An early Ethereum investor has doubtless accomplished a full exit from their ETH place after on-chain information confirmed the switch of holdings to a centralized trade. The sell-off is estimated to have generated round $274 million in revenue.

This comes as ETH continues to face promoting stress from US institutional traders as nicely. Nonetheless, some market analysts stay optimistic in regards to the prospects of the second-largest cryptocurrency.

Ethereum OG Whale Exits With 344% Achieve

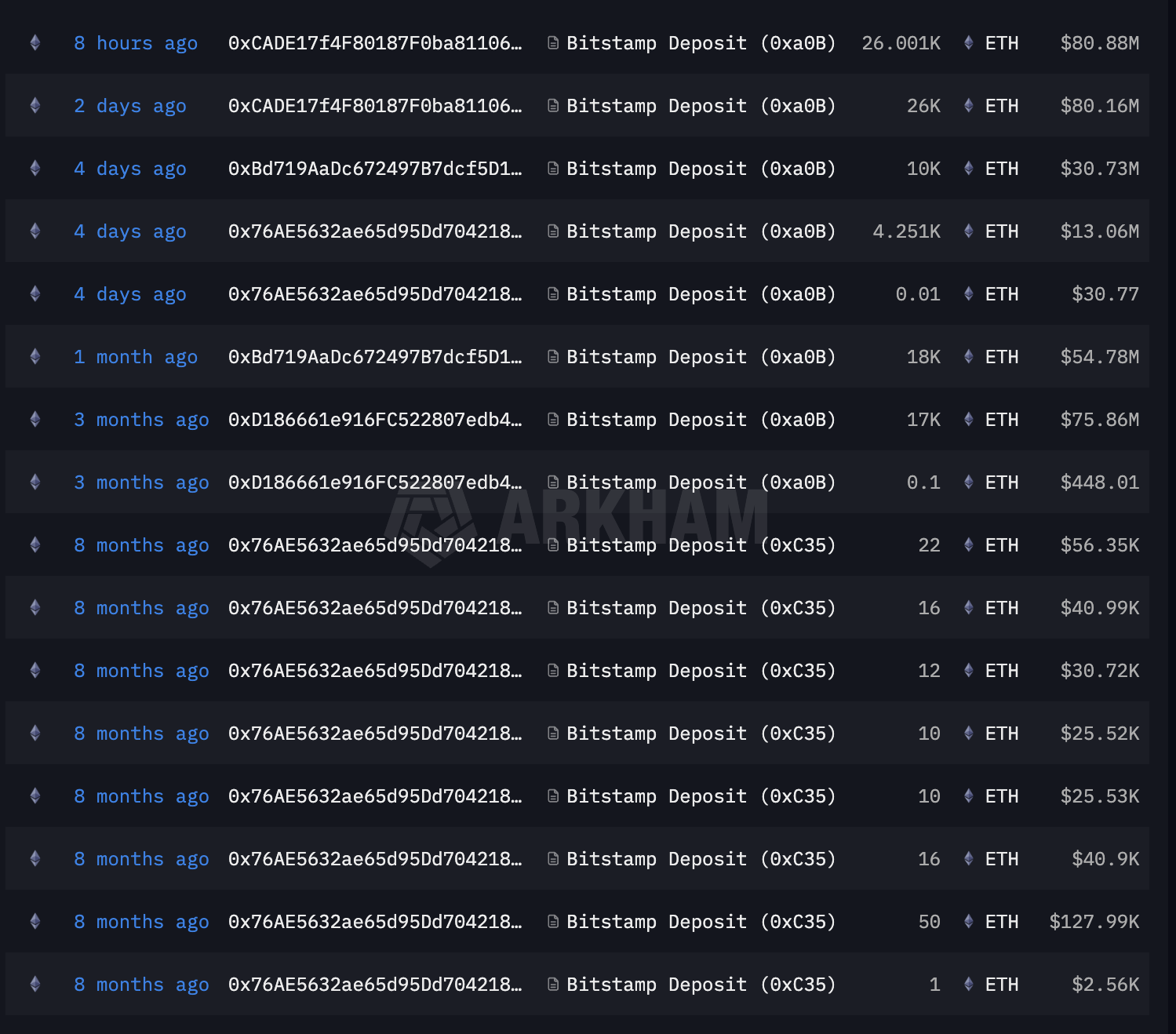

Blockchain analytics agency Lookonchain reported that the investor amassed 154,076 ETH at a median value of $517. Since late final week, the pockets started transferring ETH to Bitstamp, a centralized cryptocurrency trade.

“Over the previous 2 days, he deposited one other 40,251 ETH ($124 million) into Bitstamp and nonetheless holds 26,000 ETH ($80.15 million),” Lookonchain posted on January 10.

A number of hours in the past, the investor moved the ultimate 26,000 ETH to the trade. In accordance with Lookonchain, the investor has made an estimated whole revenue of round $274 million, representing a acquire of roughly 344%.

These newest transfers observe a sample of gradual deposits that started a lot earlier. Arkham information signifies that the investor initially despatched a complete of 137 ETH to Bitstamp roughly eight months in the past.

This was adopted by a switch of 17,000 ETH three months in the past and one other 18,000 ETH roughly one month in the past, suggesting a long-term, staged exit technique reasonably than a single sell-off.

