Ethereum (ETH) has traded sideways across the $3,000 degree for the previous two weeks. Though latest shopping for got here from companies equivalent to BitMine and Development Analysis, the demand seems inadequate.

The next knowledge reveals the remainder of the image, as promoting strain stays equally sturdy. Because of this, ETH is unlikely to stage a fast restoration within the brief time period.

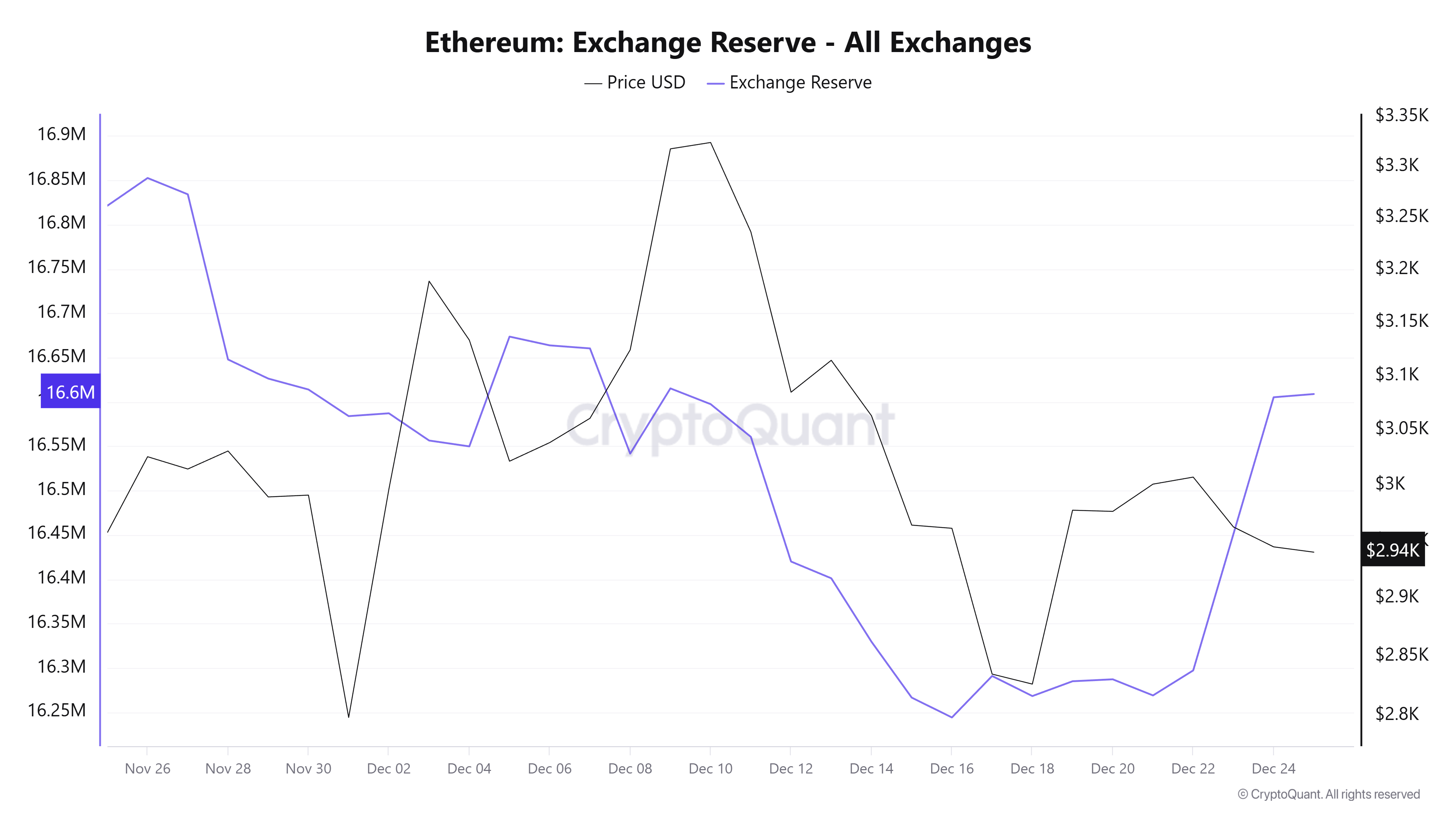

1. ETH Trade Reserves Rise Once more Throughout Christmas Week

Information from CryptoQuant reveals that ETH reserves throughout all exchanges had declined steadily for a number of months.

