Bitcoin encounters mounting promoting stress as January 2026 ends, together with a $2.24 billion drop in stablecoin market capitalization, a year-low Coinbase premium, and a pointy decline in mining hashrate attributable to a extreme US ice storm.

The mixed affect of those elements has prompted veteran dealer Peter Brandt to warn that Bitcoin may fall under $70,000 if these market pressures persist.

Stablecoin Exodus Alerts Capital Flight From Crypto

The crypto market is going through a significant liquidity drop, because the market cap of the highest 12 stablecoins has fallen by $2.24 billion in simply 10 days, according to Bitcoin’s 8% decline. In response to market intelligence platform Santiment, this lower goes past typical profit-taking.

The information point out a essential problem for Bitcoin bulls. Slightly than rotating capital into stablecoins to attend for higher entry factors, buyers are cashing out to fiat.

High Stablecoin Marketcaps. Supply: Santiment

Stablecoins present important liquidity for crypto purchases. When their provide drops, the market’s capability to soak up promoting stress or assist rebounds is diminished.

Traditionally, crypto recoveries have trusted the expansion of the stablecoin market cap, signaling new capital coming into the house. The current decline means that short-term shopping for energy is shrinking.

Moreover, Santiment defined that this withdrawal might be attributable to cash shifting into gold and silver as buyers discover them extra enticing within the present surroundings. The consequence of this transfer is that altcoins will endure heavy losses.

Coinbase Premium Plunges Into Unfavorable Territory

Bitcoin’s decline is compounded by the Coinbase Premium Index, which has fallen to its lowest stage in a 12 months, exhibiting heightened promoting stress from US buyers.

The Coinbase Premium tracks the worth hole between Bitcoin on Coinbase Professional and the worldwide common, providing perception into US institutional and retail sentiment.

Coinbase Bitcoin Premium Index. Supply: Coinglass

Knowledge from Coinglass reveals the premium went deep into destructive territory from January 12 to 26, 2026, with readings under -0.05% and dropping to almost -0.15% after January 21. CryptoQuant knowledge reveals that the 7-day common Coinbase Premium Index has fallen to its lowest stage because the starting of the 12 months.

The destructive premium means Bitcoin is buying and selling at a reduction on Coinbase, reflecting stronger promoting by US contributors.

