Throughout Myriad, Kalshi, and Polymarket, prediction merchants are converging on a well-recognized conclusion: bitcoin seems to be way more more likely to flirt with six figures than collapse into deep drawdown territory anytime quickly.

The $100K-or-Bust Framing Takes Maintain

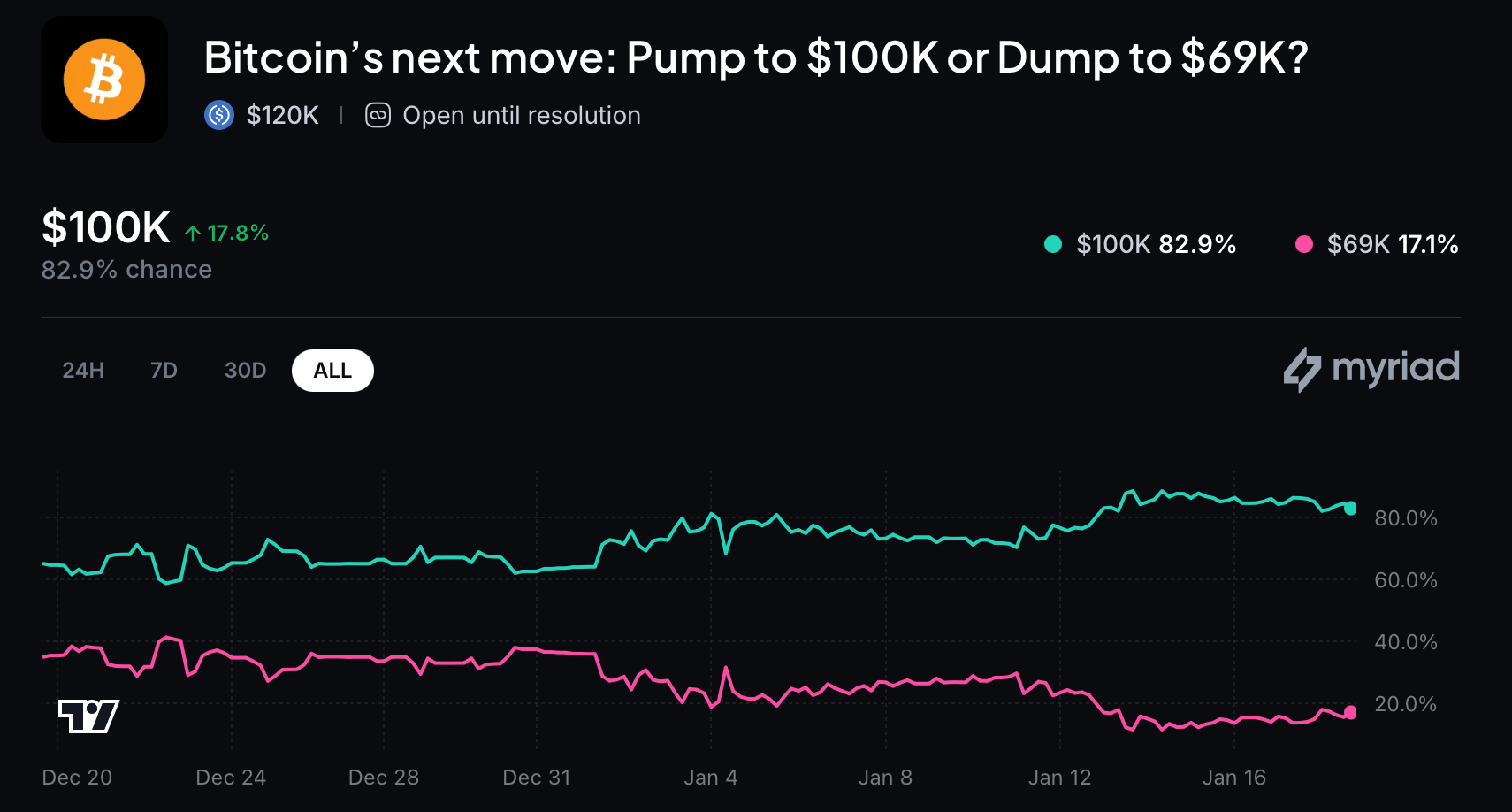

On Myriad, the market bluntly titled “ Bitcoin’s subsequent transfer: Pump to $100K or Dump to $69K?” exhibits merchants overwhelmingly siding with upside. Roughly 82.9% of members imagine bitcoin will tag $100,000 earlier than it ever exams $69,000, leaving simply 17.1% backing a pointy drawdown situation.

