This week, bitcoin is buying and selling 29% beneath its all-time excessive from October, when the bellwether digital asset cleared $126,000 per coin, leaving its most ardent backers to reckon with an uncomfortable actuality: treasured metals like gold have been stealing the highlight. Nonetheless, loads of die-hard crypto believers stay satisfied that when gold’s run loses steam, bitcoin is subsequent in line for a dramatic comeback.

Treasured Metals Advocates Flex as Bitcoin Bulls Argue the Wait Will Be Price It

There’s no scarcity of bickering throughout social media platforms like X over bitcoin’s displaying versus gold’s eye-catching run. Whereas bitcoin nonetheless edges out gold on a five-year foundation, posting good points of 189% in contrast with gold’s 158%, the hole is narrowing by the day. Including to the discomfort, silver has already pulled forward, with its five-year efficiency topping bitcoin after climbing 261% over the previous 60 months.

On Thursday, Jan. 22, gold is altering fingers at $4,833 per ounce, whereas silver clocks in at $93.53 per ounce as of 10 a.m. Japanese. On the similar second, bitcoin ( BTC) is idling round $89,098 per coin, down 8% over the previous week. Over on X, defenders of bitcoin are pushing again, arguing that the asset’s present underperformance doesn’t robotically spell doom.

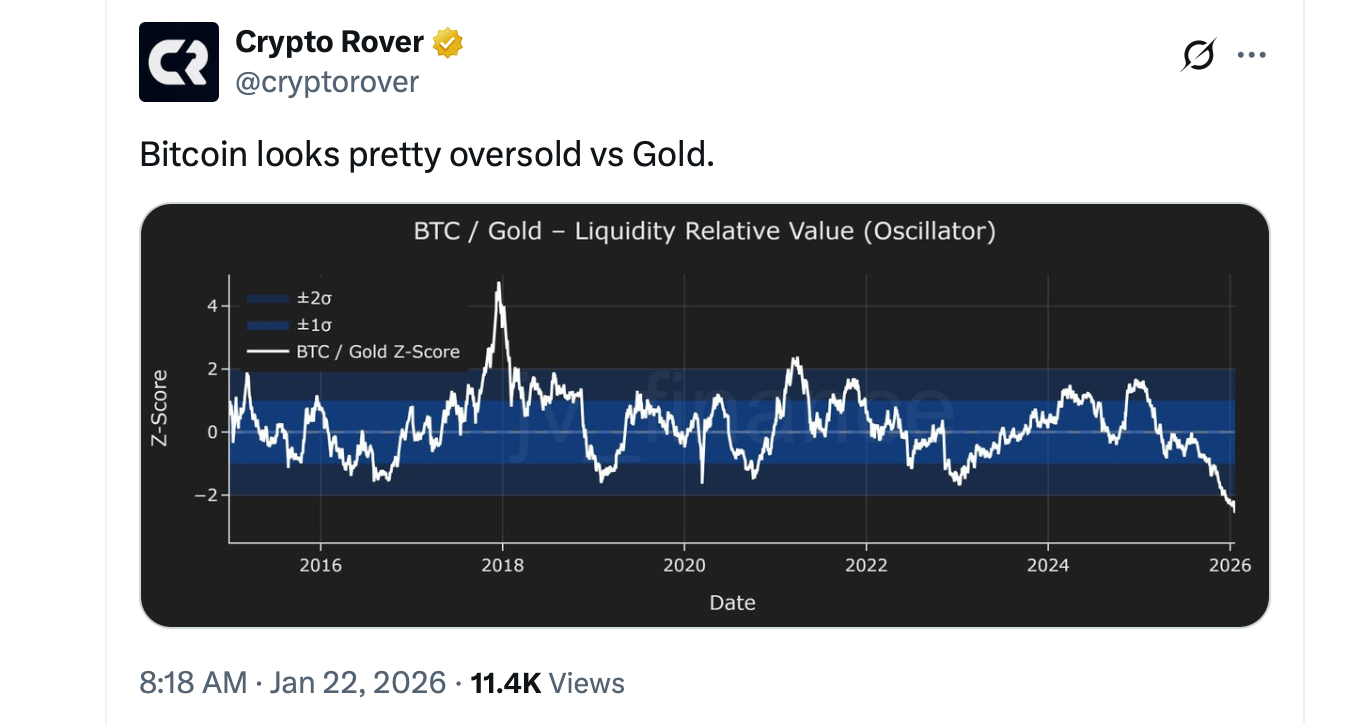

“ Gold going up whereas BTC struggles doesn’t imply BTC failed,” one X person wrote Thursday. “It means capital is selecting which danger it desires to hold immediately. That alternative adjustments each day.” One other commentator took a sharper tone, insisting bitcoin is “criminally oversold in comparison with gold.”

