Ethereum (ETH) is experiencing notable promoting stress in January 2026, as whale wallets and institutional gamers have moved over $110 million price of ETH to main exchanges.

On the similar time, the Coinbase Premium Index signifies weakening demand throughout the US market. Nonetheless, rising staking demand and supportive technical alerts level to a cautiously optimistic outlook for the asset.

Massive Ethereum Transfers Sign Elevated Exercise From Whales and Establishments

On-chain information signifies a wave of enormous Ethereum transactions. Blockchain analytics agency Lookonchain reported {that a} pockets recognized as 0xB3E8, which started buying and selling ETH eight years in the past, transferred 13,083 ETH, price roughly $43.35 million, to Gemini final week.

Regardless of the latest motion, the pockets nonetheless holds 34,616 ETH, valued at roughly $115 million.

It seems that a whale is dumping 13,000 $ETH($41.75M).

Galaxy Digital OTC pockets simply transferred 13,000 $ETH($41.75M) out and has already deposited 6,500 $ETH($20.89M) into #Binance, #Bybit, and #OKX.https://t.co/UT2jKKEMFS pic.twitter.com/GolGaNMzrN

— Lookonchain (@lookonchain) January 19, 2026

Apart from whales, institutional gamers have additionally made notable strikes. Lookonchain famous that Ethereum treasury firm FG Nexus offered 2,500 ETH, price about $8.04 million.

“Ethereum holding firm FG Nexus offered one other 2,500 $ETH($8.04M) as we speak and nonetheless holds 37,594 $ETH($119.7M). Their final $ETH sale was in November 2025, once they transferred 10,975 $ETH($33.6M) to Galaxy Digital on Nov 18 and 19,” the submit acknowledged.

Moreover, Lookonchain revealed {that a} pockets probably linked to enterprise capital agency Fenbushi Capital despatched 7,798 ETH price $25 million to Binance. The tokens had been staked for 2 years earlier than re-entering circulation.

It’s price noting that market contributors typically view such alternate inflows as an early sign of potential promoting, as belongings are usually transferred to centralized exchanges to entry liquidity or execute trades.

Nonetheless, these actions don’t essentially translate into rapid market gross sales, because the funds might also be meant for inner rebalancing, collateral deployment, hedging methods, or over-the-counter settlements. In consequence, whereas alternate deposits can improve short-term promoting threat, they don’t, on their very own, verify that liquidation is imminent.

