Lengthy-term Bitcoin (BTC) whales promoting coated calls, a technique of promoting name choices that give the client the suitable however not an obligation to buy an asset sooner or later at a predetermined worth in trade for the vendor amassing a premium, is suppressing spot BTC costs, in accordance with market analyst Jeff Park.

Giant, long-term BTC holders, also referred to as “whales” or “OGs,” introduce a disproportionate quantity of sell-side stress by means of this coated name technique, partly as a result of market makers are on the opposite aspect, shopping for the coated calls, Park stated.

Because of this the market makers should hedge their publicity to purchase the calls by promoting spot BTC, forcing market costs down, regardless of sturdy demand from conventional exchange-traded fund (ETF) traders.

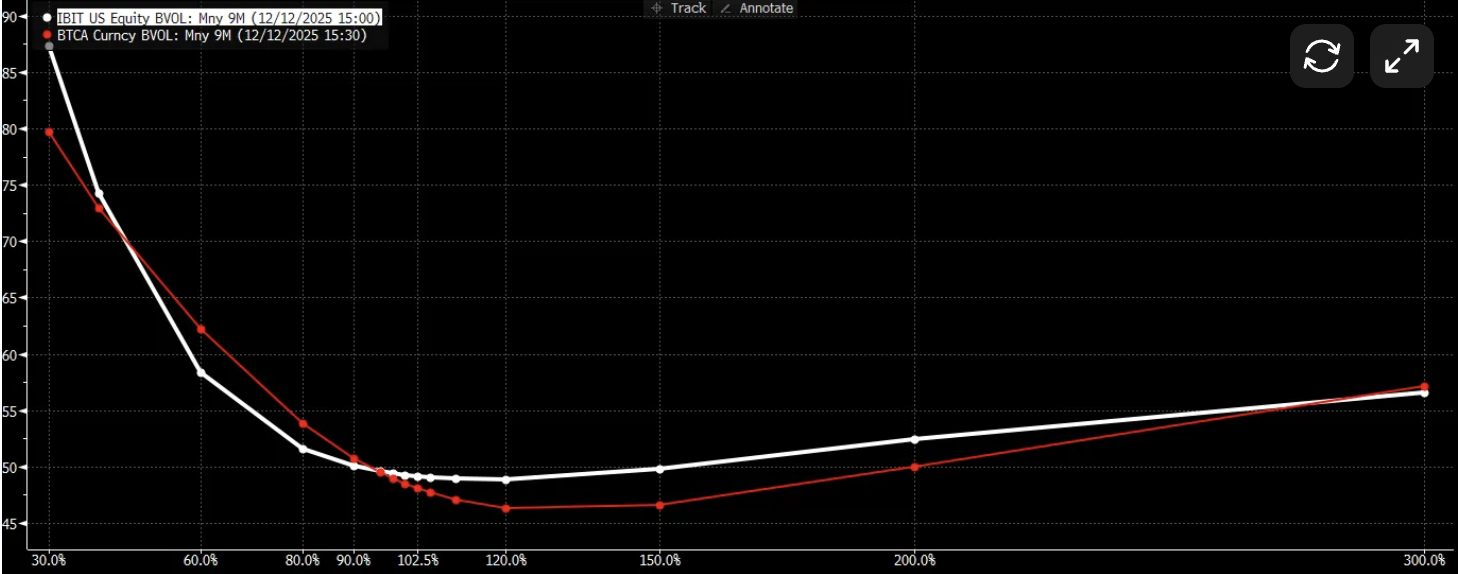

The volatility skews of BlackRock’s IBIT ETF versus native Bitcoin choices, like these discovered on crypto derivatives trade Deribit. Supply: Jeff Park

As a result of the BTC used to underwrite the choices has been held for a very long time and doesn’t signify new demand or contemporary liquidity, the calls act as a internet downward stress on costs. Park stated:

“When you have already got the Bitcoin stock that you simply’ve had for 10-plus years that you simply promote calls towards it, it’s only the decision promoting that’s including contemporary delta to the market — and that route is detrimental — you’re a internet vendor of delta once you promote calls.”

The evaluation concluded that Bitcoin’s worth is being steered by the choices market and that worth motion will stay uneven so long as whales proceed to extract short-term income from their Bitcoin stash by promoting coated calls.

Bitcoin decouples from shares as analysts try to gauge the place BTC’s worth goes subsequent

Bitcoin, which some analysts say is correlated with tech shares, decoupled from the inventory market within the latter half of 2025, as shares continued to print contemporary highs whereas Bitcoin fell again right down to concerning the $90,000 stage.

The worth of Bitcoin hovers above the $90,000 stage. Supply: CoinMarketCap

A number of analysts forecast that BTC will resume its worth rally when the US Federal Reserve continues the rate-cutting cycle and injects liquidity into the monetary system, which is a optimistic worth catalyst for risk-on property.

24.4% of merchants anticipate one other rate of interest lower on the Federal Open Market Committee (FOMC) assembly in January, in accordance with monetary derivatives firm CME Group’s FedWatch information instrument.

Nonetheless, different analysts venture a possible drop to $76,000 and say that Bitcoin’s bull run is already over.