The Bitcoin worth has remained on edge this week as traders await the Financial institution of Japan’s rate of interest determination scheduled for Dec. 19.

Abstract

- Bitcoin worth has pulled again this week as merchants look ahead to the BoJ rate of interest determination.

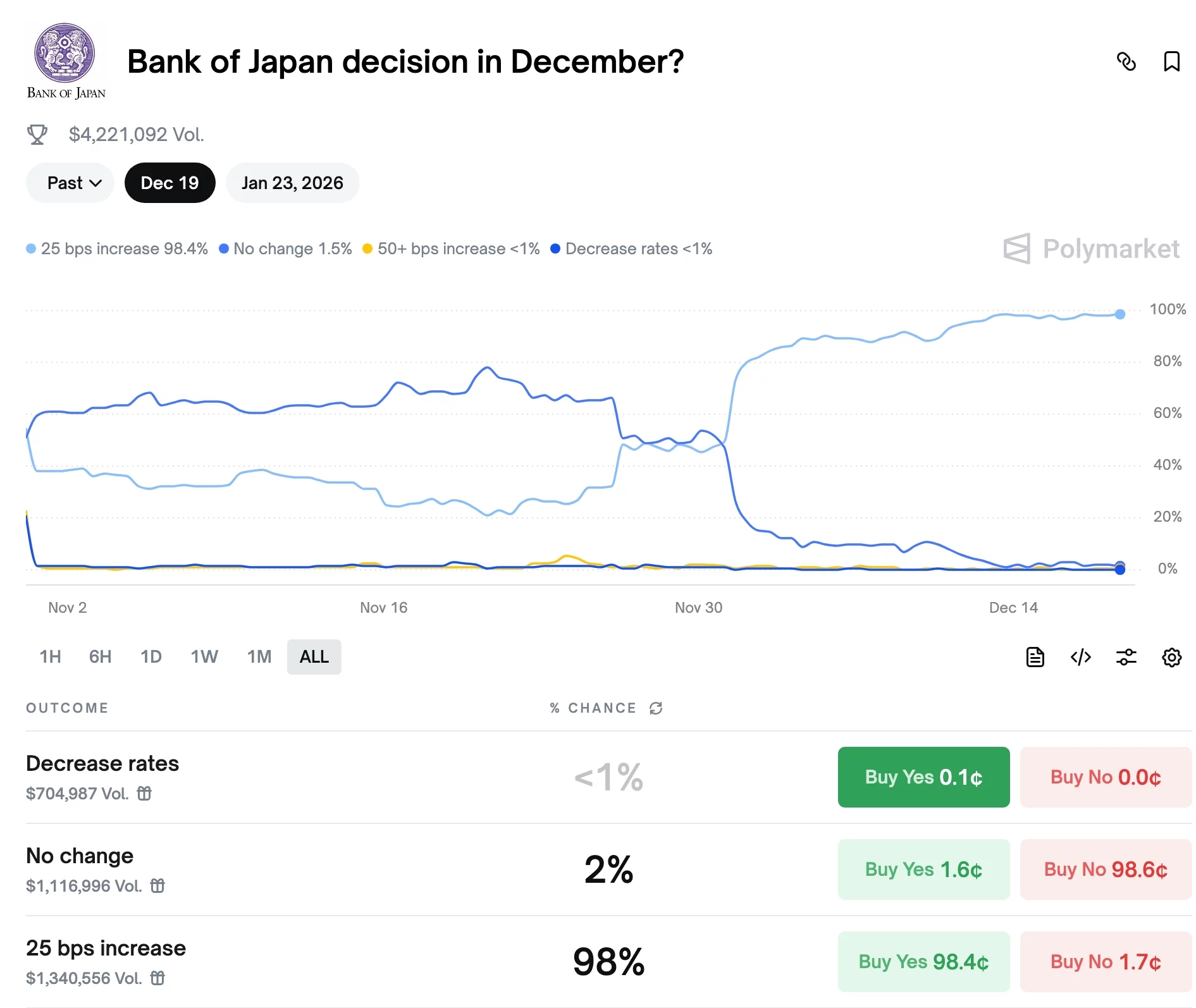

- Polymarket odds of a fee reduce have jumped to 99%.

- Bitcoin has fashioned a bearish flag sample on the each day chart.

Bitcoin (BTC) token was buying and selling at $87,700 at press time. This worth was about 7.47% under the best level this month, and 30% under the all-time excessive.

Odds of BoJ rate of interest hike are rising

Bitcoin, altcoins, and the inventory market have pulled again up to now few days as odds of a BoJ fee hike have jumped. Polymarket assigns a 98% chance to a hike.

Odds of BoJ rate of interest hike | Supply: Polymarket

A BoJ fee hike is vital given its measurement, because it is likely one of the largest central banks globally, with over $4.48 trillion in property. Additionally it is the largest holder of US authorities bonds.

You may additionally like: Bitwise says Bitcoin, Ethereum, and Solana eye new highs as ETF demand soars by 2026

The danger of a BoJ hike at a time when the Fed is reducing charges is that it might now push traders to unwind their carry trades. A carry commerce occurs when an investor borrows from a low-interest-rate nation and invests in higher-yielding property.