The market resolves strictly on Binance’s BTC/ USDT spot worth utilizing one-minute candle closes, making it a fast-moving barometer of sentiment fairly than a long-horizon prophecy.

Supply: Myriad on Jan. 19, 2026.

Kalshi’s Draw back Debate Is a Coin Flip, Not a Collapse Name

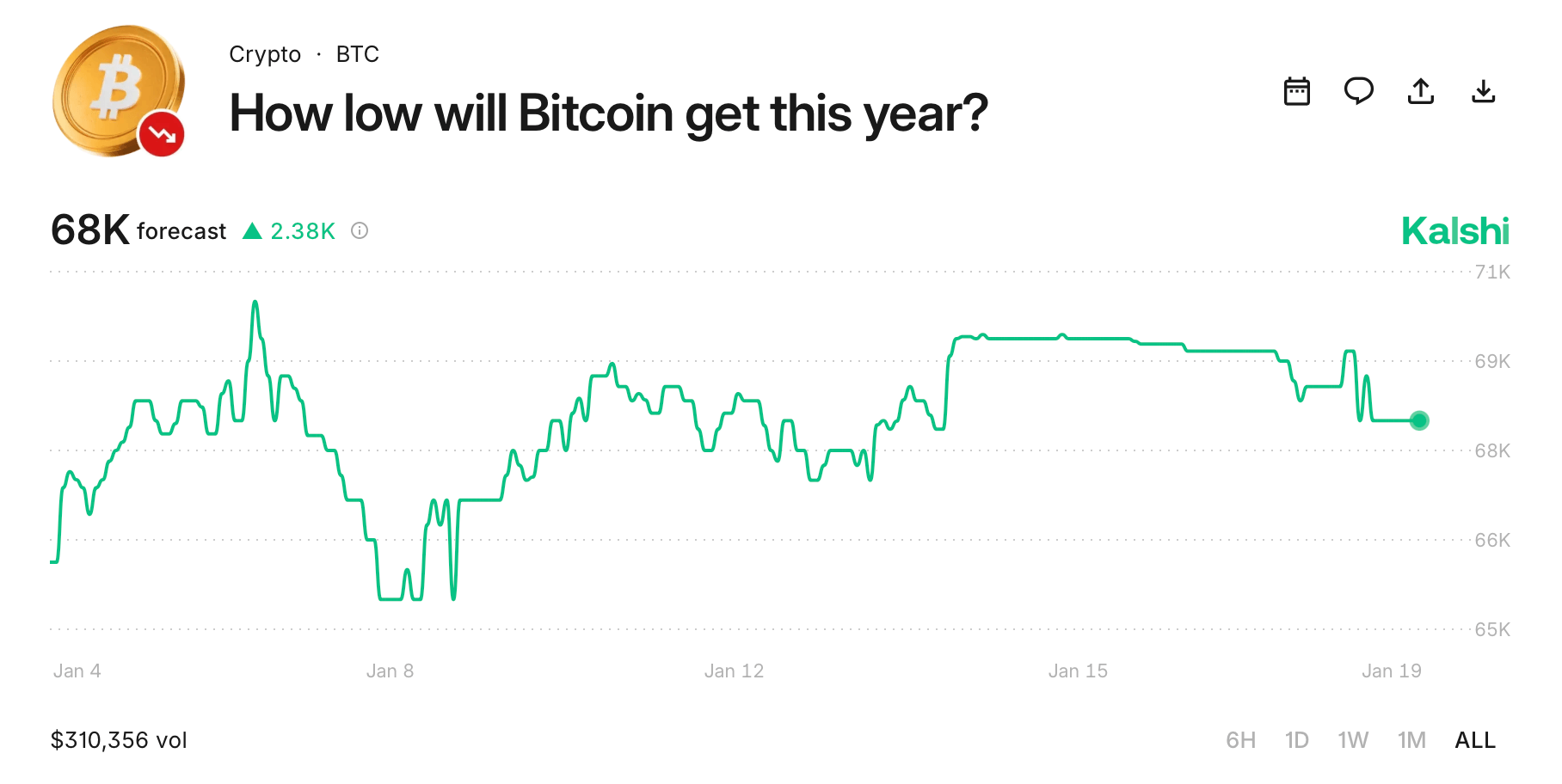

On Kalshi, the query shifts from “if” to “how a lot.” The contract “How low will Bitcoin get this 12 months?” costs a near-even probability—about 52%—that bitcoin dips beneath $70,000 sooner or later in 2026. Deeper ache is much less convincing, with sub-$65,000 odds falling to roughly 47%, whereas a softer pullback beneath $72,000 carries the next 55% likelihood. The takeaway is nuance: draw back danger is acknowledged, however panic promoting just isn’t the bottom case.

Supply: Kalshi on Jan. 19, 2026.