Nevertheless, the pattern reversed in December. This week, ETH trade reserves elevated from 16.2 million to 16.6 million. That rise equals roughly 400,000 ETH transferred onto exchanges.

Ethereum Trade Reserve. Supply: CryptoQuant.

On-chain knowledge reveals that one “OG whale” alone deposited 100,000 ETH into Binance.

Latest BeInCrypto stories present that BitMine Immersion Applied sciences purchased 67,886 ETH this week. Development Analysis additionally bought 46,379 ETH. Even so, these figures stay smaller than the quantity of ETH moved onto exchanges.

If ETH is transferred to exchanges for liquidation and exceeds shopping for absorption, promoting strain might intensify. If this pattern continues into the ultimate days of the 12 months, ETH costs might face additional draw back strain.

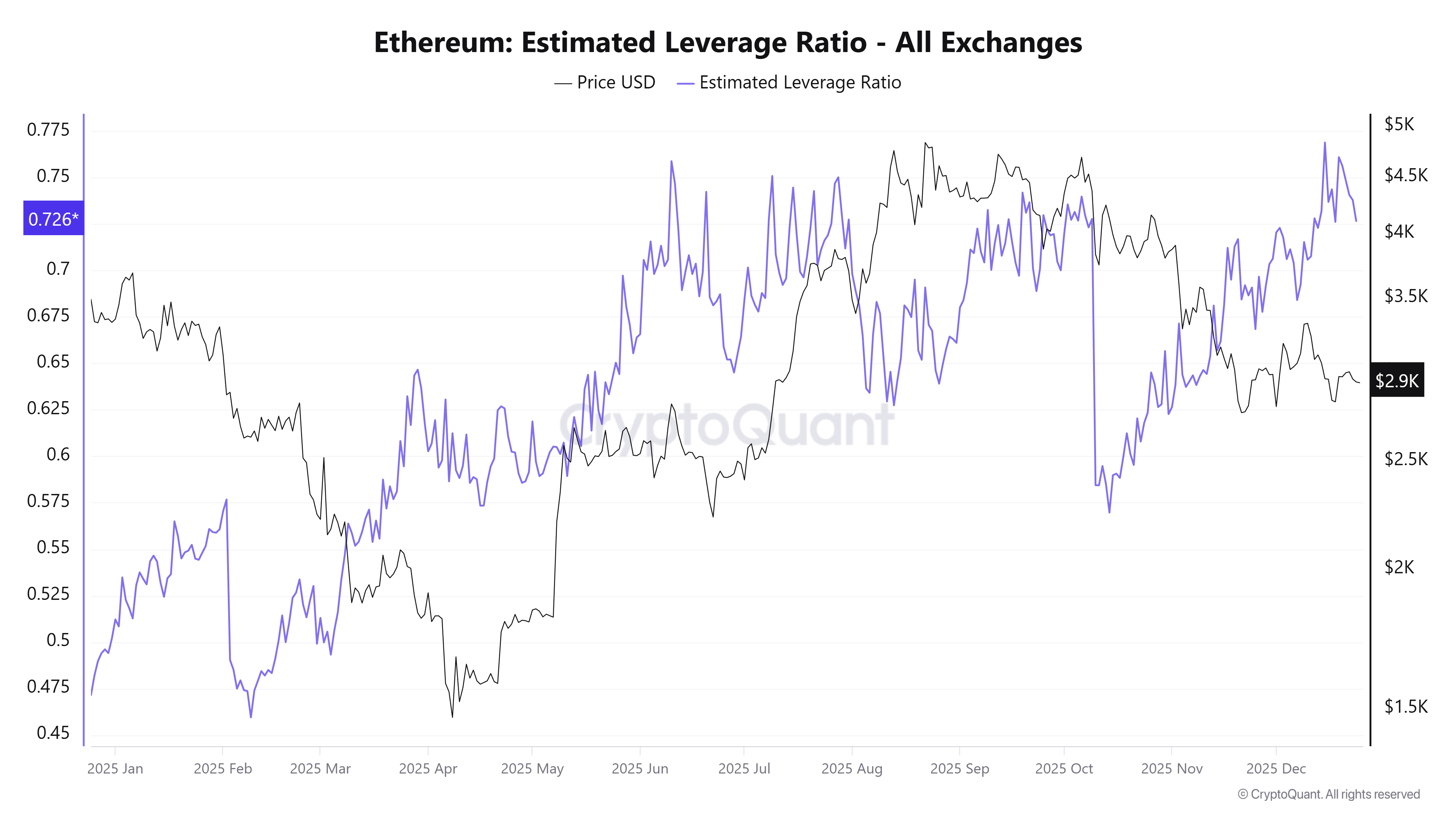

2. Ethereum’s Estimated Leverage Ratio Stays Elevated

One other key metric is Ethereum’s Estimated Leverage Ratio, which stays at an alarming degree, in response to CryptoQuant.

This ratio equals trade open curiosity divided by coin reserves. It displays the common leverage utilized by merchants. Rising values counsel extra buyers are taking over larger leverage in derivatives markets.

Ethereum Estimated Leverage Ratio. Supply: CryptoQuant.

On October 10, the day with the biggest liquidation losses in market historical past, the ratio stood at 0.72. Presently, the ratio has returned to related ranges. Some readings even attain as excessive as 0.76.

With leverage nonetheless elevated, Ethereum stays weak to small worth strikes. Such strikes might set off cascade liquidations.

