Bitcoin traded between $95,916 and $96,137 per unit on Jan. 15, 2026, at 9:40 a.m., inserting its market cap at $1.93 trillion with 24-hour buying and selling quantity totaling $67.65 billion. The session produced a large intraday vary of $94,887 to $97,704, reflecting heightened exercise after this week’s aggressive advance. Worth motion stays pinned slightly below latest highs, leaving bitcoin in consolidation mode because the market digests positive aspects reasonably than extending them.

Bitcoin Chart Outlook

On the day by day chart, bitcoin continues to mirror a broader restoration that started close to $84,398 and accelerated towards the $97,939 area. Latest candles have narrowed close to resistance, signaling hesitation as worth exams higher boundaries with out a decisive follow-through.

Quantity expanded in the course of the rally part however has since moderated, a typical trait when markets pause after sturdy directional strikes. Structurally, assist stays concentrated between $90,000 and $91,000, whereas the latest excessive close to $97,939 and the psychological $100,000 stage proceed to outline overhead strain.

BTC/USD 1-day chart by way of Bitstamp on Jan. 15, 2026.

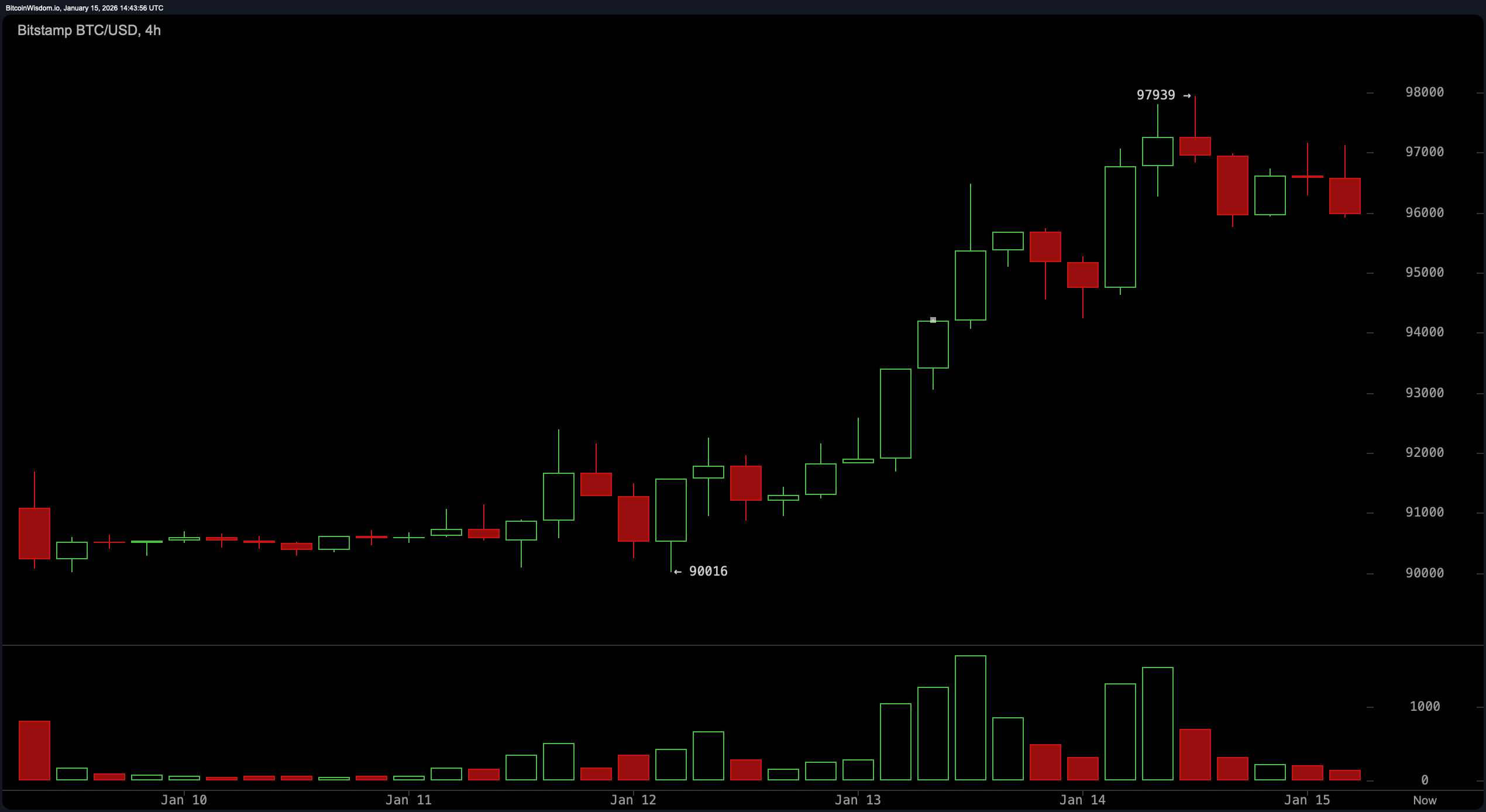

The four-hour chart provides texture to the consolidation narrative. After a robust breakout that started round Jan. 13, worth momentum cooled as bitcoin printed decrease highs beneath the latest peak. Quantity traits present constant participation in the course of the upswing, adopted by a noticeable slowdown as costs stalled. This timeframe highlights the $94,500 to $95,000 space as an vital response zone the place earlier demand emerged, whereas repeated failures to reclaim the $97,900 space counsel the market is reassessing short-term path reasonably than reversing development.

BTC/USD 4-hour chart by way of Bitstamp on Jan. 15, 2026.

