After a prolonged disappearing act—final noticed in November 2024—the elusive 2010-era mega whale has resurfaced but once more, lastly rousing 2,000 long-slumbering bitcoins mined in bitcoin’s earliest chapter. The hoard, now valued at $181 million, traveled in a single, clear sweep and was processed in full at block top 931668.

Early Bitcoin Miner Breaks Silence, Transfers 2,000 BTC Held Since 2010

Bitcoin.com Information has chronicled this particular whale repeatedly since 2020, working on the view that the large holder is probably going a single entity or particular person somewhat than a free cluster of wallets. Additional examination of the bitcoin blockchain suggests this entity had been quietly unloading strings of 2010 coinbase rewards effectively earlier than we recognized the spender six years in the past.

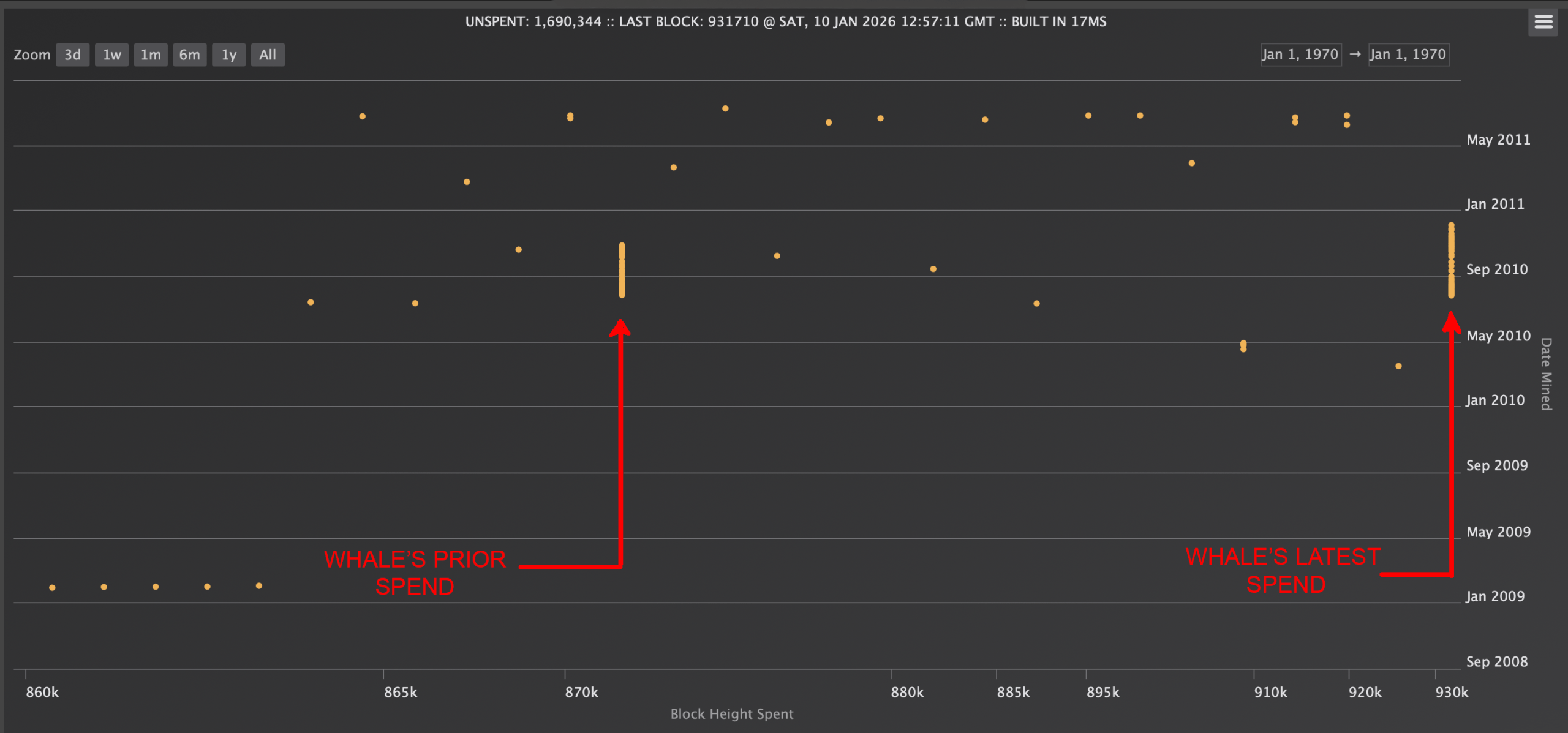

Notably, the whale’s earlier sighting got here on Nov. 14, 2024, after which it sat out the whole lot of 2025. That day’s sample mirrored Jan. 10, 2026, with the entity spending 40 coinbase rewards mined in 2010 and clearing the complete settlement in block 870,329. The latest 40-block subsidy switch cleared at block 931,668, and it was flagged by btcparser.com, with different onchain sleuths rapidly catching the identical path.

“A miner simply bought 2,000 BTC from block rewards dormant since 2010, transferring the funds to Coinbase Alternate,” wrote Sani, founding father of timechainindex.com, on X. “The funds had been held in 40 P2PK addresses,” the analyst added.