James Verify, also called Checkmate and co-founder of Checkonchain, contends that some bitcoin holders run quick on endurance at any time when gold behaves as anticipated, including that each bitcoin and gold are prone to climb over the lengthy haul as fiat forex steadily loses buying energy. “There are bitcoiners on the market who couldn’t deal with six months of gold going up,” Checkmate mentioned. “Their conviction melted as they watched gold have what’s a traditional optimistic yr for the corn (after bitcoin had two of them again to again btw).”

He added:

“Peter Schiff has felt like this for 17-years, and might be again to feeling like that quickly sufficient. He actually grew silver hair ready for silver to go up. In the event you’re feeling notably salty, go purchase a gold coin, you’ll put the highest in, after which we will get again to common programming. Each cash are going significantly increased, personal them each. Fiat has no backside.”

This view echoed extensively throughout bitcoin-focused social media circles. “Each gold rally ends with a bitcoin supercycle,” the X account Bitcoin Teddy wrote Thursday. Others chimed in beneath Checkmate’s thread, poking enjoyable at gold with a dose of tongue-in-cheek humor. “Our grandkids will giggle about how we used to dig up shiny yellow rocks out of the bottom, make them into bricks, transport them with armed guards, after which pay to retailer them in a secure,” the X account Finity remarked. “Kinda like how we have a look at letter-carrying pigeons now.”

Bitcoin proponent Anthony Pompliano mentioned he believes deflation is a significant factor weighing on BTC proper now, a view others echoed whereas arguing that gold needs to be coping with the identical forces as effectively. “I truly suppose deflation is without doubt one of the main headwinds for bitcoin and is an effective knowledge level as to why the asset hasn’t outperformed during the last 12 months,” Pompliano wrote Thursday. One other person jumped in, stressing that “ Gold needs to be going through those self same headwinds however for some motive it’s not. Makes me suppose, it quickly will,” the particular person added.

Additionally learn: Myrmikan Capital: Gold’s Development Highlights the Weak spot of the US Inventory Market

For now, the standoff between bitcoin and treasured metals reads much less like a verdict and extra like a ready recreation. Gold and silver are having fun with their second within the solar, whereas bitcoin trades effectively beneath its October peak, testing the resolve of even its loudest champions. But amongst longtime holders, the temper isn’t panic a lot as impatience, blended with a well-recognized perception that rotations between property are momentary and barely well mannered.

Whether or not that confidence proves prescient stays an open query, however the debate itself highlights a deeper divide over time horizons and conviction. To some, gold’s rise is a sign to rethink danger; to others, it’s merely the prelude earlier than capital wanders again towards bitcoin. Within the meantime, the argument rages on, memes fly freely, and each camps appear sure of 1 factor: fiat, of their view, remains to be the weakest wager of all.

FAQ ❓

- Why is bitcoin underperforming gold proper now? Bitcoin is buying and selling effectively beneath its October excessive as some capital has rotated towards gold and silver. How lengthy this lasts is up for debate.

- How has bitcoin carried out in contrast with gold over 5 years? Bitcoin remains to be forward over the previous 5 years, rising 189% in contrast with gold’s 158% acquire. Silver, however, has outperformed BTC over the five-year run.

- Why are some buyers nonetheless bullish on bitcoin?Many supporters consider bitcoin’s present weak point is momentary and that capital will rotate again as soon as gold’s rally cools. That is debatable.

- What position does deflation play in bitcoin’s worth motion?Some analysts argue deflation has weighed on bitcoin’s efficiency, at the same time as gold seems much less affected for now.