Regardless of sturdy accumulation by Bitcoin ETFs and DATs this 12 months, Bitcoin’s worth has failed to draw the sturdy retail participation seen in earlier cycles.

Nicely-known market analysts equivalent to Ki Younger Ju, CEO of CryptoQuant, and veteran dealer Peter Brandt have launched their newest Bitcoin outlooks. Their views make clear Bitcoin’s short-, medium-, and long-term prospects.

Brief-Time period Outlook

Within the brief time period, Bitcoin could proceed dealing with difficulties in staging a restoration. This weak spot seems in declining stablecoin reserves.

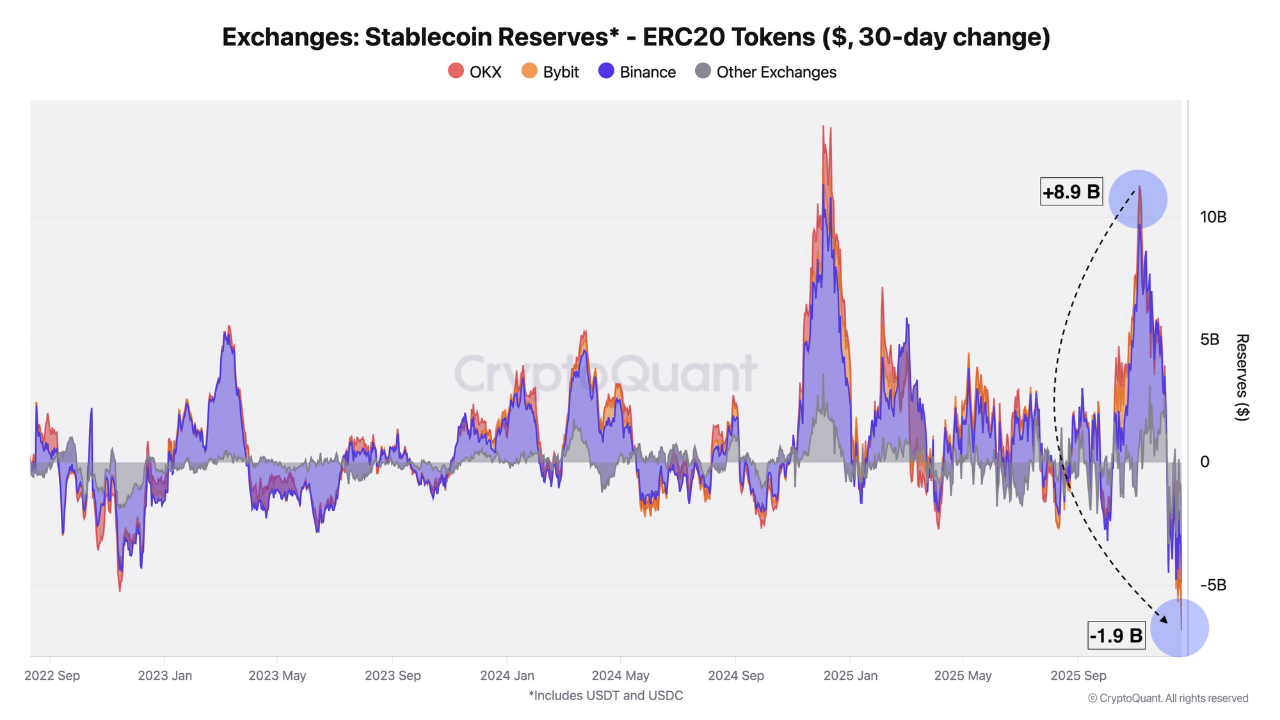

CryptoQuant knowledge reveals that stablecoin reserves on main exchanges dropped sharply. Capital outflows reached practically $1.9 billion inside simply 30 days.

Stablecoin Reserves (ERC20-Token) on Exchanges. Supply: CryptoQuant.

Binance, the market’s main liquidity venue, typically displays investor readiness to purchase via stablecoin balances. Nevertheless, knowledge point out that ERC-20 stablecoin reserves fell considerably on Binance and different centralized exchanges. This pattern means that retail traders are exiting the market.

“This motion suggests a transparent lack of investor curiosity in speedy market publicity. Moderately than maintaining their stablecoins on exchanges whereas ready for alternatives, some traders have chosen to withdraw them,” analyst Darkfost commented.

Consequently, Bitcoin lacks enough shopping for strain within the brief time period, which limits its upside potential.

Medium-Time period Outlook

Within the medium time period, Ki Younger Ju, founding father of CryptoQuant, famous that on-chain capital inflows into Bitcoin are regularly weakening.

He defined that after roughly 2.5 years of steady development, the realized cap stalled over the previous month. This metric measures whole realized capitalization based mostly on the final buy worth of every Bitcoin.

