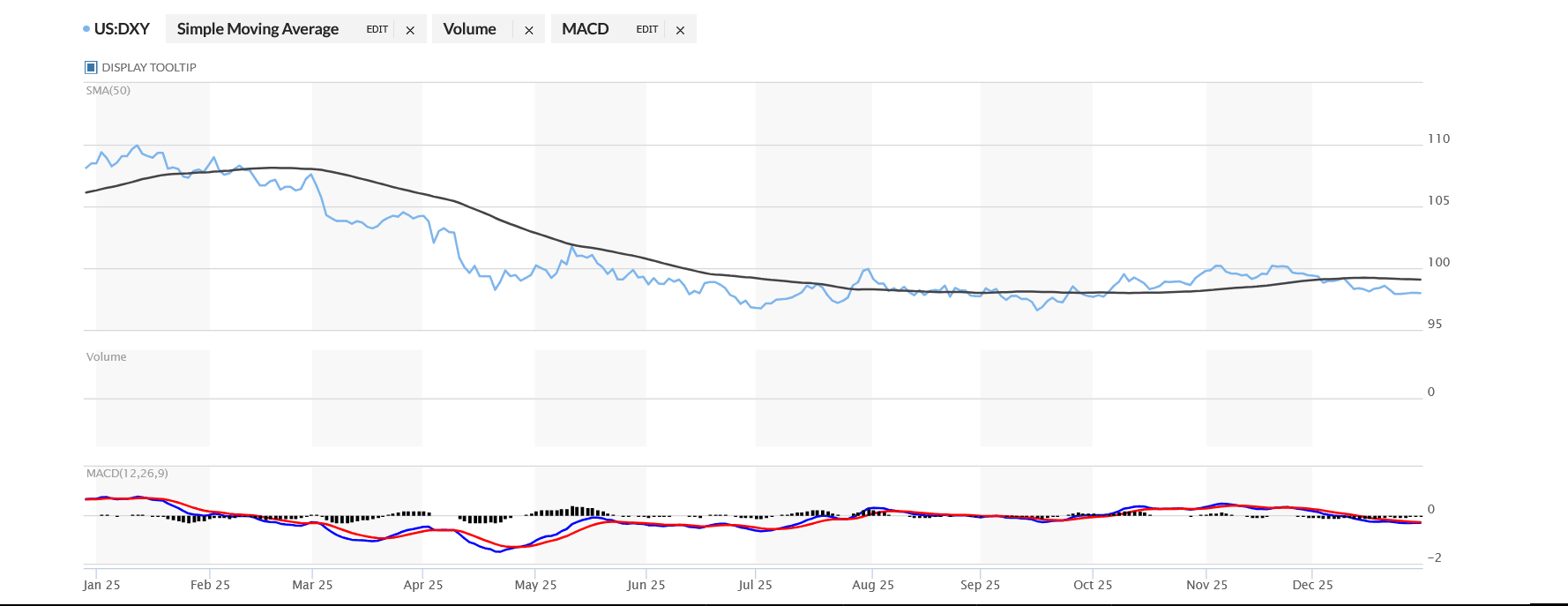

The U.S. greenback’s latest retreat has began to ripple by way of international markets, and cryptocurrencies like Ethereum are positioned to learn. With the Federal Reserve easing charges and the greenback’s decade-long power starting to fade, buyers are reassessing the place actual progress and returns might come from. Ethereum value, at present buying and selling close to $2,955, sits on the intersection of this shift — quietly coiling for what could possibly be a decisive transfer in early 2026.

Why Greenback Weak point Issues for Ethereum Worth Prediction?

A weaker greenback tends to elevate threat property, from tech shares to cryptocurrencies, as international buyers seek for options that may outperform depreciating U.S. holdings. The greenback index fell about 10% in 2025, marking its first sustained decline in years. Analysts at Deutsche Financial institution and TD Securities count on that development to proceed into 2026 because the Fed maintains a dovish stance and international progress stays resilient.

For Ethereum value, that macro backdrop is important. When the greenback weakens, demand usually rises for scarce, globally traded digital property like ETH value. Traders holding non-U.S. currencies discover crypto cheaper to purchase, whereas U.S. buyers hedge in opposition to the greenback’s lack of buying energy. This dynamic traditionally drives inflows into Bitcoin and Ethereum — a sample seen throughout earlier rate-cut cycles.