The P2PK wallets funneled the two,000 BTC right into a consolidated P2SH (Pay-to-Script-Hash) tackle, which in the end made its approach to the crypto change Coinbase. This wasn’t a one-off both, because the whale’s earlier spending strings found by Bitcoin.com Information have repeatedly proven ties to Coinbase-linked wallets.

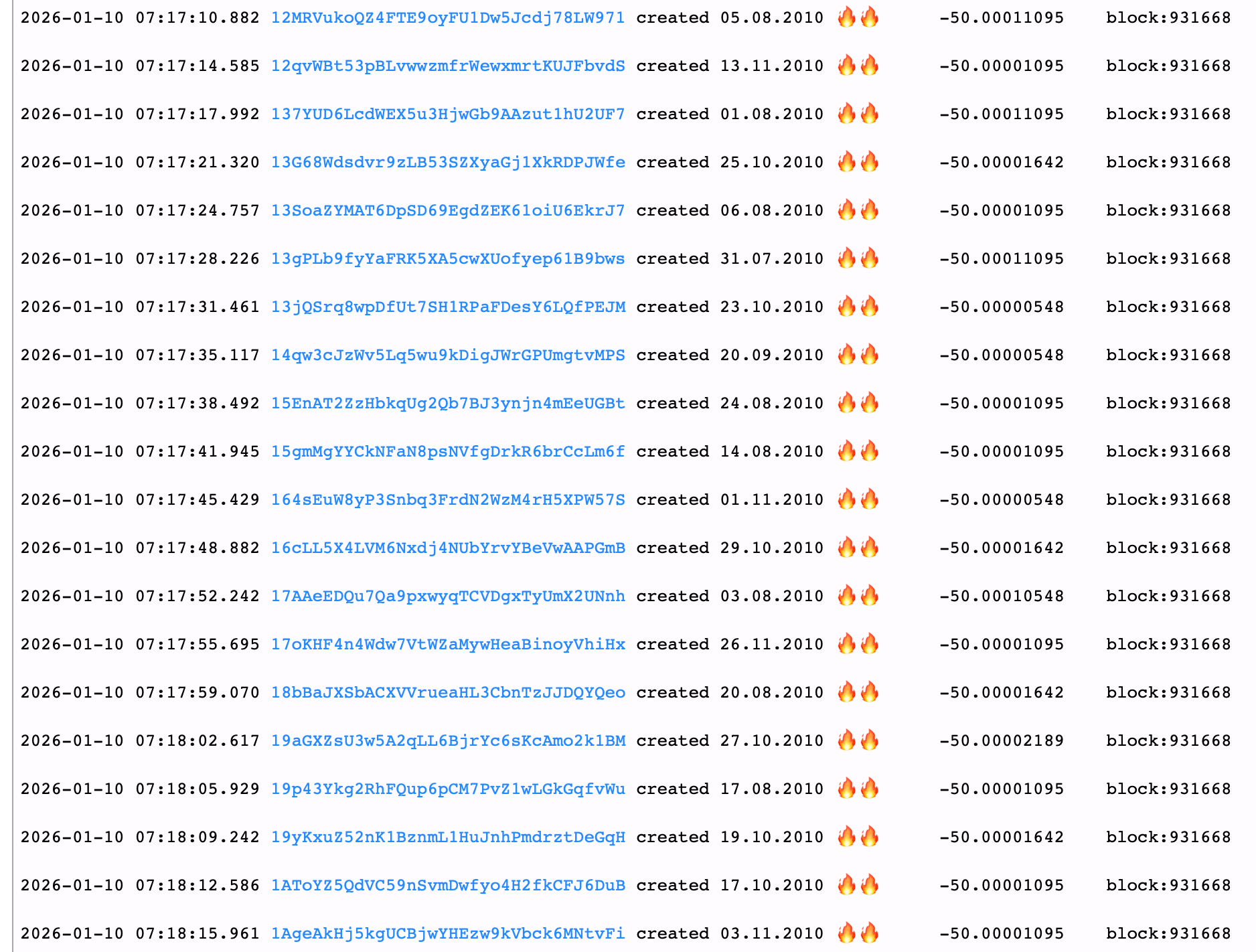

Twenty of the 40 P2PK addresses that moved 50 BTC every on Jan. 10, 2026.

Including one other wrinkle, the matching bitcoin money ( BCH) tied to those identical block rewards was shuffled roughly 5 years in the past. This whale—beforehand caught offloading tens of hundreds of cash—has appeared largely detached to bitcoin’s worth swings.

