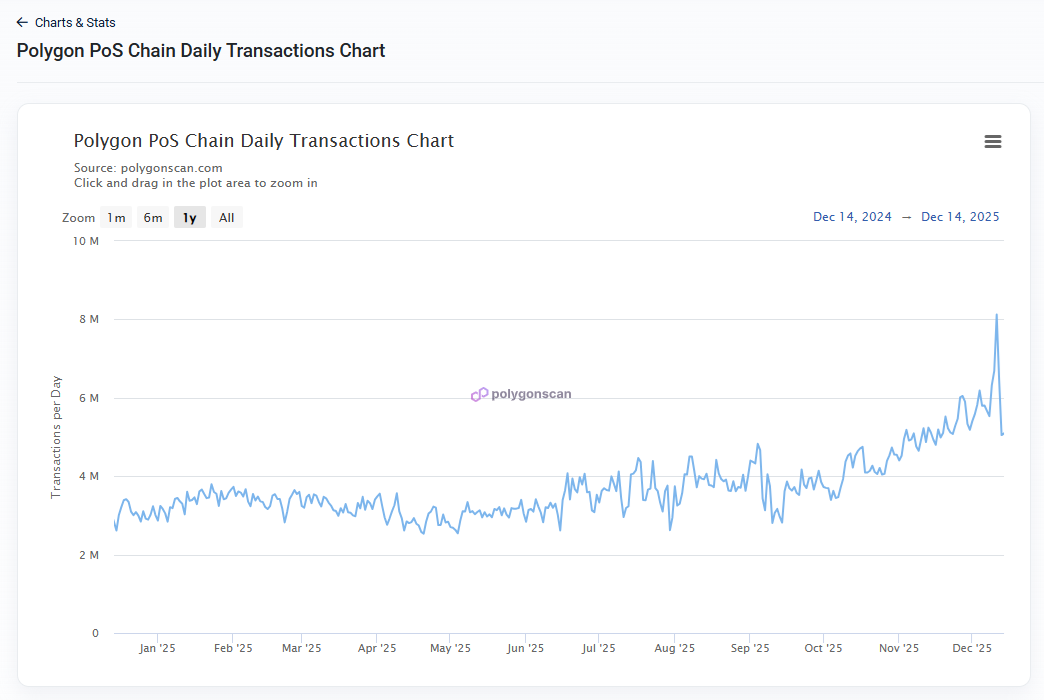

Polygon elevated its whole transactions to ranges not seen since 2021. Exercise on Polymarket is saving the L2 chain after the outflow of different varieties of apps.

Polygon each day transactions are again to a one-year excessive, returning to the baseline ranges in the course of the 2021 bull market. Polygon reached file ranges in late 2024, because of the recognition of Polymarket. The chain mirrored Polymarket’s success in November and stored rising its exercise up to now two weeks.

Polygon transaction ranges reached a yearly peak just lately, pushed by Polymarket exercise and USDC funds. | Supply: Polygon Scan

Now, Polygon appears to be making an enduring comeback, attaining over 8.1M transactions as of December 10. Polygon has now recovered about 50% of the transactions from the final quarter of 2025, when Polymarket settled a few of its largest prediction markets, with peak open curiosity.

Polygon has misplaced a lot of the earlier exercise from play-to-earn gaming from the 2021 bull market. At present, Polymarket is the primary supply of exercise, primarily based on the utilization of Polygon-based USDC tokens.

Polygon is likely one of the few L2 chains to retain long-term development and get well from the 2022-2023 bear market. The present apps are utilizing the Polygon proof-of-stake chain, with nearly no exercise on the Polygon ZK-EVM community.

Polygon will increase velocity

One of many sources for rising transaction counts is the just lately elevated velocity of Polygon. The chain launched an replace to extend transaction capability by 30%, as much as 1,400 transactions per second.

Polygon’s most lively transactions are POL token transfers, in addition to cross-chain settlements. The community holds $2.8B in stablecoin liquidity, principally counting on USDC. Stablecoins make up the majority of Polygon-based tokens, as different belongings launched on the chain retain solely minimal worth.

The latest asset profile additional proves that Polygon is generally used to settle prediction markets. The chain additionally carries rising site visitors in P2P stablecoin settlements.

POL token trades close to all-time low

Regardless of the chain’s success, the native POL (MATIC) token stored sliding to new all-time lows. POL is at $0.11, with a continuing slide up to now yr. The Polygon neighborhood has additionally known as for returning to the outdated ticker for its former recognition.

Polygon is used as a utility chain, and a few of the charges may be paid instantly in USDC. POL stays a utility token and isn’t related to DeFi utilization, liquid staking, or different actions. In consequence, Polygon has change into a settlement layer, with out turning right into a speculative hub.

The Polygon crew focuses extra on funds and RWA tokenization, with out a lot concentrate on the native token.

POL remains to be anticipated to make a comeback if the asset enters a hype part. At present, the token principally sits in whale wallets and related clusters, suggesting accumulation close to the decrease vary. POL open curiosity is close to an all-time low, at round $35M.