Ethereum “OG” Investor’s Transfers. Supply: Arkham

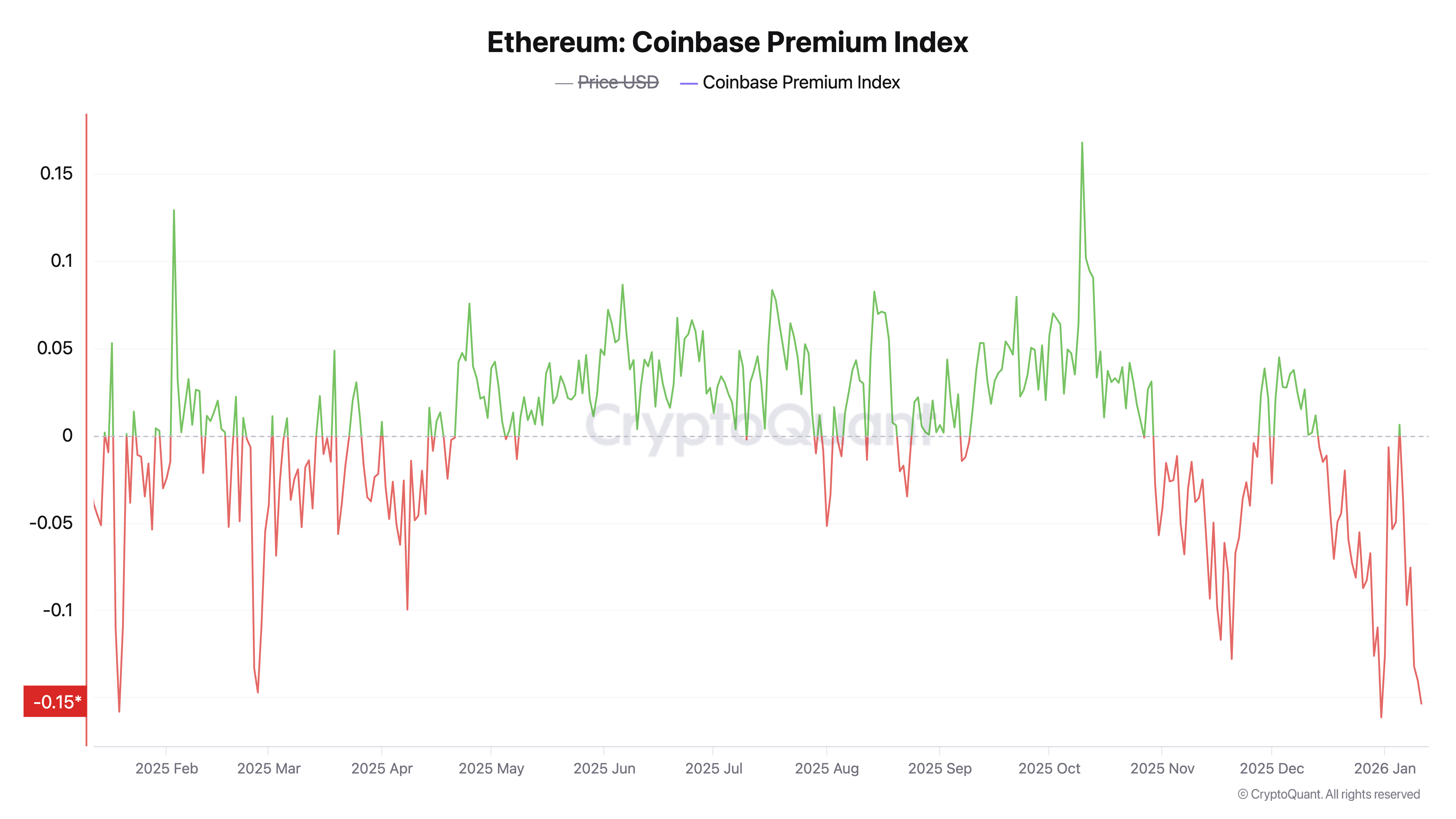

The timing of the whale’s exit additionally aligns with broader indicators of institutional warning. The Coinbase Premium Index for ETH stays deeply adverse. The metric tracks the worth distinction between Coinbase, typically used as a gauge of US institutional sentiment, and Binance, which displays broader world retail exercise.

A adverse studying signifies that ETH is buying and selling at a reduction on Coinbase in comparison with offshore platforms, suggesting elevated promoting stress from US-based institutional contributors. This pattern has continued into 2026, signaling continued risk-off positioning amongst skilled traders.

ETH Coinbase Premium Index”>

ETH Coinbase Premium Index”>ETH Coinbase Premium Index. Supply: CryptoQuant

Is Ethereum “Undervalued?”

Regardless of the continued promoting stress, some analysts preserve a constructive outlook on ETH, selecting to look past short-term volatility.

Quinten François has advised that Ethereum seems “massively undervalued” when evaluating its financial exercise with its value.

$ETH is massively undervalued pic.twitter.com/IvfdosUQpk

— Quinten | 048.eth (@QuintenFrancois) January 11, 2026

Equally, Milk Street added that the clear mismatch turns into evident when analyzing the info. In accordance with the put up, the amount of financial exercise selecting Ethereum has continued to develop, even in periods when ETH’s value has lagged behind that enlargement.

The evaluation famous that giant traders proceed to prioritize Ethereum for its uptime, liquidity, settlement reliability, and regulatory readability.

“As extra exercise strikes onchain, transaction quantity and price technology improve, elevating the financial weight positioned on Ethereum’s base layer. When utilization stays excessive, ETH has traditionally struggled to stay flat for lengthy. We are going to go greater as adoption continues. At all times zoom out,” Milk Street said.

From a technical perspective, analysts are figuring out key patterns that might assist a value restoration.

$ETH seems to be prepared to maneuver greater.

The falling wedge and channel are damaged.

Consolidation is full and the goal sits above $4,400.

Don’t overthink it. The pattern has shifted. pic.twitter.com/MCtD8Uxxg2

— Crypto King (@CryptoKing4Ever) January 10, 2026

The push and pull between short-term promoting and market confidence make the present Ethereum market a posh one. Early adopter exits and a adverse Coinbase Premium sign warning, whereas rising financial exercise underpins ecosystem energy. Whether or not the ETH value in the end aligns with these fundamentals stays to be seen.

The put up Ethereum Whale Nets $274 Million Revenue in Strategic Exit Amid Market Jitters appeared first on BeInCrypto.