On the time of writing, gold is altering palms at $5,079.30 per ounce, whereas silver is buying and selling at $113.24—ranges that presently make immediately’s prediction market wagers look much less like fringe curiosities and extra like forward-looking scoreboards.

Gold and Silver Prediction Markets Favor Power, Not Moonshots

Polymarket’s metals contracts provide a uncommon window into crowd expectations, translating macro narratives into clear chances slightly than headlines. 4 energetic contracts monitor whether or not gold and silver futures will attain or exceed particular worth ranges by set deadlines, relying strictly on official settlement costs.

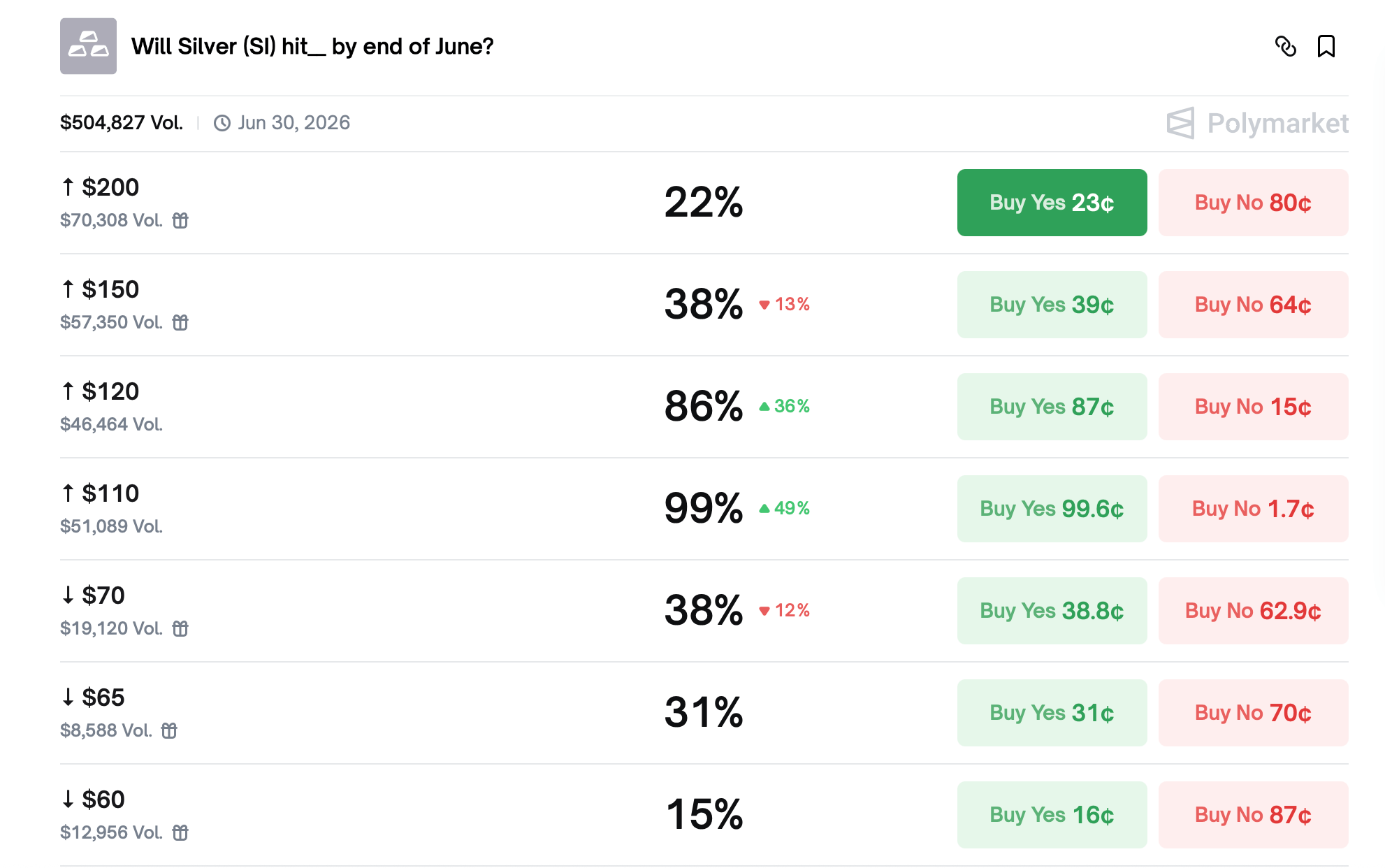

Two contracts concentrate on silver, each tied to CME silver futures. The primary contract seems out to the ultimate buying and selling day of June 2026, structured as a ladder starting from $35 to an eye-popping $200. Merchants assign close to certainty—roughly 99.6%—to silver reaching $110, whereas confidence thins shortly above that mark, sliding to about 86% at $120, 39% at $150, and roughly 20% at $200.

Supply: Polymarket on Jan. 26, 2026.

That distribution says quite a bit. The market consensus will not be debating whether or not silver stays elevated; it’s debating how far the rally realistically goes. The group seems snug with continued energy however attracts a transparent line between believable upside and speculative extra.

The second silver contract on Polymarket narrows the timeframe to the top of January 2026. Right here, chances compress even additional. Lower cost thresholds carry sturdy “sure” pricing, whereas increased targets fade quickly, many falling under 1%. The takeaway: merchants count on silver to remain agency, however they don’t seem to be paying up for fireworks within the close to time period.

Gold contracts inform an analogous story, simply at loftier worth ranges. One contract asks whether or not CME gold futures will hit sure thresholds earlier than the top of January 2026. Odds cluster closely round a single mid-range degree priced close to certainty, whereas most increased targets hover close to zero likelihood, reflecting skepticism towards a sudden breakout inside weeks.

Buying and selling curiosity in that January gold market sits round $1.35 million, signaling energetic participation with out the frenzy seen in meme-driven contracts. In different phrases, it is a market pushed by macro conviction, not vibes.

The longer-dated gold contract extends by means of June 2026 and paints a broader arc. Merchants overwhelmingly count on gold to succeed in $5,000, pricing that consequence as practically sure. Past $5,500, chances drop off sharply. The $6,000 degree sits in what merchants deal with as a coin-flip zone, whereas expectations collapse shortly above $6,500.

Additionally learn: Blackrock Pushes Deeper Into Bitcoin, Submitting ETF Constructed for Each Publicity and Revenue

Taken collectively, these 4 contracts sketch a constant image. Individuals on Polymarket are broadly bullish on valuable metals however disciplined about tail dangers. Power is anticipated; parabolic strikes will not be being chased.

It is usually notable that each one 4 contracts rely completely on official settlement costs from the CME. That design strips out intraday noise and forces merchants to anchor expectations to verifiable outcomes slightly than momentary spikes.

With gold already north of $5,000 and silver effectively above $110, these markets counsel the group believes the heavy lifting could already be achieved. The remaining debate will not be path, however magnitude.

In brief, prediction markets are signaling confidence with out euphoria—a bullish posture, trimmed with restraint, and priced accordingly.

FAQ

- What worth ranges do Polymarket merchants count on for silver by June 2026?The market assigns close to certainty to silver reaching $110, with sharply decrease odds above $120.

- Do merchants count on a near-term breakout in silver by January 2026?No, chances suggest silver stays elevated however inside a comparatively tight vary.

- How assured are merchants in $5,000 gold?The June 2026 gold contract costs $5,000 as a near-certain consequence.

- Are excessive gold targets like $6,500 broadly anticipated?No, chances fall shortly past $6,000, displaying skepticism towards outsized upside.