The US authorities has been making an attempt to execute a historic pivot with its Bitcoin holdings, shifting from a messy, case-by-case stock of seized crypto right into a strategic nationwide reserve for nearly a yr now.

That ambition, typically framed as a “digital Fort Knox,” is now going through a credibility take a look at after allegations that roughly $40 million in crypto was siphoned from government-linked seizure wallets.

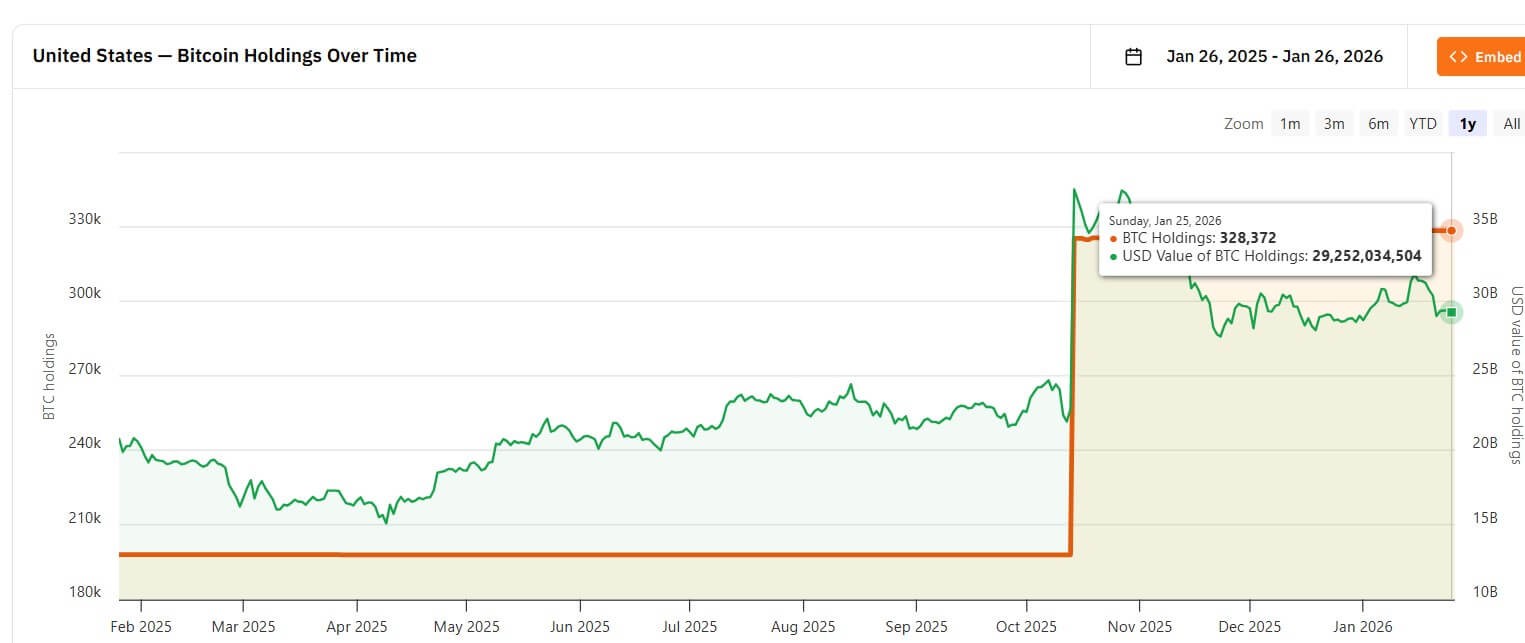

Even when the reported loss is small relative to the roughly $28 billion in Bitcoin the US is extensively believed to manage, the episode cuts on the core premise of the brand new posture. It raises doubts about whether or not Washington can handle a sovereign-scale Bitcoin steadiness sheet with reserve-grade safety and auditable controls.

The alleged insider breach

Over the weekend, blockchain investigator ZachXBT alleged that greater than $40 million in crypto was siphoned from US government-linked seizure wallets.

ZachXBT linked the alleged theft to John Daghita, popularly generally known as Licks, who he mentioned maintains household ties to the chief management of Command Providers & Assist (CMDSS), a non-public agency contracted to assist US Marshals Service (USMS) crypto seizure operations.

Company filings point out that Dean Daghita serves as president of CMDSS. The agency is predicated in Haymarket, Virginia, and is contracted by the USMS to handle and get rid of particular classes of seized cryptocurrency.

ZachXBT mentioned he was in a position to join John Daghita to the alleged theft after what he described as a “band-for-band” argument on Telegram, a dispute wherein two people tried to show their wealth by evaluating pockets balances.

The dispute allegedly culminated in a persona recognized as “Lick” screen-sharing an Exodus pockets and shifting massive sums in actual time.

That screen-shared exercise supplied a path ZachXBT mentioned he used to hint a cluster of addresses that’s linked to greater than $90 million in suspected illicit flows. Of this, roughly $24.9 million moved from a US-controlled pockets in March 2024.

