Key Notes

- Ether began the week above $3,000 after a pointy rise in buying and selling exercise.

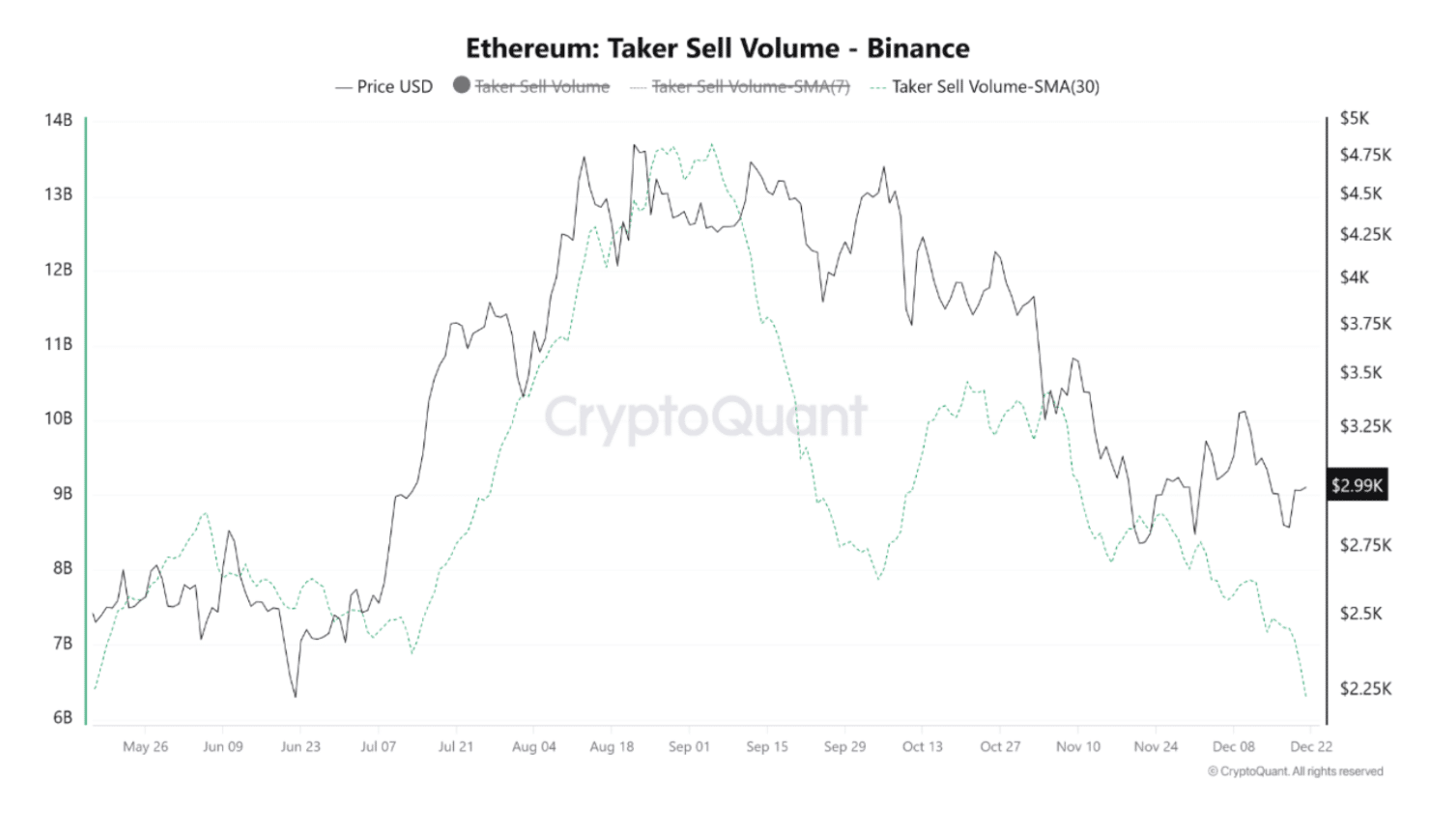

- Taker Promote Quantity factors to fading sell-side stress.

- A transfer above $3,200 would sign takeover by the bulls, analyst says.

Ether ETH $3 047 24h volatility: 2.1% Market cap: $368.34 B Vol. 24h: $17.29 B has began the week on a optimistic be aware after a unstable stretch. On Dec. 22, the cryptocurrency reclaimed the $3,000 stage as its buying and selling quantity jumped by 100%. Analysts are predicting a reduction rally forward, backed by cooling promote stress.

Knowledge by CryptoQuant suggests that the 30-day shifting common of Ethereum Taker Promote Quantity has slipped to about $6.3 billion, the bottom studying since Could. This drop signifies that fewer merchants are actually exiting positions out of urgency or concern.

Ethereum Taker Promote Quantity 30-day SMA | Supply: CryptoQuant

The newest ETH buy by Tom Lee’s Bitmine confirms the renewed shopping for curiosity. In line with the information by Lookonchain, the corporate has acquired 13,412 ETH, value over $40 million, on Dec. 22.

