The worth of Ether (ETH), the native cryptocurrency of the Ethereum layer-1 blockchain community, bottomed out in April 2025, and its worth motion mirrors the 2019 cycle, based on market analyst Michaël Van De Poppe.

A surge in stablecoins, tokenized real-world belongings (RWAs), that are conventional or bodily belongings represented as tokens on a blockchain, and developer exercise on the Ethereum community are causes to be bullish on Ethereum’s worth, Van De Poppe stated.

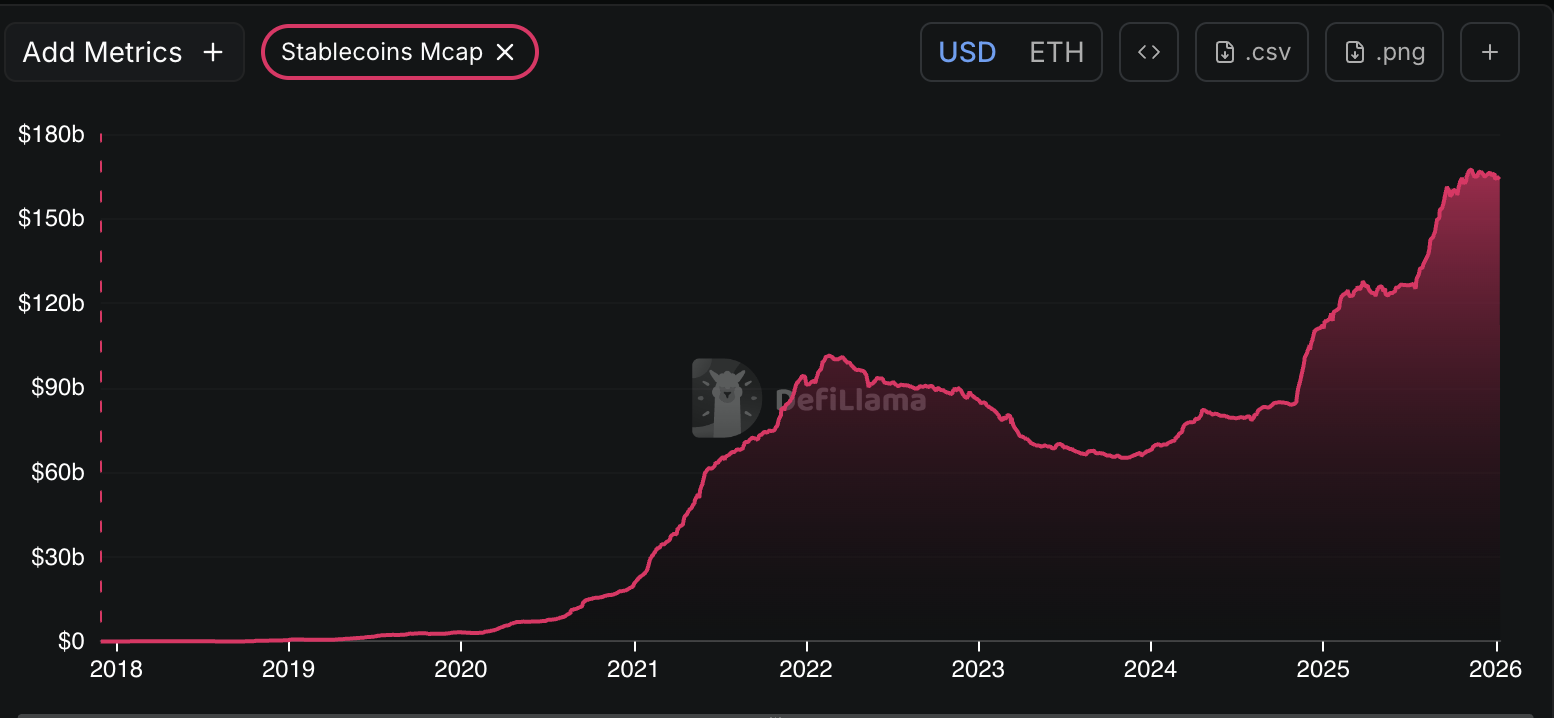

“The stablecoin provide on Ethereum has seen a rise of greater than 65% in 2025. It is doubled for the reason that peak in 2021,” he wrote in a Sunday X submit.

The stablecoin market cap on Ethereum. Supply: DeFiLlama

The full stablecoin market capitalization on Ethereum is over $163.9 billion, with about 52% of the market cap dominated by stablecoin issuer Tether’s USDt (USDT) dollar-pegged stablecoin, based on DeFiLlama.

Ethereum processed about $8 trillion in stablecoin switch quantity in This fall 2024 alone, based on Token Terminal.

The contrarian evaluation of investor sentiment that ETH is lifeless or dying adopted ETH briefly, tapping $3,300 and breaking above its 365-day transferring common, earlier than falling again to about $3,100, the worth on the time of publication.

ETH popped up above the 365-day EMA earlier than falling again to the $3,100 stage. Supply: TradingView

Associated: ETH worth to $5K subsequent? Ether rallied 120% the final time this occurred

The ETH–BTC ratio mirrors the 2019 cycle

“ETH known as lifeless, because it has been trending downwards for 4 years towards Bitcoin (BTC). Nevertheless, since April 2025, it has bottomed out, and we’re already in an Ethereum market,” Van De Poppe stated.

He shared a chart of the Ethereum-Bitcoin (ETH–BTC) ratio, a metric that tracks the worth and power of ETH towards BTC, which bottomed in April, round 0.017, earlier than rallying to a neighborhood excessive of 0.043 in August 2025.

The ETH–BTC ratio bottomed out in April 2025 and rallied. Supply: Michael Van De Poppe

The ratio climbed again right down to 0.034, the extent on the time of this writing, following a market-wide crash in October that disrupted the upward worth pattern in crypto markets.

Present investor sentiment about Ethereum is just like investor sentiment patterns that preceded earlier worth rallies, based on crypto market evaluation firm Santiment.

Journal: Ethereum’s Fusaka fork defined for dummies: What the hell is PeerDAS?