The FED’s week hasn’t introduced any surprises to the market. The Federal Reserve had expectedly moved the rate of interest down for one quarter some extent, with 3 members voting towards the choice, out of 10. Jerome Powell, the prevailing FED’s governor, had confirmed one other price reduce in 2026, after which, the FED would in all probability take a break, because the employment scenario appears secure, and the following focus within the dual-mandate of the FED could be to give attention to inflation.

Nonetheless, merchants are already beginning to low cost the dovishness of a supposed new FED’s president Kevin Hassett, who is thought for his dovish rethorics. He had talked about earlier this week that there is perhaps much more than 3 price cuts.

Euro, Yen and different main currencies are pushed by hawkish narratives, compared to the US greenback. For instance, the yield of 30-year bonds of Germany had reached yet one more peak.

Aside from declining the rates of interest, the FED had introduced buybacks of short-term bonds (T-bills) for about 40 billion month-to-month, which pushes down the true rate of interest and brings some liquidity to the markets: that’s thought-about mildly constructive information for shares, metals and crypto.

The US shares indices, nevertheless, wrestle to take care of the momentum, whereas metals show a stable rally, having pushed Gold above $4300, and silver to the brand new historic excessive. Platinum and palladium have set new intermediate-term highs too.

Bitcoin struggles to maintain the momentum, having locked in a comparatively slim buying and selling vary close to 92000 – 93000 worth space. After the substantial outflow from Bitcoin ETFs and the rotation from crypto again to fiat belongings, Bitcoin tries to seek out some demand again.

To this point, the principle driving narrative now’s the differential between US and European belongings, in favor of the latter. Chinese language shares additionally entice a major quantity of capital flows and hedge funds put together for a rally, as Bloomberg specialists say. Let’s dive into potential alternatives, given the data above.

DAX

DAX is establishing for the breakout of the huge consolidation sample, having been constructed since June 2025. Regardless of the tip of dovish financial coverage within the EU, inflation retains regular round 2.3%. German bond yields have reached one other peak, and shares may entice some capital flows too, as yields aren’t anticipated to proceed rising.

European shares appear like a balanced resolution given the stress on the US greenback and overheated AI sector. Earlier than breaking to the brand new peak, DAX is meant to check the 20-day shifting common, because the chance of fast continuation is comparatively low.

HANG SENG

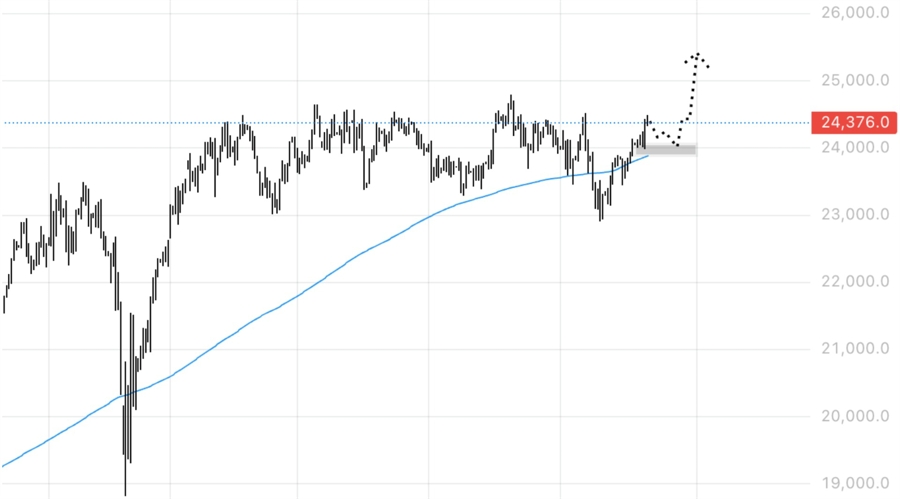

The Dangle Seng index is locked in a consolidation, proper above the 200-day shifting common.

The market loses volatility, and in an effort to discover a set off for the transfer, it could want to check the strategic help zone beneath (200-day shifting common).

That’s the frequent sample for the triangular formation – it is perhaps shaken to either side with fast worth impacts earlier than figuring out the route.

The logical vacation spot for the transfer could be the 24500 space: after testing this space, the market could reverse increased and discover a shopping for stress as proven on the chart beneath.