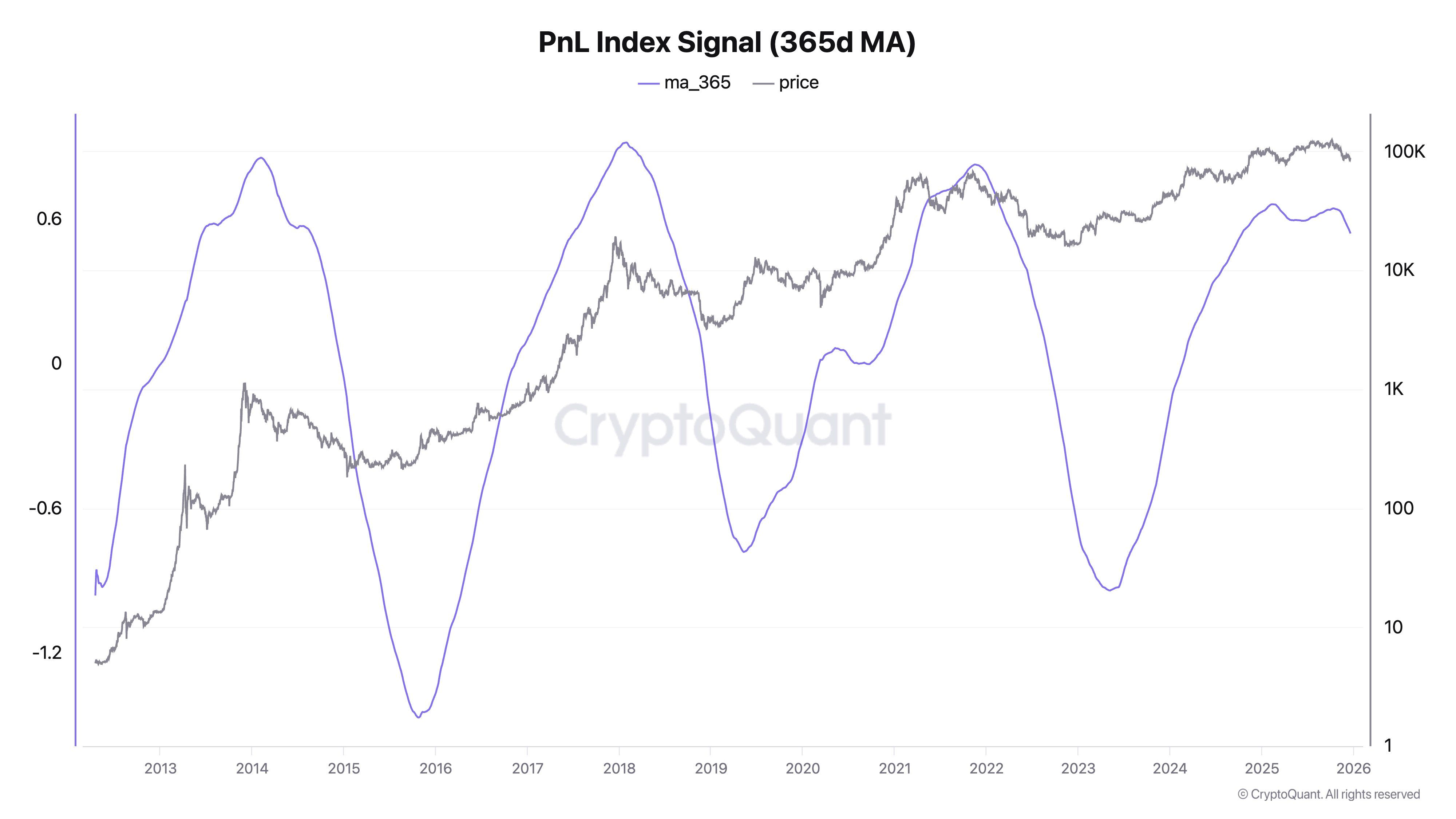

PnL Index Sign. Supply: CryptoQuant.

Information additionally reveals that the PnL Index Sign, which tracks revenue and loss based mostly on the fee foundation of all wallets, has moved sideways since early 2025. The indicator has begun trending downward towards year-end, signaling rising losses.

“Sentiment restoration may take a number of months,” Ki Younger Ju predicted.

Lengthy-Time period Outlook

Over the long run, most analysts stay optimistic. Peter Brandt, a famend dealer with expertise relationship again to 1975, maintains a bullish stance.

In a latest submit on X, Brandt said that Bitcoin has skilled 5 logarithmic parabolic advances over the previous 15 years. Declines of not less than 80% adopted one another. He argued that the present cycle has not but ended.

I’m in strategy of digging into this. I’ve already projected the following bull market excessive to happen in Sep 2029

— Peter Brandt (@PeterLBrandt) December 22, 2025

When requested concerning the timing of a possible backside, Brandt supplied no particular reply. Nevertheless, he projected that the following bull market peak might happen in September 2029.

His thesis depends on historic efficiency. Later market cycles are likely to last more, delivering smaller proportion good points in comparison with earlier ones.

Total, analysts recommend that Bitcoin could require a number of months to get better. A brand new all-time excessive is unlikely to reach shortly.

The submit Ki Younger Ju and Peter Brandt Simply Launched Medium- and Lengthy-Time period Bitcoin Predictions appeared first on BeInCrypto.