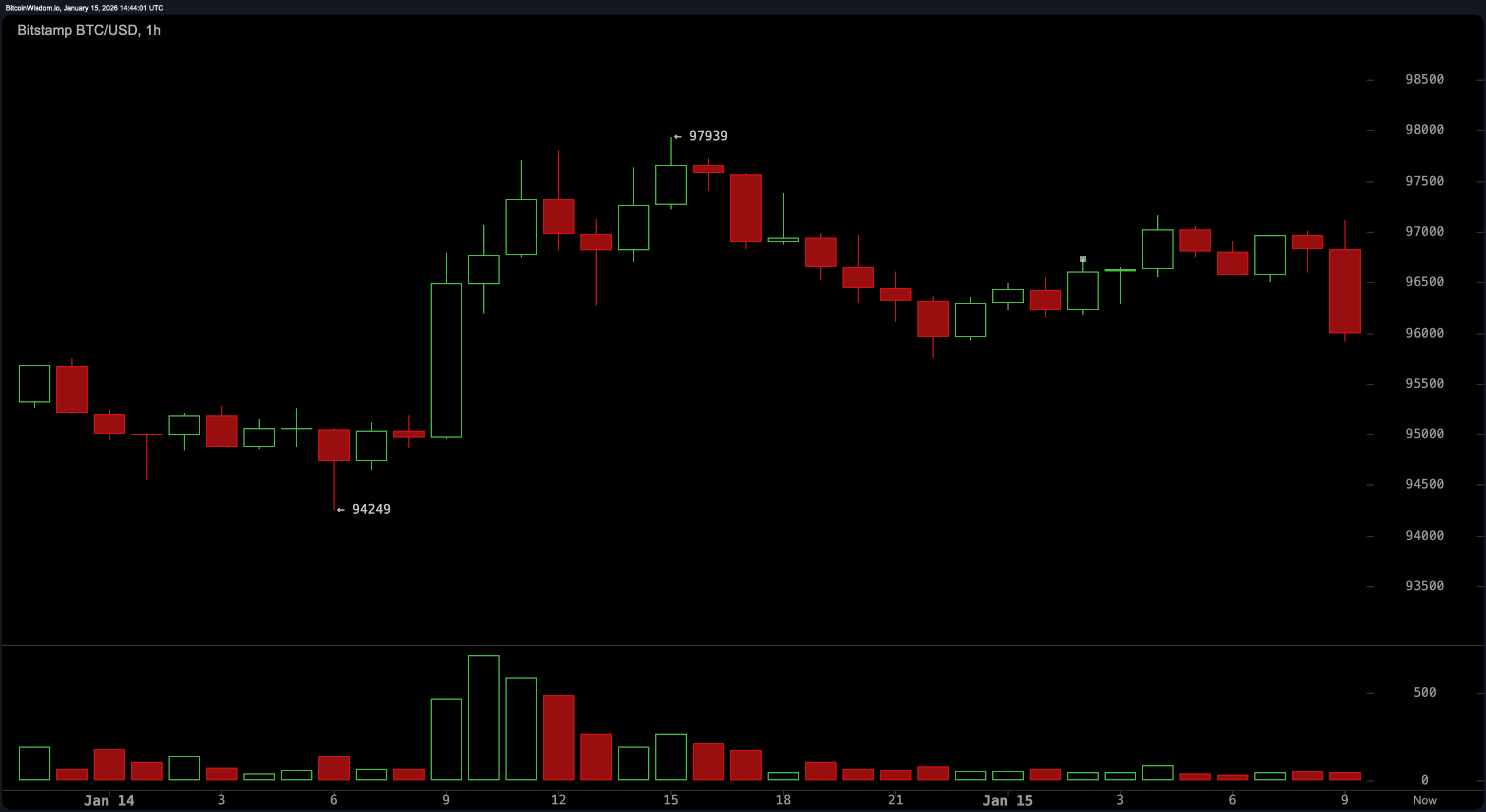

Brief-term alerts from the one-hour chart emphasize compression over conviction. Worth has moved sideways with declining quantity, indicating decreased momentum after the sooner push greater. The construction resembles a consolidation band, with $96,500 appearing as a near-term inflection level; weak spot under that stage would tilt strain downward throughout the vary. Conversely, renewed energy above $97,200 would sign that short-term members are re-engaging, although affirmation would require quantity to return in pressure.

BTC/USD 1-hour chart by way of Bitstamp on Jan. 15, 2026.

Oscillators current a blended however coherent image. The relative energy index ( RSI) at 69 and the Stochastic at 89 each register impartial readings, reflecting elevated however not excessive circumstances. The typical directional index (ADX) at 32 confirms development presence with out acceleration, whereas the Superior oscillator at 3,966 stays impartial. On the similar time, the commodity channel index (CCI) at 182 and momentum (10) at 2,900 sign stretched circumstances following the rally, even because the transferring common convergence divergence ( MACD) stage at 1,476 maintains a constructive bias. Collectively, these readings counsel momentum has slowed however not unraveled.

Transferring averages reinforce the broader development whereas highlighting overhead friction. Shorter-term measures, together with the exponential transferring common (EMA) and easy transferring common (SMA) from 10 by 50 intervals, proceed to slope upward and stay supportive beneath the value. The exponential transferring common (100) at $96,011 nonetheless aligns with the prevailing advance, whereas the straightforward transferring common (100) at $97,092 sits nearer to the present worth, appearing as near-term resistance. Longer-term strain is clear on the exponential transferring common (200) at $99,563 and the straightforward transferring common (200) at $106,010, reinforcing the concept bitcoin is consolidating under heavier technical ceilings reasonably than accelerating unchecked.

