The broader cryptocurrency market is seemingly seeking to finish 2025 in a muted mode, however a number of property have stood out with large capital inflows.

Certainly, the yr is coming to an finish with Bitcoin (BTC), the maiden cryptocurrency, struggling to construct momentum after crashing beneath the $100,000 mark.

Whereas Bitcoin opened the yr on a flying word, the asset is on observe to publish losses, whereas different property are closing out a few of their most spectacular years on file.

To this finish, Zcash (ZEC) has emerged as one of many standout performers of 2025, dramatically outperforming Bitcoin regardless of beginning the yr as a comparatively neglected and low-priced crypto asset.

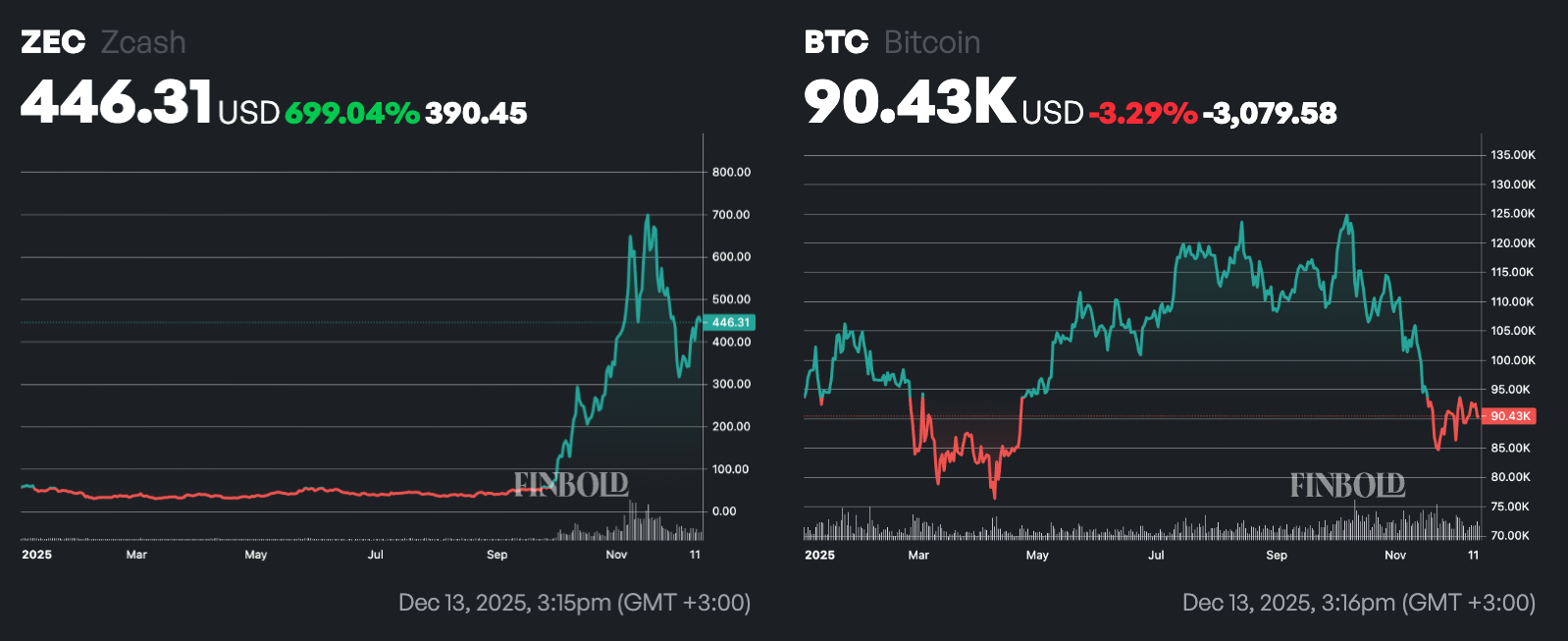

As of press time, ZEC was buying and selling at $446, reflecting a year-to-date acquire of about 699%. In contrast, Bitcoin was altering palms close to $90,430, posting a year-to-date decline of roughly 3.3% after surrendering a lot of its early-year positive aspects.

The divergence highlights how capital rotated inside the crypto market in 2025. Notably, Bitcoin started the yr with sturdy momentum, supported by institutional inflows and lingering optimism following prior cycle highs.

Nonetheless, because the yr progressed, BTC struggled to maintain upside traction amid profit-taking, ETF circulation volatility, and broader risk-off circumstances. These pressures weighed on Bitcoin’s efficiency, leaving it modestly decrease on the yr regardless of a number of rallies.

Why Zcash dwarfed Bitcoin

Zcash, then again, benefited from a renewed give attention to privateness in digital finance that pushed traders towards property providing stronger transaction confidentiality, an space the place ZEC has lengthy differentiated itself.

On the similar time, rising use of shielded transactions diminished liquid provide, whereas ongoing community upgrades improved usability and strengthened confidence within the protocol’s long-term relevance.

Shortage dynamics additionally performed a job. Anticipation round Zcash’s issuance schedule and tighter efficient provide helped amplify upside strikes as soon as momentum took maintain.

As ZEC broke by means of long-standing resistance ranges within the second half of the yr, technical shopping for and leverage-driven momentum accelerated positive aspects, pushing the token from double-digit costs earlier within the yr to properly above $400 by December.

Subsequently, an investor allocating capital to Zcash firstly of 2025 can be sitting on positive aspects of roughly six to seven instances their preliminary funding, whereas an analogous allocation to Bitcoin would at the moment be within the purple.

Featured picture through Shutterstock