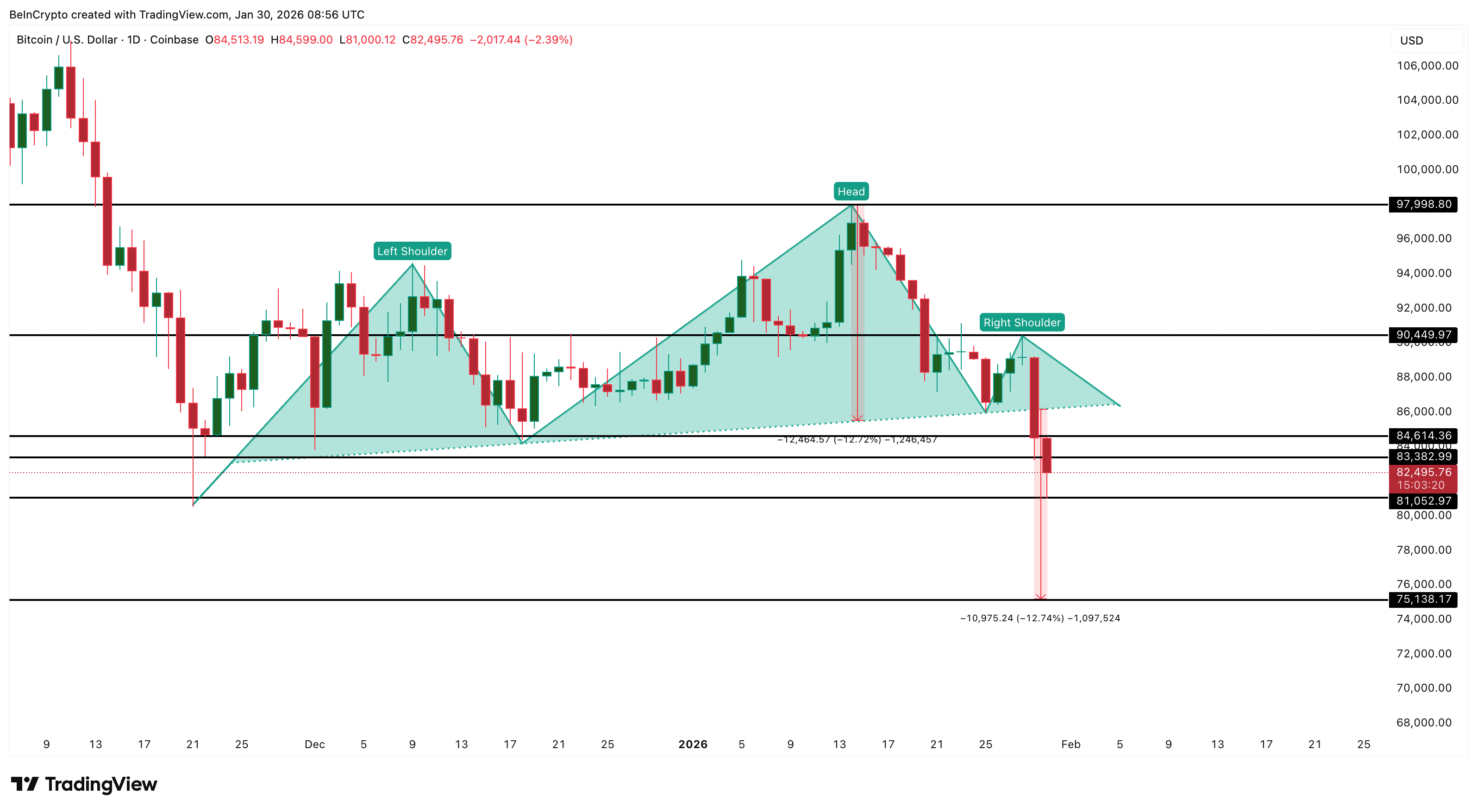

The technical construction has now deteriorated. Bitcoin has damaged beneath the neckline of a head and shoulders sample on the every day chart. It is a bearish reversal formation that usually seems earlier than prolonged corrections.

Primarily based on this sample, the breakdown initiatives one other 12% draw back from the neckline. That locations danger close to the $75,000 zone if promoting resumes. The $81,000 stage is now vital help.

If Bitcoin loses this stage once more, momentum might speed up decrease. If it holds, stabilization turns into attainable.

Bitcoin Value Evaluation: TradingView

Restoration depends upon reclaiming key on-chain and chart ranges. The primary vital $BTC worth zone sits close to $83,300, matching the second-largest URPD cluster. A transfer above this stage would present consumers are defending prior possession areas.

The primary stage stays $84,600. That’s the place long-term holders bought. And that’s the place the most important URPD cluster sits. Till Bitcoin closes decisively above $84,600, rebounds would stay fragile.

The submit The Actual Story Behind Bitcoin’s 10% Crash — Why Liquidations Got here Later appeared first on BeInCrypto.