Ethereum simply pushed near 30% staked provide whereas value exams its 200 day EMA close to $3,339 on the every day chart. The setup places long run dedication and a significant resistance degree in the identical body.

Staked ETH reaches new highs as locked provide edges towards one third

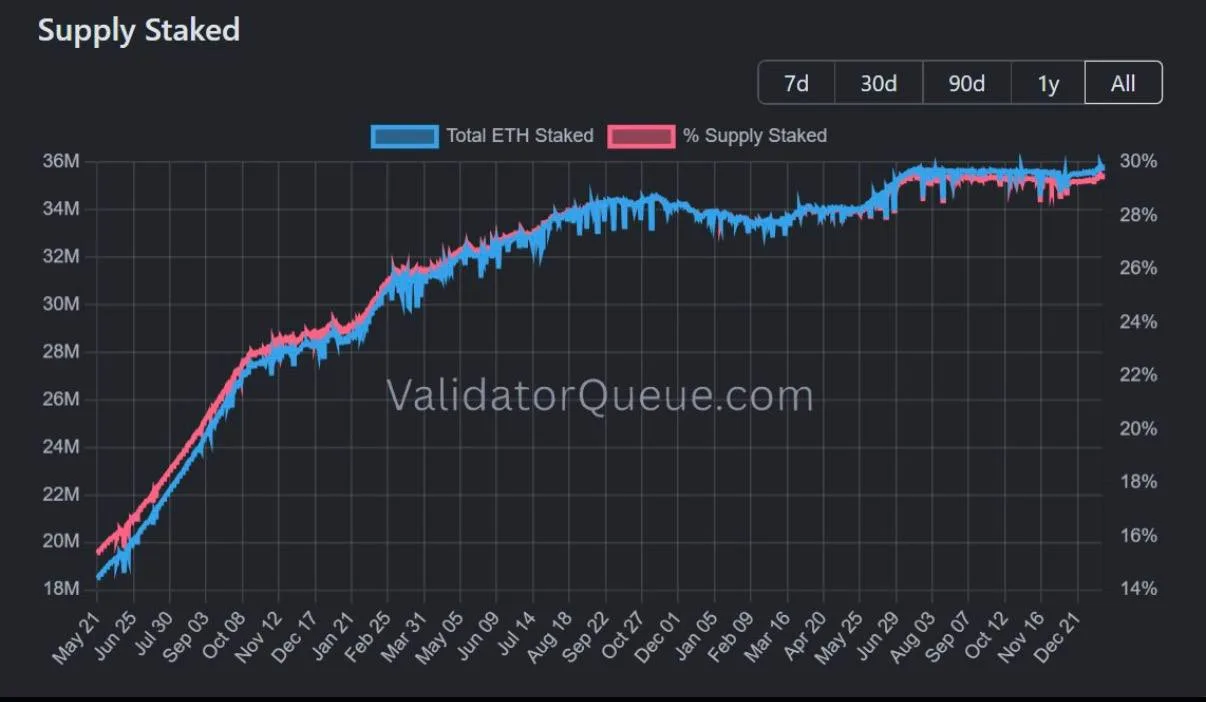

Ethereum staking climbed previous 36 million ETH, pushing the share of provide locked within the community to almost 30%, in keeping with information proven by ValidatorQueue.com and a publish by X person Broke Doomer (@im_BrokeDoomer). The publish additionally pegged the worth securing the Ethereum community at greater than $118 billion, based mostly on the staked steadiness.

Ethereum Provide Staked. Supply: ValidatorQueue / X

A “Provide Staked” chart from ValidatorQueue.com exhibits complete ETH staked rising from roughly 18–20 million initially of the timeline to above 36 million on the newest level. In the meantime, the proportion line climbed in parallel, shifting from the mid teenagers to simply underneath 30%.

The steepest features appeared early within the collection, when staked ETH accelerated into the excessive 20 thousands and thousands after which crossed 30 million. After that, the curve flattened, with the overall hovering within the low to mid 30 thousands and thousands earlier than resuming an upward pattern towards the present peak.

Latest readings present the staked steadiness consolidating across the mid 35 thousands and thousands after which pushing larger once more. On the identical time, the provision share stayed near the 30% mark, signaling that staking development saved tempo with modifications in circulating provide throughout the identical interval.

ETH exams 200 day EMA after rebound from $3,075 space

Meanhwile, Ethereum rose to about $3,374 on the every day ETHUSD chart on Bitstamp on Jan. 14, 2026, up about 1.53% on the session, as value pushed into the realm of its 200 day exponential shifting common close to $3,339. The transfer adopted a rebound from the low $3,000s that lifted ETH again above a number of shorter time period pattern gauges proven on the chart.

Ethereum U.S. Greenback Day by day Chart. Supply: TradingView (Bitstamp)

A publish by Swazers Charts (@SwazersC) mentioned an earlier ETH name was up about 9.6% and described the strategy to the 200 EMA as a key take a look at. The chart annotation additionally marked a previous “bounce” degree close to $3,075, which sits under the present buying and selling zone and features up with the newest swing low space in early January.

The indicator panel exhibits ETH buying and selling above its 9 day EMA close to $3,196, the 21 day EMA close to $3,128, and the 50 day EMA close to $3,140. That clustering under value displays quick time period energy after the rebound, whereas the 100 day EMA close to $3,288 sits just below the 200 day EMA and provides one other layer of resistance close to the present degree.

Swazers Charts pointed to $3,668 as a possible subsequent degree. On the chart, that concentrate on sits above the 200 day EMA zone, so the speedy query is whether or not ETH can maintain above the long run common on a every day shut, then flip it into help on a retest.