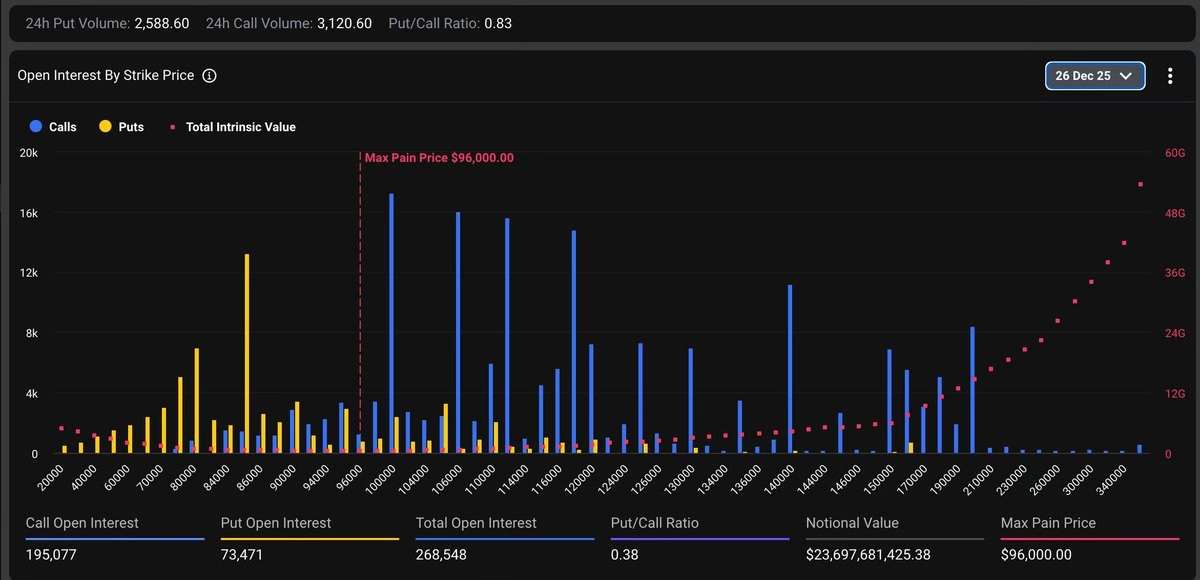

About $23.6 billion value of Bitcoin (BTC) choices are set to come back off the books on Friday, December 26, marking the biggest BTC choices expiry in historical past.

Extra particularly, open curiosity information on CoinGlass as of December 23 reveals a heavy focus of name choices between $100,000 and $120,000, signaling that many merchants are positioning for additional upside.

On the draw back, put choices are clustered round $85,000, suggesting key assist ranges are being carefully watched. The so-called Max Ache Ranges, the worth at which choice holders would undergo the best losses, sit close to $96,000.

To place issues into perspective, this 12 months’s $23.6 billion could be in comparison with $19.8 billion final 12 months and $11 billion in 2023.

One of the vital vital Bitcoin occasions

Regardless of the sheer measurement of the expiry, positioning could be considered as constructive. Specifically, the put-to-call ratio stands at 0.38, so merchants seem to hunt upside publicity relatively than draw back safety.

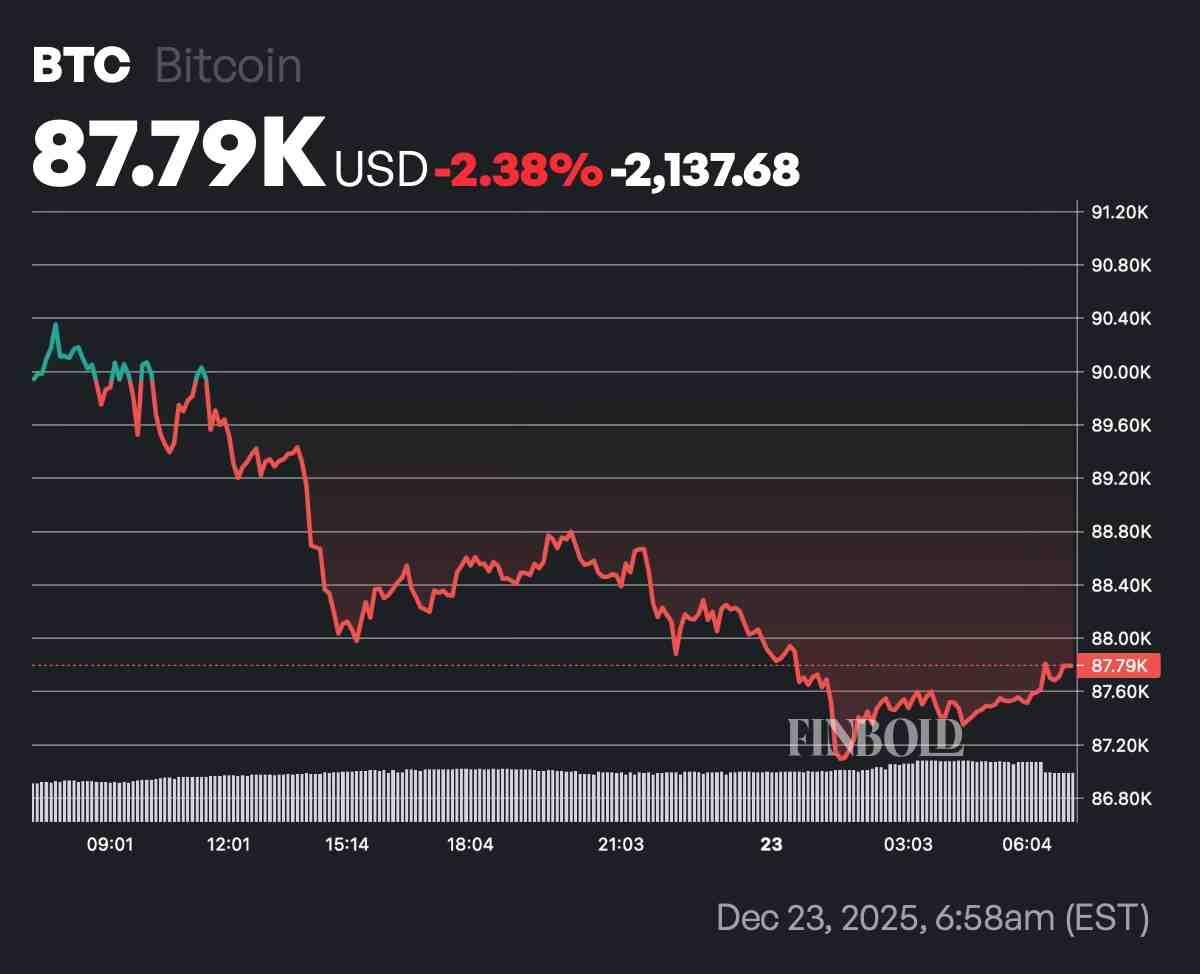

On the time of writing, Bitcoin is buying and selling close to $87,800, down 2.38% on the day. However, because it tends to commerce extra erratically forward of main choices expiries, new sharp strikes are possible as soon as contracts roll off and open curiosity resets.

Given the scale of this occasion, even modest worth fluctuations close to expiry may set off risky swings as merchants shut positions and unwind hedges.

The timing can also be notable, touchdown throughout a vacation week, when market liquidity is often skinny. In different phrases, giant orders can transfer costs extra aggressively than typical.

Finally, the staggering figures reinforce how institution-driven the market has turn into, with derivatives flows more and more dictating worth motion, irrespective of in what path.

Featured picture by way of Shutterstock