Plainly Tom Lee(@fundstrat)’s #Bitmine simply purchased one other 13,412 $ETH($40.61M).https://t.co/m3WT8Jwh6x pic.twitter.com/DCpdDNp0U9

— Lookonchain (@lookonchain) December 22, 2025

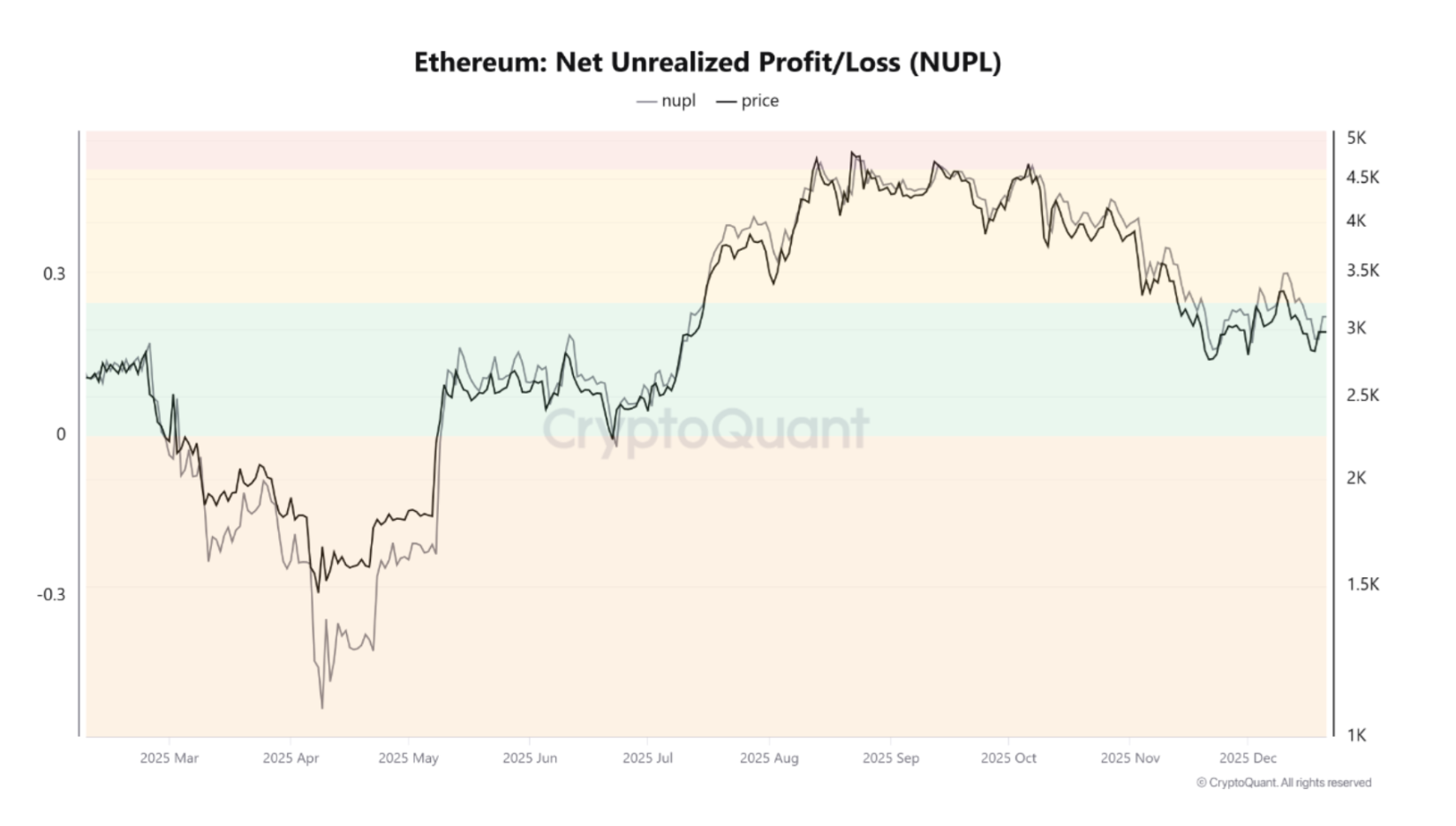

Furthermore, the Web Unrealized Revenue and Loss indicator (NUPL) for Ether stays in optimistic territory close to 0.22. This stage reveals that the typical ETH holder continues to be in revenue, although these positive factors are reasonable.

Ethereum NUPL | Supply: CryptoQuant

Traditionally, this vary suggests guarded confidence. It indicators that the market is now not fear-driven, however continues to be removed from overheated situations seen close to cycle tops.