This situation spotlights a vulnerability that has much less to do with refined protocol exploits and extra with custody governance, contractor entry, and the sorts of human failure modes that are inclined to scale poorly when actual cash and actual operational complexity collide.

In the meantime, that is additionally not the primary time federal crypto custody operations have confronted scrutiny. In October 2024, a pockets linked to the Bitfinex hack proceeds was drained of roughly $20 million, although the funds had been largely recovered.

Fragmentation creates threat

In common creativeness, the US authorities’s roughly $28 billion Bitcoin place appears like a single stockpile sitting behind a single set of controls.

Nonetheless, the operational actuality for these property is much extra fragmented.

Custody preparations for seized crypto are a patchwork of businesses, authorized statuses, and storage options. Funds can sit at totally different factors within the forfeiture pipeline, and “US holdings” isn’t a single ledger entry however fairly a posh operational system.

That variance issues as a result of safety in a multi-agency mesh will depend on course of self-discipline, constant requirements, and the speedy migration of funds from short-term seizure wallets into long-term chilly storage.

It is because a single custodian could be defended with fortress-like protocols.

Nonetheless, a system involving a number of distributors and handoffs behaves in a different way. It depends on the consistency of controls throughout each node within the community, together with the folks and contractors who contact the method.

So, the paradox round which company holds which keys and when expands the assault floor.

Thus, oversight can slip within the gaps between organizations, between short-term wallets and long-term storage, and between coverage ambition and day-to-day operational actuality.

In that context, the importance of this reported $40 million loss turns into larger because it implies a course of failure.

Such custody failure suggests unknown publicity elsewhere, particularly if the weak spot is rooted in vendor governance or insider entry fairly than a one-off technical exploit.

The contractor’s “exhausting tail” vulnerability

Contractors like CMDSS are central to understanding this threat profile as a result of they sit the place the federal government’s custody system turns into most intricate.

A Authorities Accountability Workplace (GAO) determination from March 2025 confirmed that the USMS awarded CMDSS a contract to handle “Class 2–4 cryptocurrencies.”

The GAO doc attracts a distinction between asset lessons that helps clarify why contractors matter.

Class 1 property are usually liquid and could be readily supported by customary chilly storage. Class 2–4 property, against this, are described as “much less common” and require specialised dealing with, typically involving bespoke software program or {hardware} wallets.

That’s the exhausting tail of crypto custody, the lengthy checklist of property that aren’t merely Bitcoin and a handful of different liquid tokens, however the messy stock that arrives by seizures. Managing these property can require navigating totally different blockchains, unfamiliar signing flows, and sophisticated liquidation necessities.

In sensible phrases, it creates a reliance on exterior experience to handle probably the most difficult elements of custody. Underneath this mannequin, the federal government successfully outsources the messiest nook of crypto operations.

The GAO notes that contractors are strictly prohibited from utilizing authorities property for staking, borrowing, or investing.

However contractual prohibitions will not be bodily controls. They can not, on their very own, forestall misuse of a non-public key if human controls are bypassed.

That’s the reason the allegations, framed as contractor ecosystem threat and social engineering fairly than protocol failure, carry weight past the particular theft declare. If the system’s resilience will depend on self-discipline throughout each vendor and handoff, then the weakest node turns into probably the most enticing goal.

Notably, warnings about custody gaps will not be new. A 2025 report highlighted that the USMS couldn’t present even a tough estimate of its BTC holdings and had beforehand relied on spreadsheets missing sufficient stock controls. A 2022 Division of Justice Workplace of Inspector Normal audit explicitly warned that gaps like these might consequence within the lack of property.

Is the US ready to hodl?

The stakes of those operational gaps have risen as a result of US coverage is shifting.

The White Home has moved to ascertain a Strategic Bitcoin Reserve and a separate Digital Asset Stockpile, with directives for the Treasury to manage custodial accounts the place Bitcoin “shall not be bought.”

That coverage change shifts the federal government’s position from a short lived custodian, traditionally related to auctions and proof disposal, to a long-term holder.

For years, the crypto markets handled the US authorities’s stash as a possible provide overhang, a supply of latent promoting strain if seized cash had been liquidated.

Nonetheless, the strategic reserve framing shifts the lens, because the central query turns into custody credibility.

If Bitcoin is to be handled as a reserve asset analogous to gold, the usual traders will implicitly demand is vault-grade safety, clear custodianship, constant controls, and auditable procedures.

So, this alleged $40 million theft attracts consideration again as to whether the infrastructure supporting this ambition nonetheless resembles an advert hoc proof workflow or is being scaled for long-term stewardship.

It is because a big, well-known authorities Bitcoin hoard might change into a primary goal for malicious actors searching for to use a porous system. Crypto analyst Murtuza Service provider mentioned:

“If criminals imagine seized funds could be siphoned from authorities wallets, they could deal with forfeiture as a short lived inconvenience, not an endpoint, particularly if laundering routes exist by exchanges and cross-chain hops.”