Bull Verdict:

Bitcoin’s broader construction stays constructive, with worth holding effectively above key assist zones and shorter-term exponential transferring averages and easy transferring averages persevering with to development upward. Consolidation beneath latest highs suggests digestion reasonably than deterioration, and momentum indicators, whereas stretched, haven’t flipped decisively towards the prevailing development. So long as the value stays supported above the mid-$90,000 vary, the technical backdrop favors continuation following this pause.

Bear Verdict:

The failure to decisively clear the latest excessive close to $97,900, mixed with cooling quantity and stretched oscillator readings, leaves bitcoin susceptible to a deeper consolidation part. Longer-term transferring averages overhead proceed to exert strain, and a breakdown under short-term assist would possible invite elevated draw back probing towards decrease demand zones. On this situation, the market can be signaling exhaustion reasonably than mere hesitation.

FAQ ❓

- What’s bitcoin’s worth vary on Jan. 15, 2026? Bitcoin traded at $96,137 at 9:40 a.m. Japanese time, with a wider intraday span of $94,887 to $97,704.

- Why is bitcoin consolidating close to $97,000? Technical indicators present cooling momentum after a fast rally, prompting sideways worth motion close to resistance.

- Which ranges matter most for bitcoin proper now? Help sits close to the mid-$90,000 zone, whereas resistance stays slightly below $98,000 and close to $100,000.

- What do indicators counsel for bitcoin’s short-term outlook? Oscillators and transferring averages level to consolidation, not a confirmed development reversal.