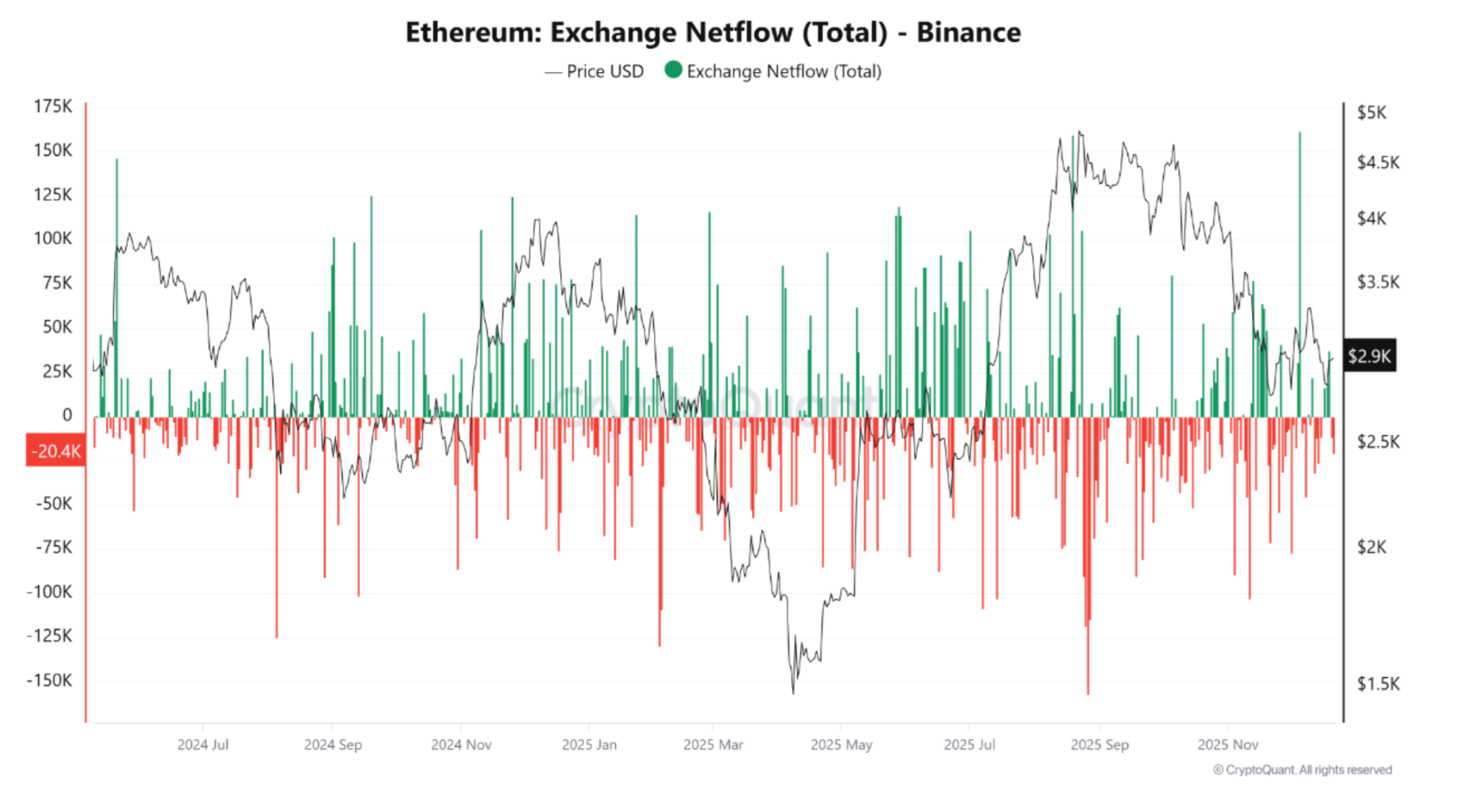

In the meantime, Binance has recorded giant internet outflows of ETH, which suggests near-term promoting threat is decrease. Importantly, these trade exits are regardless of reasonable unrealized positive factors, suggesting holders usually are not dashing to lock in earnings.

Ethereum netflow on Binance | Supply: CryptoQuant

Latest Ether Worth Weak point Nonetheless Suggests Warning

This easing in promoting stress comes after a tough week for Ethereum, when the value slipped beneath $2,800. Final week, spot ETH ETFs noticed a mixed internet outflow of $644 million, with not one of the 9 funds posting inflows.

In style crypto analyst CyrilXBT famous on X that whereas ETH is bouncing, it’s nonetheless below key resistance ranges. He defined that the $2,700-$3,000 space acts as a fragile help for the highest altcoin, and additional weak spot can lead to a “fast draw back acceleration.”

Associated article: ETH Eyes $2,800 as Whales Dump and Ethereum ETFs See $234M Outflows

Nonetheless, he added that ETH might look “wholesome” if it manages to cross the $3,200-$3,400 level.

$ETH

ETH is mainly caught in the identical story: bouncing, however nonetheless below key overhead ranges.

The orange band ($2.7–3.0k) is the battlefield. It’s help till it isn’t.

Above that, ETH must reclaim $3.2–3.4k to look “wholesome” once more.

Expectation: maintain $2.7–3.0k = chop +… pic.twitter.com/8Lby8IOw6Q— CyrilXBT (@cyrilXBT) December 22, 2025

On the time of writing, ETH is buying and selling close to $3,031, up by round 2% up to now day. However, it stays 38% beneath its August peak of $4,953.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm data by yourself and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material.