Ethereum Worth Prediction: Compression Earlier than Enlargement

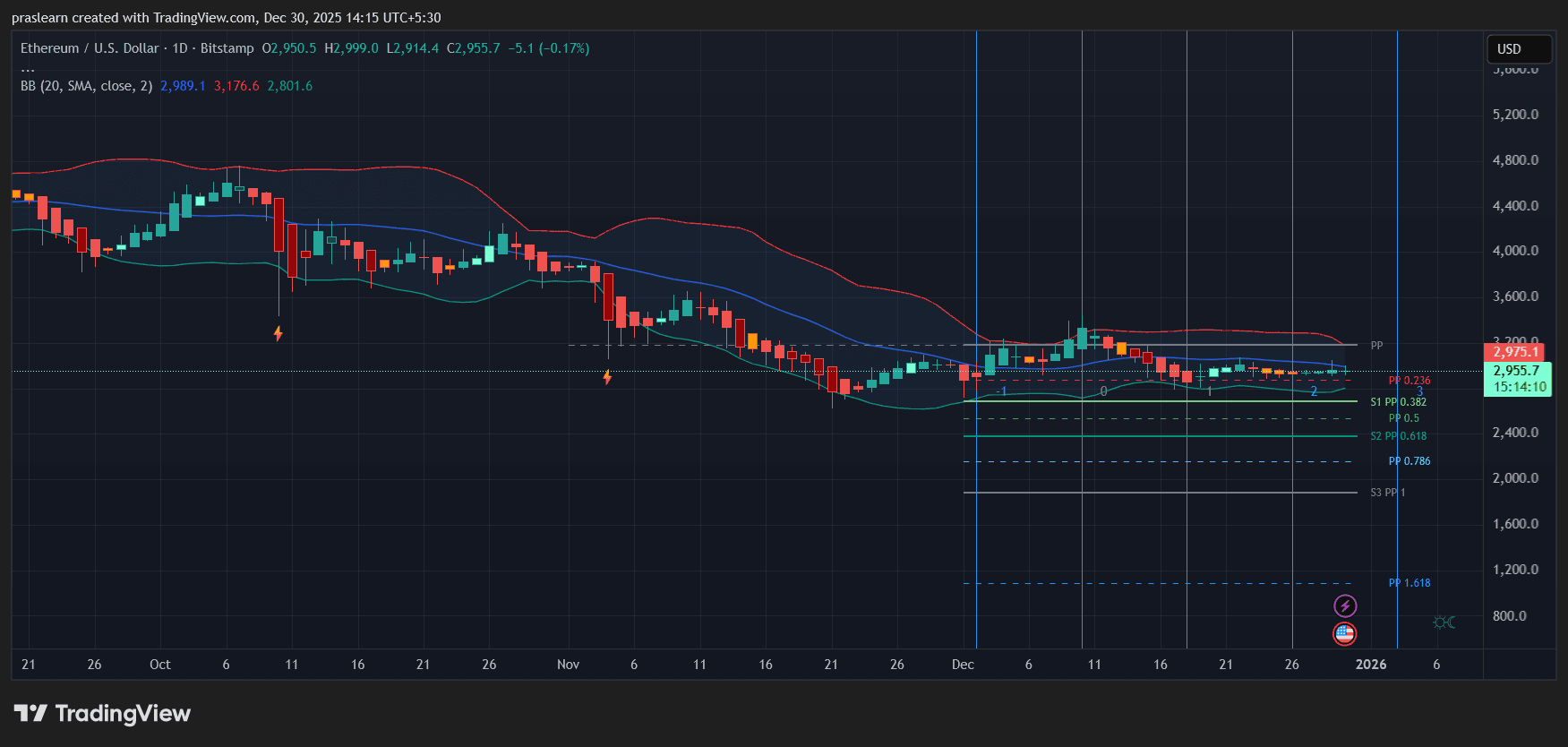

ETH/USD Day by day Chart- TradingView

Ethereum value day by day chart exhibits tight consolidation between $2,900 and $3,000, following months of gradual decline since mid-October. The Bollinger Bands have narrowed considerably, a traditional sign of declining volatility that usually precedes a breakout. The decrease band close to $2,801 is appearing as key assist, whereas the higher band close to $3,176 defines resistance.

Quantity has been muted, however candles over the previous two weeks trace at accumulation — small-bodied candles with lengthy wicks at decrease ranges present consumers stepping in round $2,900. If Ethereum can shut convincingly above $3,000, the following psychological goal sits round $3,200, adopted by the Fib retracement ranges at $3,350 (0.382) and $3,550 (0.5). Failure to carry $2,800, then again, opens draw back threat towards $2,500, the place the 0.618 retracement and prior December lows align.

The Macro Chain Response: Fee Cuts, Danger Urge for food, and ETH Demand

Fed fee cuts immediately scale back yields on U.S. Treasuries, making them much less interesting in comparison with progress property like equities and crypto. As institutional buyers rotate capital, ETH value stands to achieve not solely as a speculative play but in addition as a yield-generating asset by way of staking — a vital differentiator in a lower-yield world.

In the meantime, the weakening greenback makes Ethereum-denominated DeFi ecosystems extra engaging globally. Transactions, liquidity swimming pools, and yield alternatives priced in ETH turn into comparatively cheaper for worldwide individuals, encouraging cross-border capital movement into Ethereum’s on-chain economic system.

Investor Sentiment: Concern Easing, Accumulation Rising

Regardless of value stagnation, on-chain metrics present enhancing sentiment. Energetic addresses have stabilized, and trade reserves proceed to say no — an indication that holders are transferring ETH into chilly storage or staking relatively than promoting. That conduct usually precedes medium-term rallies.

The greenback’s decline additionally has a psychological impact: it reignites the inflation hedge narrative that powered crypto’s earlier bull runs. Even when true de-dollarization stays exaggerated, notion alone can gasoline speculative demand — and Ethereum value usually advantages first when macro tailwinds shift.

Early 2026 Ethereum Worth Prediction: ETH Worth May Retest $3,500 if Greenback Weak point Persists

If the Fed maintains its easing path by way of Q1 2026 and the greenback continues sliding, Ethereum value has a transparent path to reclaim larger ranges. Essentially the most possible state of affairs is a gradual climb towards $3,500 by March, adopted by potential consolidation earlier than a bigger breakout later within the 12 months.

Nevertheless, if the Fed pauses cuts sooner or the greenback rebounds, Ethereum value could stay range-bound close to $2,800–$3,000. For now, technical compression and supportive macro tailwinds each level to accumulation, not capitulation.

The greenback’s weakening isn’t only a macro footnote — it’s a possible catalyst for Ethereum’s subsequent main transfer. The mix of decrease U.S. yields, persistent international demand for decentralized property, and Ethereum’s enhancing on-chain power might create the circumstances for a renewed rally in early 2026.

Because the saying goes, bull markets don’t begin with headlines — they begin with quiet accumulation. Proper now, $ETH appears prefer it’s in precisely that part.