Curiosity in XRP exchange-traded funds (ETFs) is rising once more after broadly adopted investor Paul Barron revealed that “huge information” may floor this week.

His remark unfold throughout the XRP group, fueling expectations that one other replace or launch might be imminent.

Sturdy ETF Flows in Crypto

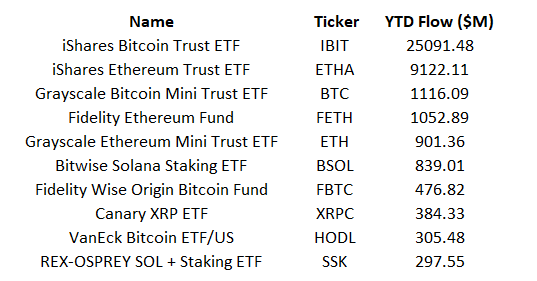

The renewed consideration comes alongside a efficiency breakdown shared by Nate Geraci, President of NovaDius Wealth. He highlighted the highest ETF performers and their year-to-date inflows. Whereas Bitcoin and Ethereum ETFs dominated the listing, XRP additionally made a notable look.

Among the many standouts, BlackRock’s IBIT Bitcoin ETFs recorded the biggest year-to-date inflows at $25 billion. Grayscale’s Bitcoin Mini Belief ETF adopted with $1.11 billion. Different Bitcoin ETFs included Constancy ($477 million) and VanEck ($305 million), as Bitcoin ETFs continued to guide inflows.

BlackRock’s Ethereum ETFs additionally led the ETH phase with $9.12 billion. Different Ethereum ETFs from BlackRock, Grayscale, and Constancy ranked excessive as nicely, although with decrease volumes. A Solana staking ETF from Bitwise additionally confirmed strong traction, with $839 million in inflows.

In the meantime, for XRP holders, the Canary XRP ETF (XRPC) recorded $384.33 million in year-to-date inflows. This locations it among the many prime ETFs total, regardless of launching solely in November.

XRP ETF Panorama Retains Increasing

Past Canary’s product, a number of different XRP ETFs are already stay however didn’t characteristic within the top-performers listing. These embody:

- 21Shares: about $250 million in belongings below administration

- Bitwise: roughly $227 million

- Grayscale: round $244.23 million

- Franklin: roughly $206.9 million

All XRP spot ETFs launched in November and December. Collectively, they now account for about $1.24 billion in whole AUM, with cumulative inflows at $1.14 billion. For a newly launched ETF class, these figures spotlight sturdy early demand.

Some business commentators, like Teucrium CEO Sal Gilbertie, have stated that whereas the present determine is spectacular, it may have been a lot increased if not for the bearish sentiment that has dominated the market since final month. Even so, XRP ETFs have proven exceptional efficiency, producing over $1 billion in simply 21 days of constant inflows.

Now, consideration is on what may come subsequent, as Barron’s tweet hinted.

What “Large Information” May Imply

Many are deciphering Barron’s remark as a possible replace on one other XRP ETF. One product the group is intently watching is the WisdomTree XRP ETF, which is among the many pending ETFs anticipated to launch subsequent.

WisdomTree is subsequent pic.twitter.com/5hKrdYU02E

— XRP 🅧 Military (@chachakobe4er) December 29, 2025

On the similar time, hypothesis round a BlackRock XRP ETF continues to flow into. Nevertheless, there may be at present no submitting or pending approval for an XRP product tied to BlackRock, making such expectations untimely.

With a number of XRP ETFs already attracting sizable inflows and no less than another set to launch quickly, this might have a notable affect on market sentiment.