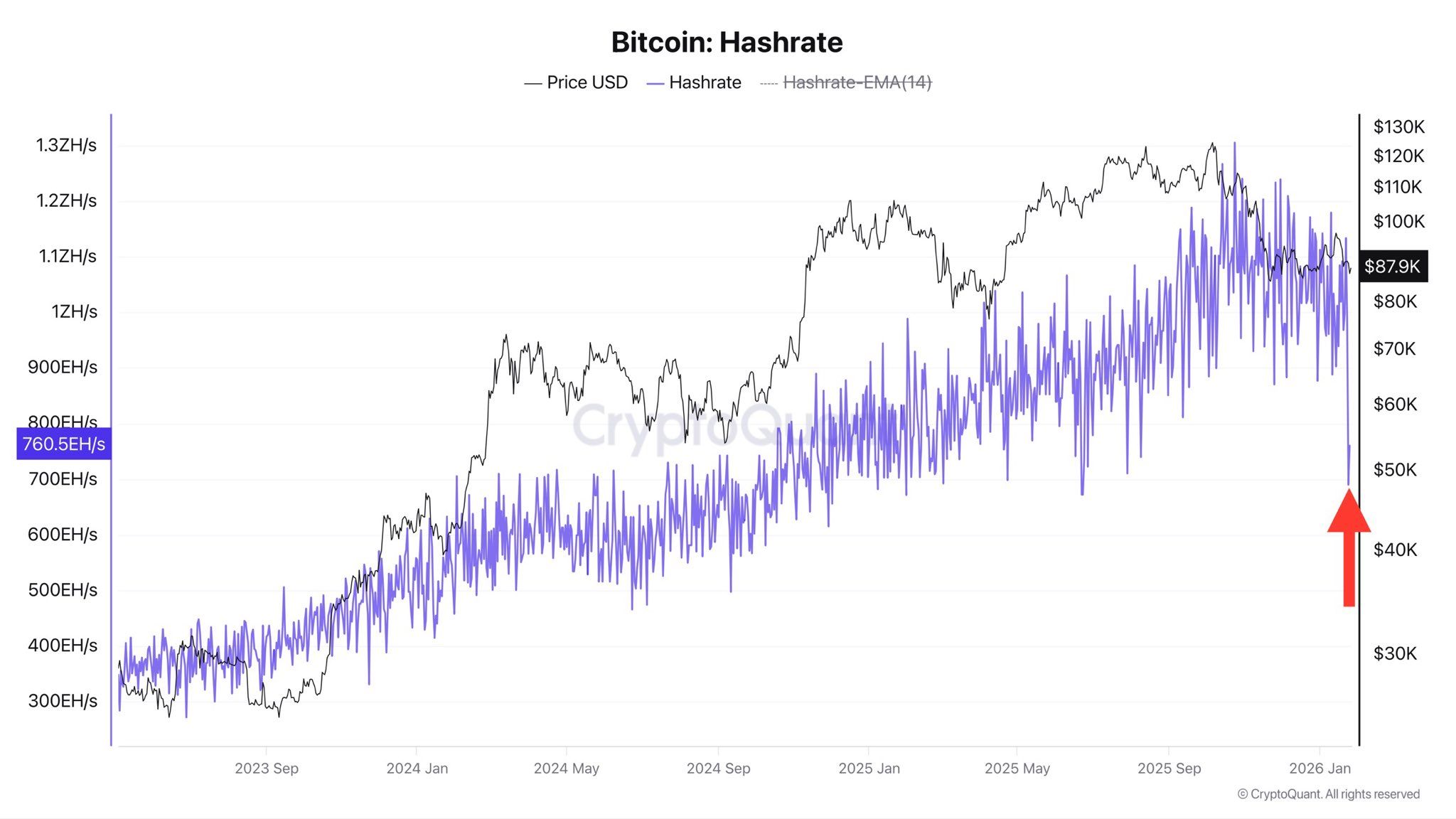

Ice Storm Triggers Mining Disaster and Hashrate Collapse

A extreme US ice storm has delivered one other blow to Bitcoin, inflicting hashrate to drop from 1.133 ZH/s to 690 EH/s over two days. The US makes up a couple of third of Bitcoin’s international mining capability, with key operations in Texas run by firms reminiscent of MARA and Foundry Digital.

Analyst Darkfost from CryptoQuant stories that MARA’s hashrate fell by 4 occasions in 3 days in comparison with its month-to-month common. The acute chilly disrupted energy grids, resulting in load cuts and better electrical energy prices. These situations pressured miners to close down operations and keep away from unsustainable prices.

Bitcoin Hashrate. Supply: CryptoQuant.

If mining firms endure income shortfalls, miners is likely to be pressured to promote their holdings to cowl ongoing bills, including to the stress of sale whereas liquidity stays tight.

“This era of stress may even set off some BTC promoting if the storm have been to persist, as miners should still must cowl mounted working prices whereas ready for situations to normalize.” – Analyst Darkfost predicted.

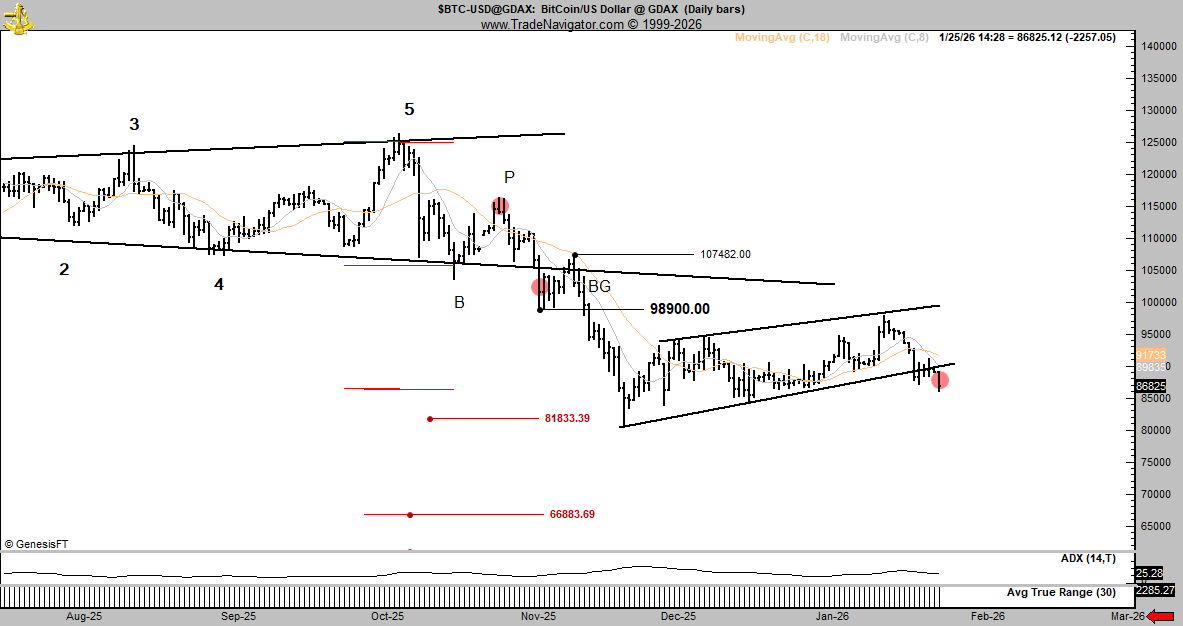

Technical Breakdown Factors to Additional Draw back

Veteran dealer Peter Brandt has flagged a bearish technical sign that matches the general downward development. Brandt notes that Bitcoin has damaged down from a bear channel on the each day chart, transferring under a rising channel established since late December 2025.

Bitcoin Bear Channel. Supply: Peter Brandt

Brandt’s evaluation suggests Bitcoin should recuperate above $93,000 to negate the bearish outlook. If it fails, the worth may decline towards $81,833 and even $66,883.

This technical forecast provides weight to the bearish narrative seen in on-chain metrics and broader market construction. With liquidity draining, sturdy U.S. promoting, and burdened miners, Bitcoin lacks the assist to reclaim key resistance ranges. The mixture of technical and basic elements makes a near-term restoration troublesome.

The submit Bitcoin Faces Draw back Danger Beneath $70,000 as A number of Promoting Pressures Mount in January appeared first on BeInCrypto.