Japan has been one of many greatest catalysts for a carry commerce, because it maintained low rates of interest for many years. As such, because the unfold between U.S. and Japanese yields narrows, traders might promote the dangerous property they purchased.

Nevertheless, the BoJ fee hike might not drive Bitcoin decrease. With odds of a hike at 99%, it has now been priced in by market contributors. As such, the coin might rebound as traders purchase the information and embrace the brand new regular.

Bitcoin worth technical evaluation

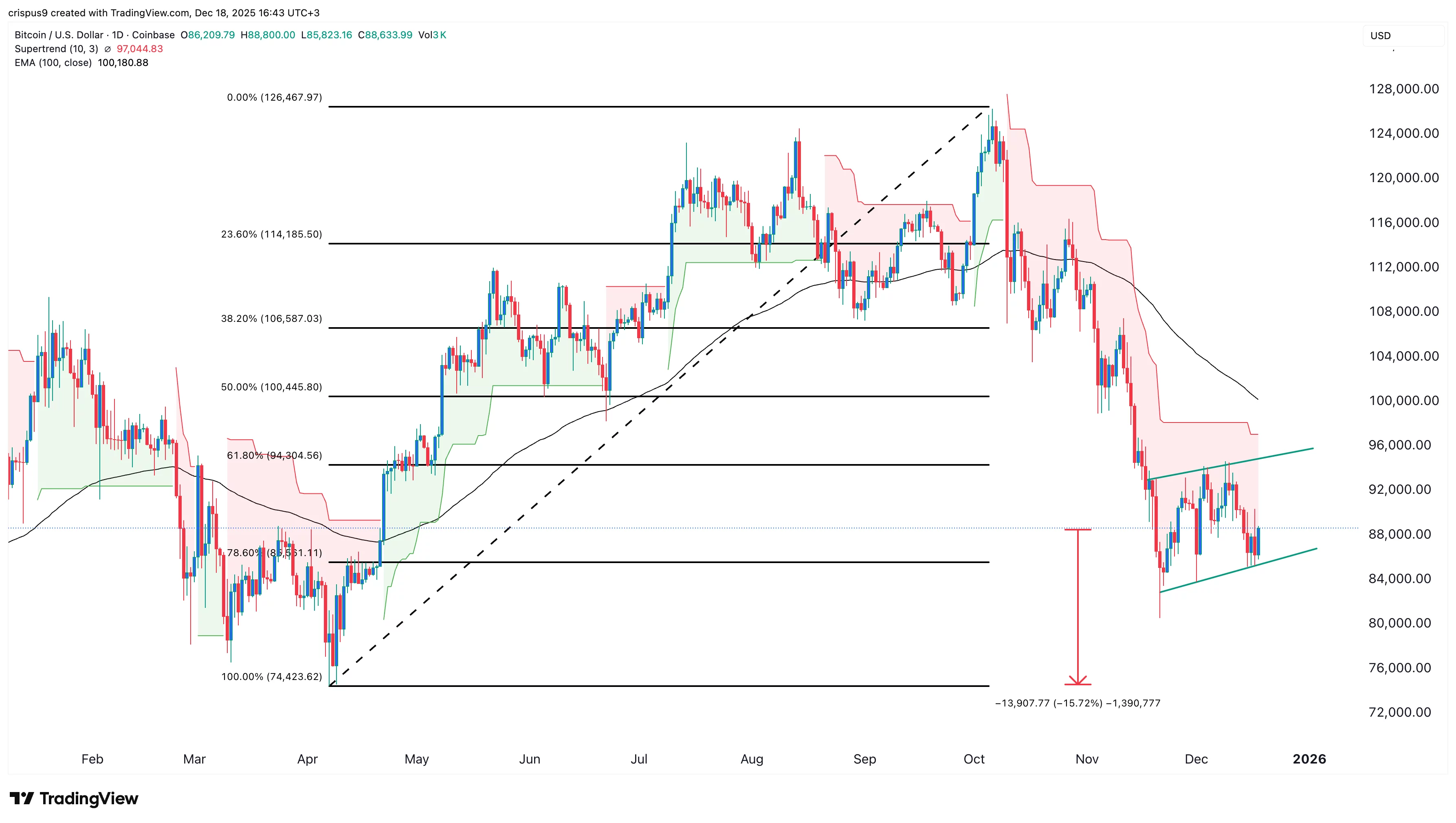

BTC worth chart | Supply: crypto.information

The each day chart reveals that the trail of the least resistance for Bitcoin is bearish within the close to time period. It’s slowly forming a bearish flag sample. It has already accomplished the formation of the inverted flagpole and is now within the flag part.

Bitcoin stays under the Supertrend indicator and the 100-day Exponential Shifting Common. Additionally it is nearing the 78.6% Fibonacci Retracement degree.

Due to this fact, there’s a danger that the Bitcoin worth will finally decline and retest the year-to-date low of $74,423, roughly 15% under the present degree.

Whereas the most definitely Bitcoin outlook is bearish, it might rebound and retest the higher facet of the flag at $94,500, after which resume the bearish development.

Learn extra: Dogecoin worth kinds bullish reversal setup as whales purchase and alternate balances drop