Silver is now a front-page asset on Hyperliquid, highlighting a delicate shift in how crypto derivatives venues are getting used as bitcoin struggles to search out route.

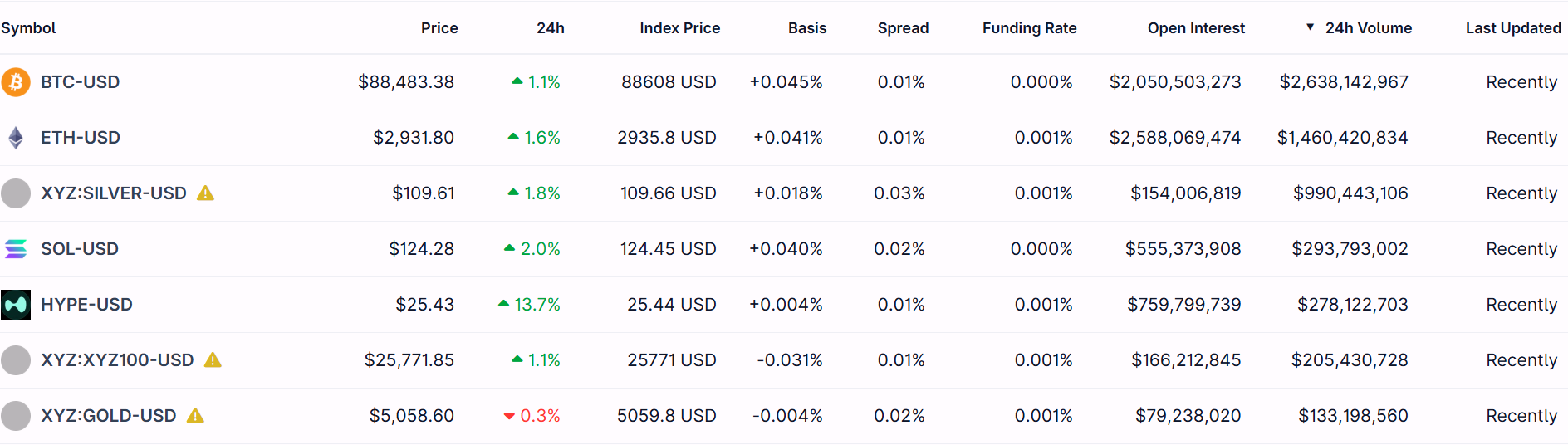

The SILVER-USDC contract has change into one in all Hyperliquid’s most lively markets, buying and selling round $110 throughout Asia hours and posting roughly $994 Million in 24-hour quantity.

Open curiosity sits close to $154.5 Million, whereas funding stays barely destructive, pointing to heavy turnover and two-way positioning slightly than a one-directional, levered guess. For a crypto-native venue constructed round perpetuals, that blend seems to be nearer to a volatility- and hedging-oriented market than a speculative lengthy.

What stands out shouldn’t be silver’s worth alone, however its prominence: silver is correct behind $BTC and $ETH pairs in quantity, in response to CoinGecko knowledge, and forward of SOL and XRP.

When a commodity contract rivals main crypto property for quantity on a decentralized trade, it suggests merchants are utilizing crypto infrastructure to specific views that bitcoin and ether not seize effectively. In different phrases, crypto plumbing is being repurposed for macro trades.

That backdrop helps clarify why bitcoin itself stays caught. Glassnode knowledge reveals $BTC pinned in what it describes as a defensive equilibrium. Spot cumulative quantity delta has flipped sharply destructive, indicating sellers are hitting bids on rallies.

ETF flows have cooled, eradicating a key supply of incremental demand. In derivatives, open curiosity has eased, funding is uneven, and choices skew has risen, signaling rising demand for draw back safety slightly than conviction about upside.

The result’s a market the place bitcoin absorbs stress with out collapsing, but in addition fails to pattern. Value stability close to $88,000 masks a scarcity of aggressive consumers and a reluctance to deploy leverage. $ETH‘s relative underperformance reinforces the message. Danger urge for food shouldn’t be transferring down the curve.

Bitcoin shouldn’t be being deserted. It’s being sidelined. And the rise of silver buying and selling on Hyperliquid is likely one of the clearest indicators but of the place uncertainty is now being priced.

Market Motion

$BTC: Bitcoin is hovering close to $88,000, buying and selling sideways as persistent promote stress and cautious positioning cap rallies regardless of the absence of panic promoting.

$ETH: Ether is buying and selling round $2,300, down on the week and lagging bitcoin as leverage and danger urge for food stay subdued.

Gold: Gold is extending its breakout, up about 15% over the previous 30 days and greater than 50% over six months, reinforcing the identical macro stress commerce exhibiting up in silver as capital gravitates towards exhausting property slightly than crypto beta.

Nikkei 225: Japan’s Nikkei 225 hovered close to flat in Asia commerce, at the same time as South Korean auto shares swung sharply on renewed U.S. tariff threats, with regional markets combined and chip-led positive aspects in Seoul and Australia offsetting weak spot in China.