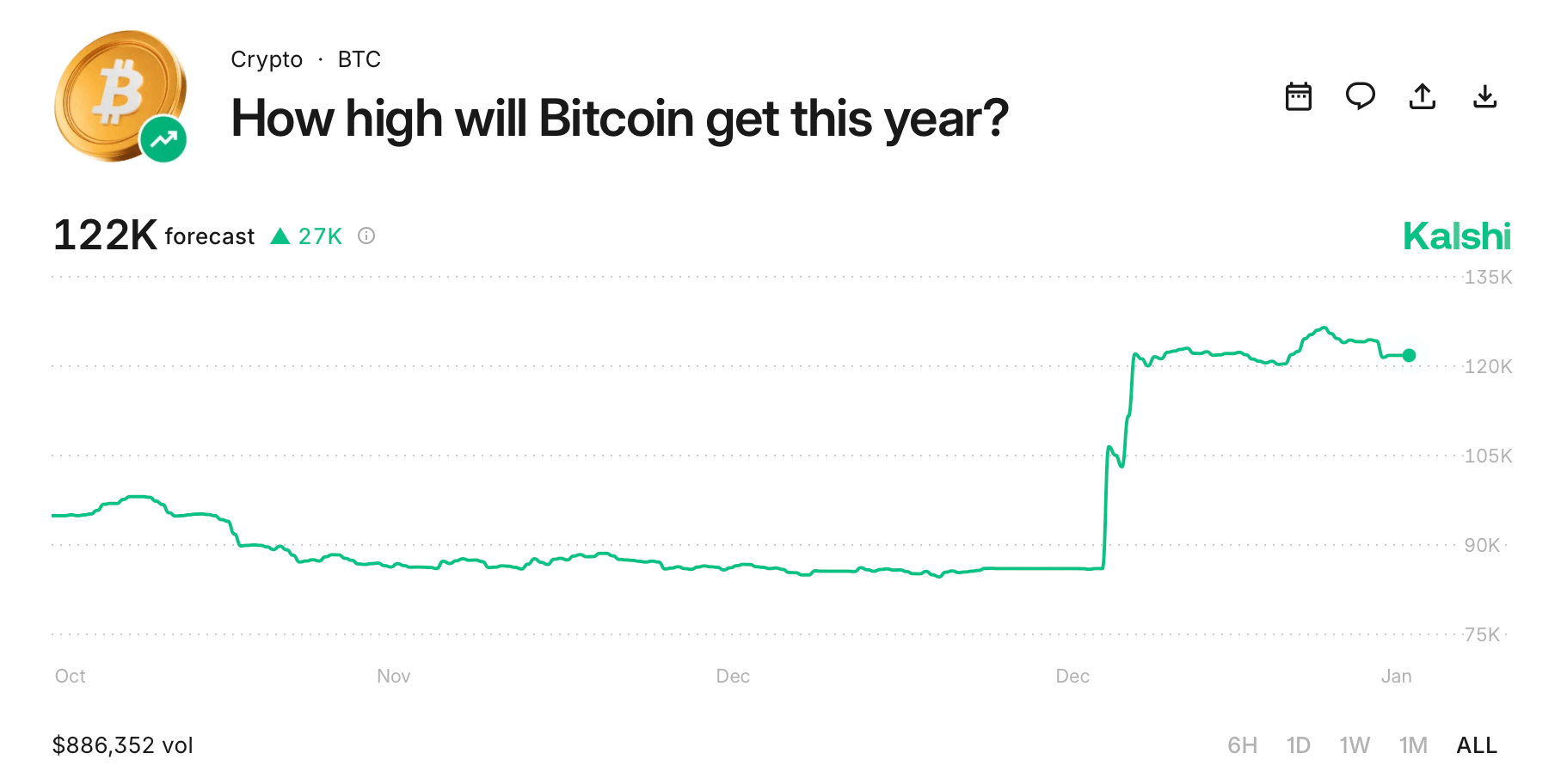

How Excessive Is Too Excessive? Kalshi’s Ceiling Comes Into View

Kalshi’s companion market, “How Excessive Will Bitcoin Get This 12 months?”, sketches the higher bounds. Merchants at the moment assign a couple of 52% likelihood that bitcoin clears $120,000 throughout 2026, utilizing CF Bitcoin Actual-Time Index information for settlement. Confidence improves at decrease thresholds—round 68% for $110,000—however thins as expectations climb, with only a 41% implied probability of exceeding $130,000. Optimism is current, but it surely comes with measured restraint.

Supply: Kalshi on Jan. 19, 2026.

Polymarket’s Lengthy-Time period Imaginative and prescient Retains the Moon at Arm’s Size

Over on Polymarket, the market “What worth will Bitcoin hit in 2026?” paints an analogous image. Excessive targets stay fringe concepts, with only a 5% likelihood assigned to $250,000 and 10% every for $200,000 and $190,000. Sentiment corporations up nearer to earth: $150,000 carries a 25% probability, $140,000 sits at 31%, and $130,000 clocks in at 40%. The very best conviction clusters round $120,000, main the board at roughly 51%.