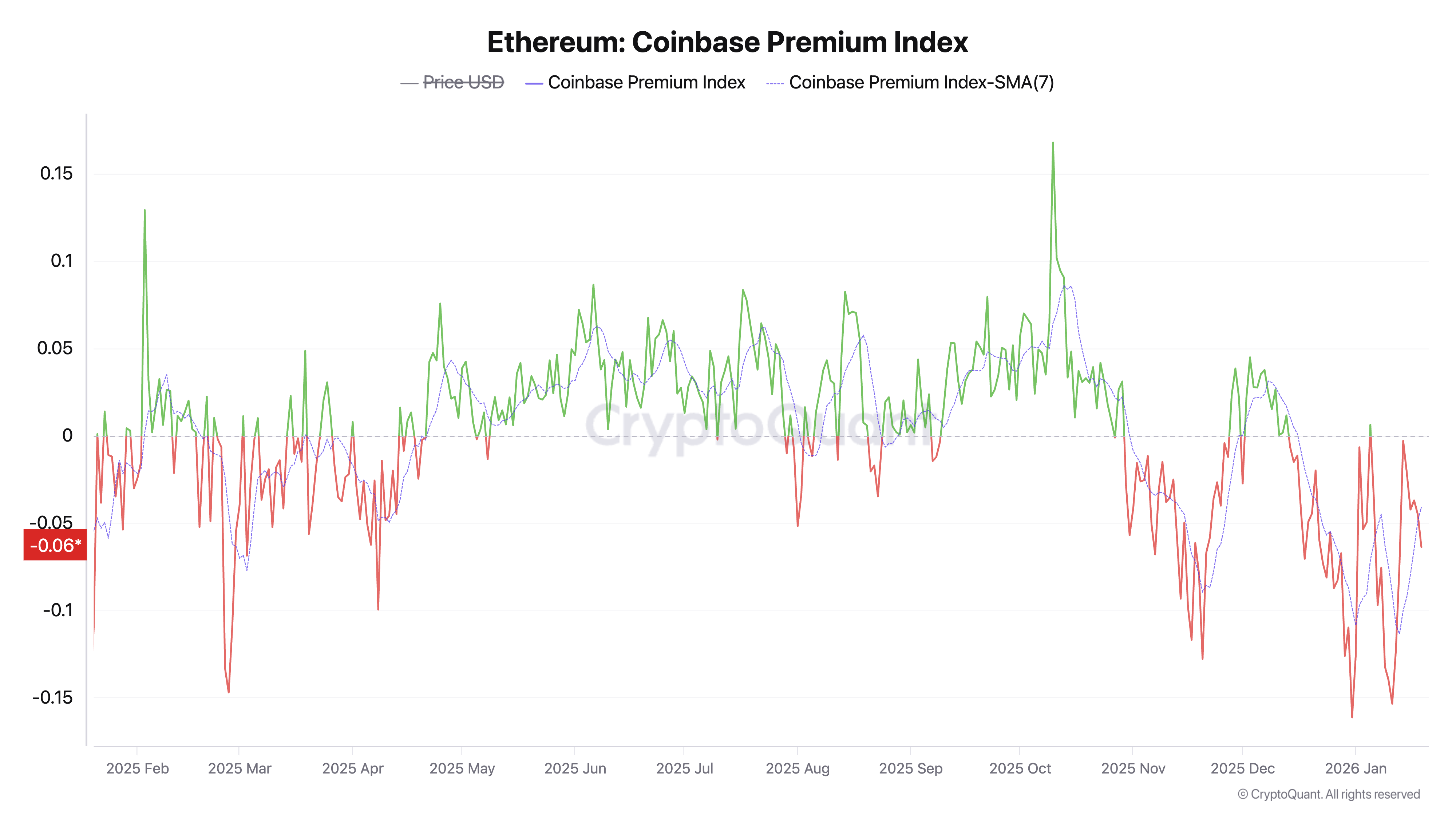

In parallel with these on-chain actions, market-based indicators present extra context on present circumstances. The Coinbase Premium Index, which measures the proportion distinction between the Coinbase Professional worth (USD pair) and the Binance worth (USDT pair), is in detrimental territory. This alerts comparatively weaker demand from US-based institutional buyers.

ETH’s Destructive Coinbase Premium Index”>

ETH’s Destructive Coinbase Premium Index”>ETH’s Destructive Coinbase Premium Index. Supply: CryptoQuant

Ethereum Staking and Technical Indicators Counsel Resilience

Nonetheless, Ethereum’s staking ecosystem continues to indicate persistent demand. Based mostly on validator queue information, 2.7 million ETH sits within the entry queue to start staking, leading to a 47-day wait. This massive backlog reveals robust curiosity in validator participation and long-term help for the community.

The comparability between entry and exit queues is noteworthy. 36,960 ETH are ready to exit. This imbalance means that whereas some giant holders are promoting, the broad validator base stays dedicated to incomes staking rewards and serving to safe the community.

Tom Lee(@fundstrat)’s #Bitmine staked one other 86,848 $ETH($277.5M) 5 hours in the past.

In complete, #Bitmine has now staked 1,771,936 $ETH($5.66B).https://t.co/P684j5Yil8 pic.twitter.com/fNoIuERqKt

— Lookonchain (@lookonchain) January 20, 2026

As well as, market analysts are pointing to technical alerts which recommend additional upside for the asset. Commenting on the present setup, analyst Crypto Gerla famous that ETH seems to be in a re-accumulation section. The analyst added {that a} transfer towards $3,600 might materialize.

Bears known as for a prime final cycle due to the $ETH head and shoulder sample.

Now, ETH is forming an inverse head and shoulder sample, however bears suppose it will not play out this time.

They had been proper in 2022 and will likely be incorrect in 2026. pic.twitter.com/mHcDZyGBXY

— BitBull (@AkaBull_) January 19, 2026

As of the most recent information from BeInCrypto Markets, Ethereum’s buying and selling worth was $3,166.51, down 1.11%. Whether or not promoting stress continues to weigh on the asset or bullish momentum regains management will likely be a key pattern to look at within the coming interval.

The submit Ethereum Whales Make a $110 Million Transfer as Market Stress Builds appeared first on BeInCrypto.