Ethereum would want to have the ability to maintain key assist ranges for a possible rebound amid large lengthy liquidations.

Ethereum has skilled some reasonable volatility over the previous 24 hours, at present buying and selling at $2,943. The crypto asset has proven a 0.7% enhance in value inside the final 24 hours, with the day by day value vary fluctuating between $2,902 and $2,971. Ethereum’s efficiency has been considerably muted during the last week, down by 11.4%.

Wanting on the previous 14 days, Ethereum has skilled a 3.7% drop, reflecting broader market tendencies and sentiment. The market capitalization stands sturdy at $355.8 billion, highlighting Ethereum’s distinguished place as a market chief. Within the subsequent periods, merchants will discover how Ethereum is navigating its long-term value tendencies and the place ETH is headed.

Ethereum Worth Prediction

Ethereum’s latest value motion has featured some key technical indicators, indicating a interval of retreat. Presently, the assist degree holds sturdy round $2,800, with the worth discovering a bounce at this degree in latest periods. This means that if Ethereum maintains this assist, it may try a rebound, doubtlessly testing resistance above $3,300. Breaking this resistance may pave the best way for an additional rally towards $3,500.

ETHUSD Worth Chart

Furthermore, the Relative Energy Index (RSI) is at present at 41.20, signaling impartial situations. This means that Ethereum isn’t overbought or oversold however is nearing the decrease finish of the RSI vary, which may recommend a reversal if shopping for strain picks up. Nonetheless, if the RSI continues to maneuver decrease, it may point out that bearish momentum will persist, testing the assist degree extra aggressively.

Additional, the Transferring Common Convergence Divergence (MACD) is signaling a bearish development, with the MACD line at -44.47 and beneath the sign line at -38.24. This bearish crossover signifies that the downward momentum is at present stronger, as mirrored by the detrimental histogram. A possible shift in momentum may happen if the MACD line crosses again above the sign line.

Ethereum Liquidation Knowledge

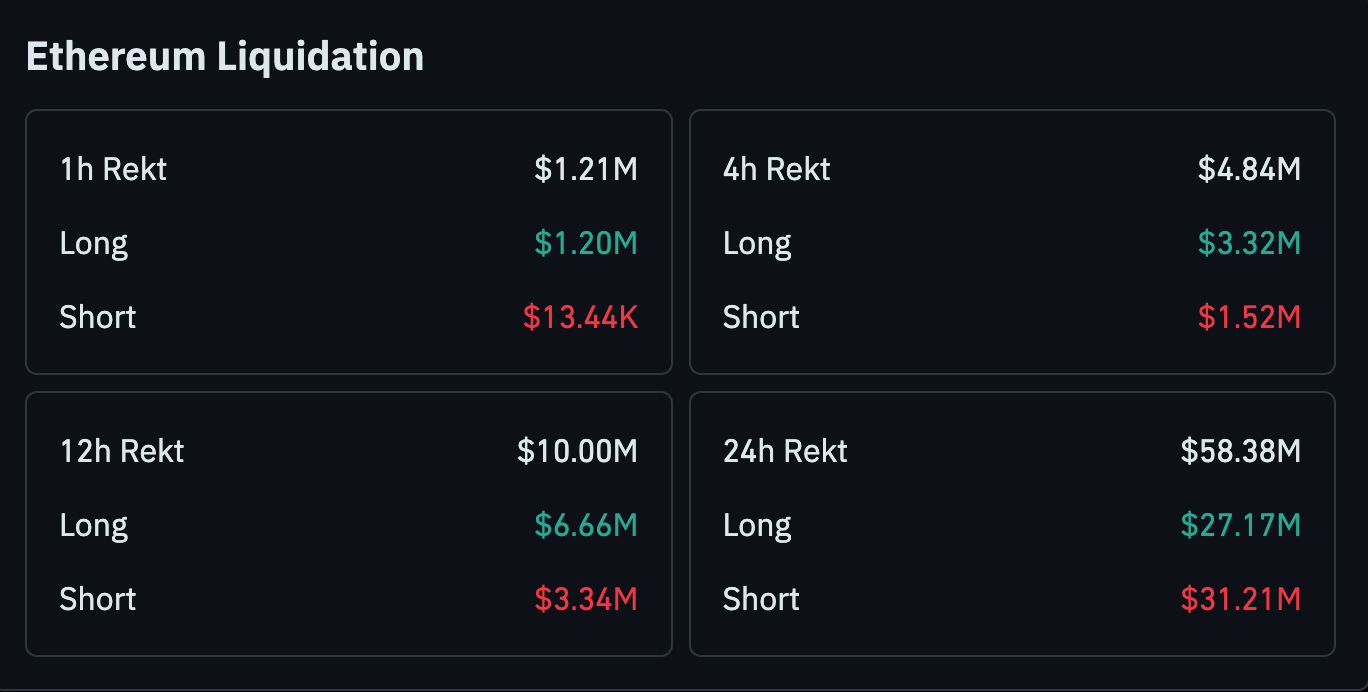

In the meantime, the Ethereum market has seen a major quantity of liquidation throughout totally different time frames, highlighting the volatility and the strain on each lengthy and brief positions. The 12-hour liquidation determine reached $10 million, with lengthy positions at $6.66 million and shorts at $3.34 million.

ETH Liquidation

The 24-hour liquidation information is much more putting, displaying $58.38 million in complete liquidations, with lengthy positions making up a good portion at $27.17 million, whereas shorts accounted for $31.21 million. This imbalance suggests heightened market volatility, with lengthy positions struggling essentially the most.