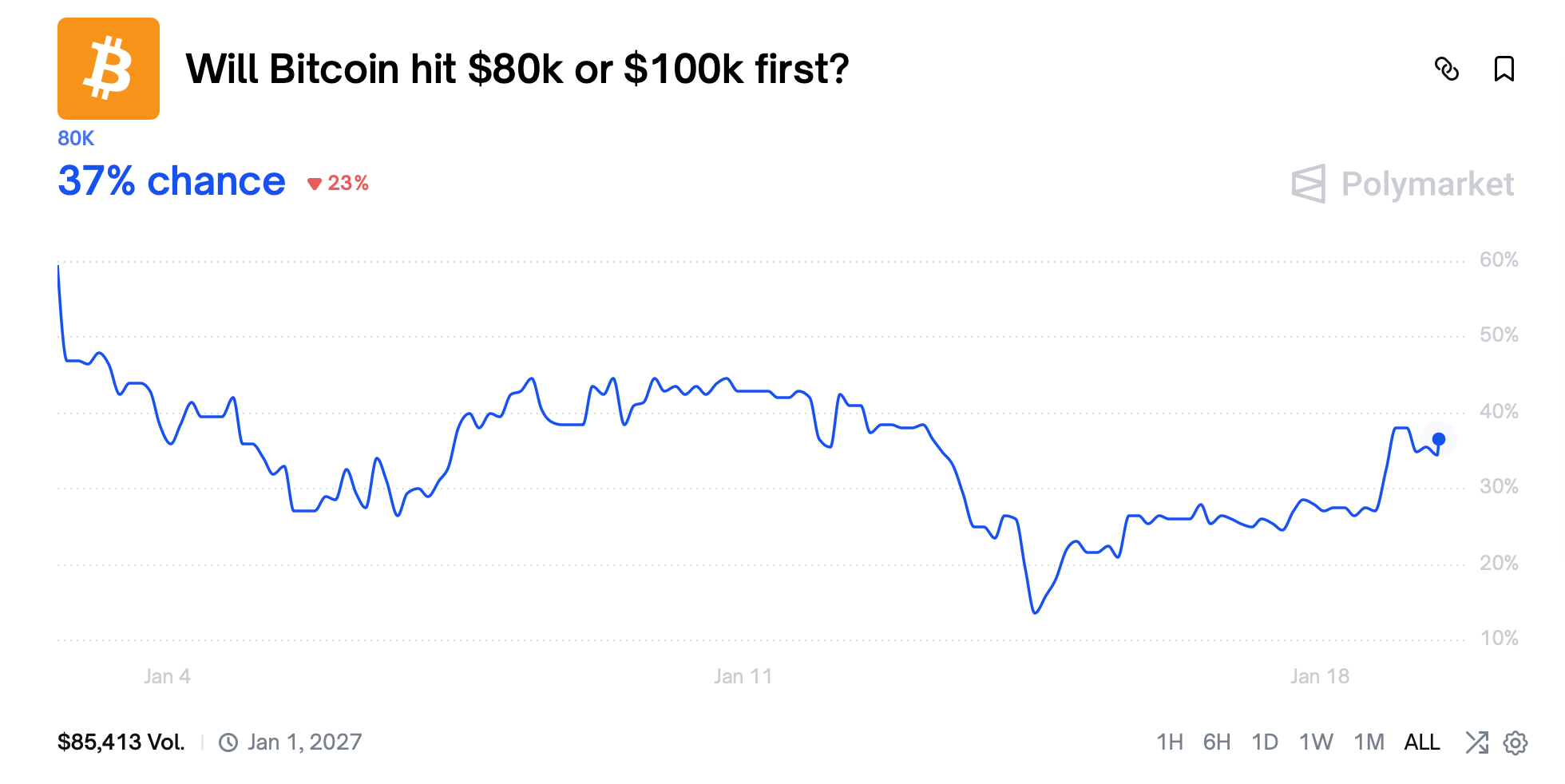

First Cease Issues: $100K Beats $80K within the Race

One other Polymarket contract asks which milestone bitcoin reaches first: $80,000 or $100,000. Merchants favor the upper quantity, pricing a 63% likelihood that $100,000 prints earlier than any dip to $80,000. The opposing consequence sits close to 37%, reinforcing the broader theme that pullbacks are seen as interruptions, not endings.

Supply: Polymarket on Jan. 19, 2026.

January Expectations Keep Grounded

Quick-term optimism cools in Polymarket’s “What worth will Bitcoin hit in January?” market. Right here, merchants overwhelmingly reject stretch targets. Odds for $150,000 sit beneath 1%, with $130,000 by $115,000 barely registering. The likelihood curve thickens at $100,000, which results in January outcomes at roughly 25%, adopted by $105,000 close to 9%. On the softer facet, an $85,000 ceiling carries an 18% probability, suggesting merchants count on consolidation fairly than fireworks.

Additionally learn: Ethereum Day by day Transaction Rely Hits File Excessive Whereas Charges Keep Flat

Six Markets, One Constant Sign

Taken collectively, these six markets inform a remarkably coherent story. Bitcoin’s draw back is debated, however not feared. Its upside is capped, however not dismissed. And $100,000 has quietly turn into the gravitational middle—much less a fantasy goal and extra a working assumption shared throughout platforms, timeframes, and contract buildings.

FAQ 🔮

- What worth degree dominates bitcoin prediction markets proper now?Most markets cluster round $100,000 because the almost definitely milestone.

- Are merchants anticipating a serious bitcoin crash?Draw back dangers are priced in, however deep collapse situations lack sturdy conviction.

- Do markets count on bitcoin to hit $200,000 or extra?Excessive upside targets stay low-probability outcomes throughout platforms.

- Is brief-term optimism as sturdy as long-term optimism?January markets are notably extra conservative than full-year forecasts.