Ethereum traded close to $3,093 on the 4-hour chart after a pointy pullback from the $3,403 peak, as sellers regained management and pushed worth beneath key development indicators. The retreat adopted a robust rally, however the newest transfer suggests short-term momentum has shifted into correction mode.

Moreover weakening worth construction, merchants are additionally watching leverage and spot stream conduct, which nonetheless level to cautious market positioning. Consequently, ETH now sits at a key determination level the place bulls should defend close by help ranges and reclaim overhead resistance to restart upside continuation.

ETH Faces Heavy Resistance Zones

ETH stays capped beneath $3,163, which aligns with the 0.618 Fibonacci degree and stands as the primary upside hurdle. Moreover, a tighter resistance zone sits between $3,227 and $3,233, the place shifting averages and the Supertrend promote sign converge. This cluster has acted as a ceiling, and ETH wants a clear 4-hour reclaim to shift momentum again in favor of patrons.

Furthermore, the $3,268 degree, marked by the 0.786 Fibonacci zone, provides one other barrier after earlier rejection. A renewed push towards $3,403 would doubtless require a stronger breakout above all three resistance zones.

ETH Worth Dynamics (Supply: Buying and selling View)

Draw back ranges have grow to be extra essential as ETH hovers near $3,088, a key midpoint Fibonacci help. Therefore, this degree now acts because the speedy line that would resolve the subsequent swing. If ETH breaks beneath $3,088, the subsequent draw back goal comes close to $3,014, adopted by deeper help at $2,922.

Associated: Shiba Inu Worth Prediction: SHIB Merchants Flip Cautious as Outflows Maintain Constructing Under Zero

Considerably, $2,922 stands out as a bounce-or-break zone, based mostly on previous reactions. If promoting strain grows, the broader construction stays anchored at $2,773, which marks the vary low.

Leverage Cools Whereas Spot Flows Keep Weak

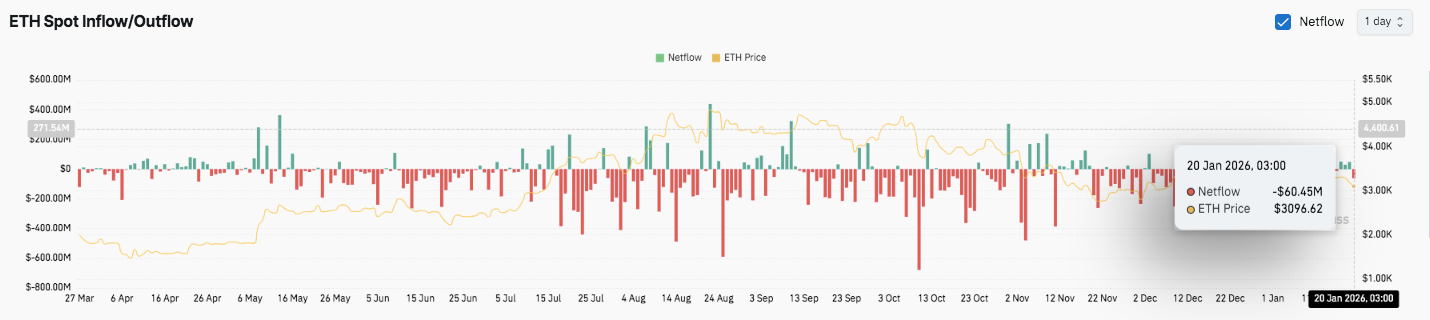

Supply: Coinglass

Ethereum futures open curiosity has adopted a transparent build-and-reset cycle over the previous yr, rising sharply in the course of the rally and later unwinding. Nonetheless, it stays elevated at about $40.31 billion as of Jan. 20, 2026, exhibiting merchants nonetheless maintain sizable publicity.

Supply: Coinglass

Spot stream knowledge has leaned bearish for months, with repeated web outflows and restricted influx follow-through. Furthermore, current web outflows close to $60 million counsel patrons nonetheless lack conviction throughout rebounds.

Bitmine Staking Provides a Recent On-Chain Sign

Tom Lee(@fundstrat)’s #Bitmine staked one other 86,848 $ETH($277.5M) 5 hours in the past.

In whole, #Bitmine has now staked 1,771,936 $ETH($5.66B).https://t.co/P684j5Yil8 pic.twitter.com/fNoIuERqKt

— Lookonchain (@lookonchain) January 20, 2026

Lookonchain reported that Tom Lee’s Fundstrat-linked Bitmine staked one other 86,848 ETH price about $277.5 million. Moreover, Bitmine’s whole staked steadiness has reached 1,771,936 ETH, valued close to $5.66 billion. This exercise provides a brand new on-chain headline as ETH checks key help and merchants look ahead to the subsequent directional break.

Associated: Bitcoin Worth Prediction: $108M Lengthy Liquidations Break EMA Cluster…

Technical Outlook for Ethereum Worth

Key ranges stay clearly outlined as Ethereum trades inside a corrective section after a robust rally.

Upside ranges embody $3,163 as the primary hurdle, adopted by the $3,227–$3,233 resistance cluster. A breakout above this zone may open a path towards $3,268, with $3,403 standing as the foremost swing-high goal.

On the draw back, $3,088 acts as speedy help. A lack of this degree exposes $3,014, then $2,922 as the subsequent key demand zone. The broader construction stays supported close to $2,773.

The technical image suggests ETH is consolidating after momentum cooled, with worth compressing between Fibonacci help and moving-average resistance. This setup usually precedes volatility growth.

Will Ethereum Go Up?

Ethereum’s near-term path relies on whether or not patrons can reclaim $3,163 and maintain above the $3,233 cluster. Robust follow-through may revive bullish momentum towards $3,403.

Nonetheless, failure to defend $3,088 dangers deeper draw back towards $3,014 and $2,922. For now, ETH stays at a pivotal inflection zone the place affirmation, not anticipation, will drive the subsequent transfer.

Associated: Oasis Worth Prediction 2026: ROFL “Trustless AWS” & Franklin Templeton Pilot Goal $0.04-$0.06

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version will not be answerable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.