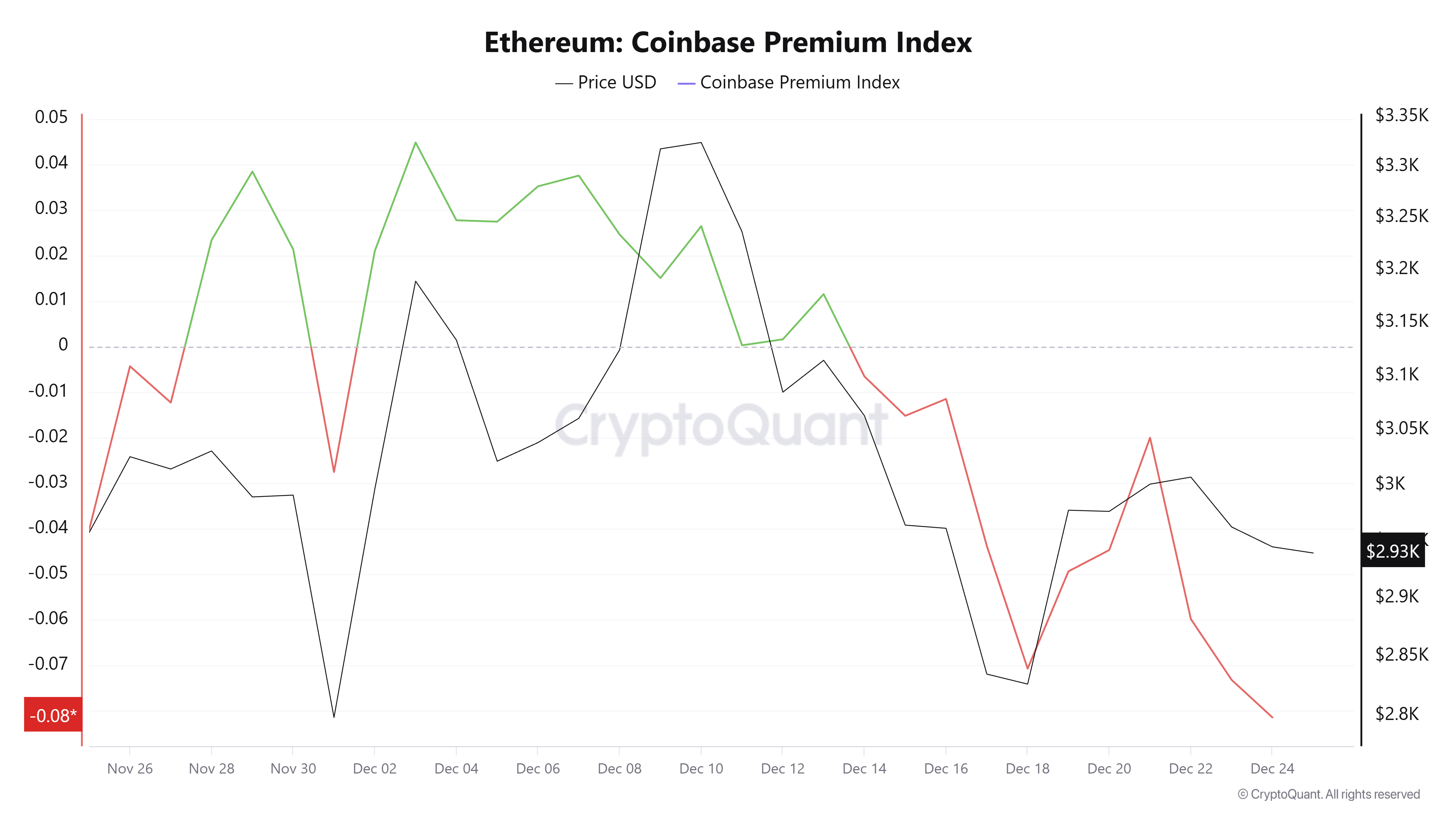

3. Ethereum Coinbase Premium Turns Deeper Adverse in December

BeInCrypto beforehand reported that Ethereum’s Coinbase Premium turned damaging in December.

Throughout Christmas week, the indicator moved additional into damaging territory. It at the moment stands at -0.08, the bottom degree up to now month.

Ethereum Coinbase Premium Index. Supply: CryptoQuant.

This indicator measures the proportion worth distinction between ETH on Coinbase Professional (USD pair) and Binance (USDT pair). Adverse values point out decrease costs on Coinbase.

This pattern means that US buyers proceed promoting at discounted costs. ETH might wrestle to recuperate within the brief time period till the Coinbase Premium turns constructive once more.

4. ETH ETF Flows Enter a Second Consecutive Month of Outflows

December is nearing its finish, and ETH ETF flows are prone to shut with a second straight month of web outflows.

Final month, web flows throughout all ETH ETFs reached -$1.42 billion. This month, outflows have already exceeded $560 million.

Whole Ethereum Spot ETF Web Influx. Supply: SoSoValue.

With out contemporary inflows, ETH lacks upward momentum. If outflows persist, particularly throughout low-volume year-end holidays, costs might retest decrease assist ranges.

“Since early November, the 30D-SMA of web flows into each Bitcoin and Ethereum ETFs has turned damaging and remained so. This persistence suggests a section of muted participation and partial disengagement from institutional allocators, reinforcing the broader liquidity contraction throughout the crypto market,” Glassnode reported.

In abstract, 4 alerts—rising trade reserves, elevated leverage, deeply damaging premiums, and sustained ETF outflows—counsel that ETH might stay in a consolidation section or face additional draw back.

Sustaining correct stop-loss ranges for derivatives positions and utilizing prudent capital allocation for spot shopping for will help merchants scale back danger amid surprising volatility.

The publish 4 Warning Indicators Recommend Ethereum (ETH) Worth Might Not Recuperate Quickly in Late December appeared first on BeInCrypto.