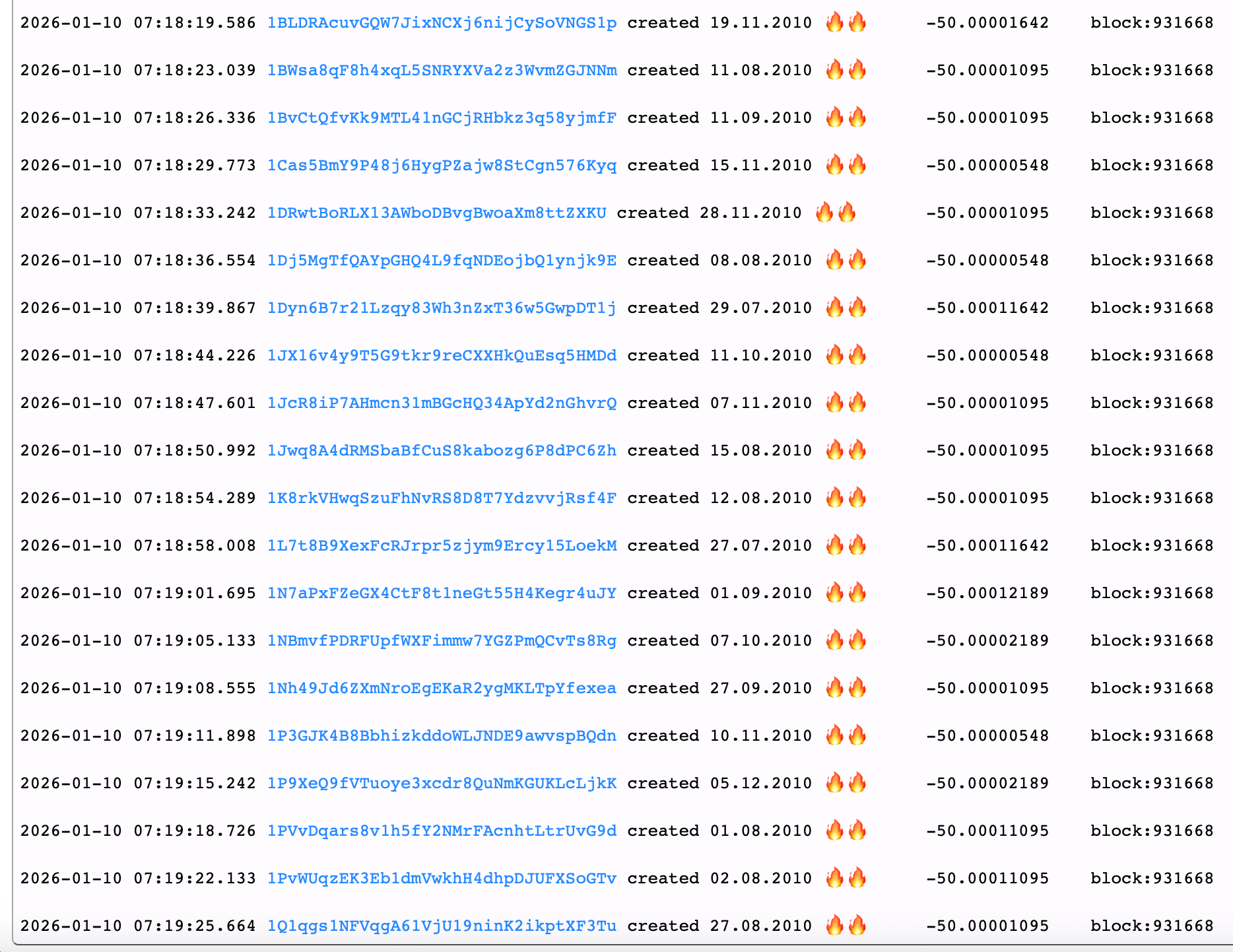

The opposite 20 of the 40 P2PK addresses that moved 50 BTC every on Jan. 10, 2026.

For instance, it might have unloaded this batch when BTC topped the six-figure stage; on Oct. 6, the take would have been roughly $126,000 per coin. As an alternative, the cash moved immediately with BTC sitting simply north of the $90,000 mark. That worth indifference has change into a defining trait of this whale’s onchain conduct, reinforcing the view that timing market tops has by no means been the first goal.

Additionally learn: Stablecoin Volumes Hit File $33 Trillion Amid Coverage Tailwinds

Whether or not costs sit at report highs or cool-off ranges, the entity’s actions recommend a methodical, long-term unwind somewhat than a reactive commerce chasing optimum exits. Furthermore, with a bitcoin stash this deep, marginal worth variations hardly appear consequential. When bitcoin as soon as modified fingers between $0.01 and $0.40, even a $90,000 price ticket nonetheless represents an eye-watering payoff.

For now, the whale slips again into the shadows, leaving analysts to attend for the following motion from one among bitcoin’s earliest miners. If historical past is any information, the silence might final months—or years—earlier than one other neatly packaged string of 2010-era rewards quietly makes its method onto the chain.

FAQ 🐋

- Who moved the two,000 BTC? A protracted-dormant bitcoin whale tied to 2010-era mining rewards transferred the funds after greater than a yr of inactivity.

- The place did the bitcoin go? The two,000 BTC was consolidated and in the end despatched to Coinbase-linked wallets, in keeping with onchain knowledge.

- When had been the bitcoins initially mined? The cash got here from block rewards mined in 2010 throughout bitcoin’s earliest years.

- Why does this whale’s exercise matter? Giant strikes from early bitcoin miners typically draw consideration on account of their measurement, age, and potential market influence.