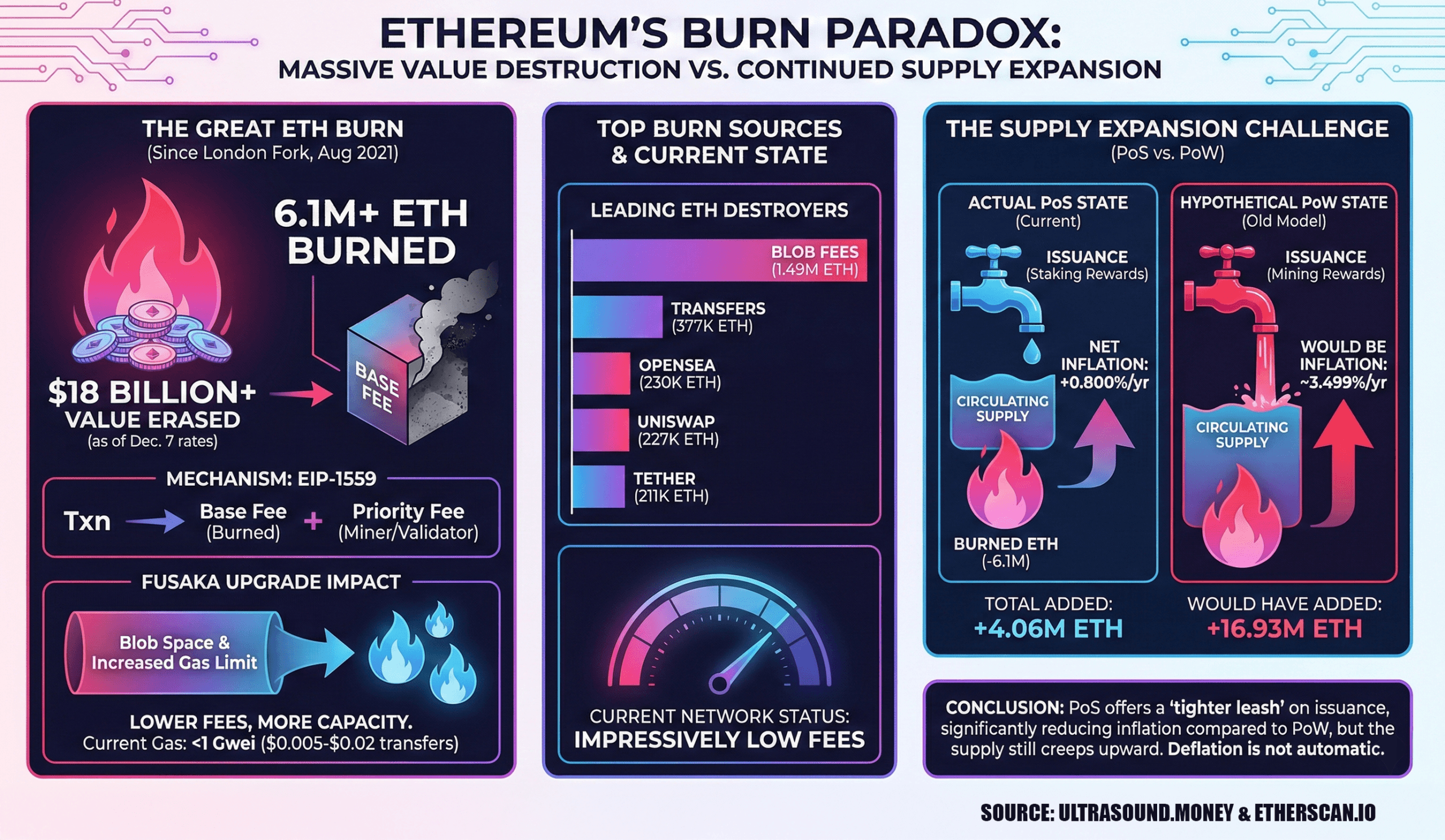

Based on metrics, the tally of ETH burned from charges has sailed previous the 6 million mark, that means that as of Dec. 7’s trade charges, greater than $18 billion in worth has successfully gone up in smoke because the London arduous fork on Aug. 5, 2021.

ETH Bonfire Surpasses 6M ETH Since 2021’s London Improve

Only in the near past, Ethereum rolled out its Fusaka improve, which dramatically expanded the community’s knowledge and gasoline capability (assume larger block gasoline limits and much bigger blob house), permitting every block to haul extra name knowledge and rollup blobs.

The Fusaka improve reshaped layer two (L2) charges and, by extension, supplied a serving to hand to onchain (L1) gasoline prices as nicely. Onchain charges on Ethereum are impressively low — dipping beneath a single gwei, based on etherscan.io’s gasoline tracker.

At 11 a.m. Japanese time on Dec. 7, a low-priority charge hovered close to 0.305 gwei, whereas a high-priority charge clocked in round 0.326 gwei. That locations switch prices someplace between $0.005 and $0.02 on Sunday, whereas sensible contract strikes like swaps, NFT gross sales, or bridging run anyplace from $0.14 to $0.50 per motion.

When the London arduous fork arrived in August 2021, it introduced EIP-1559 with it—a full makeover of Ethereum’s transaction charge mechanics that launched a dynamic base charge, robotically burned and gone for good with each block.

The fork landed 4 years, 4 months, and a couple of days in the past (intercalary year quirks included), and since then, 6.1 million ETH valued at $18 billion has been erased from circulation. Metrics from ultrasound.cash reveal that blob charges have taken the crown as the most important ETH burner, wiping out 1,492,094 ETH on their very own.

Conventional ether transfers comply with with 377,388 ETH torched, whereas the non-fungible token (NFT) market Opensea is chargeable for 230,051.12 ETH diminished to digital ashes. The decentralized trade (DEX) Uniswap v2 isn’t far behind, with 227,337.27 ETH burned, and tether ( USDT) utilization clocks in with 211,342.55 ETH eradicated. Closing out the highest 5, Uniswap v1 has erased a further 153,585.62 ETH since 2021.

Learn extra: No Santa Rally? Bitcoin Derivatives Markets Trace at a Chilly December

Regardless of the 6.1 million ETH burned, stats over the previous 4 years nonetheless present the community working inflationary at 0.800% per 12 months. Because the London arduous fork, roughly 4,065,657 ETH have been added to the availability. Underneath the proof-of-stake (PoS) mannequin, issuance has eased in contrast with what it could be beneath proof-of-work (PoW). If Ethereum have been nonetheless working on PoW system, simulated knowledge exhibits the annual inflation price would sit at 3.499%, and a hefty 16,931,820 ETH would have been added to circulation.

Whereas PoS is retaining issuance on a tighter leash, Ethereum’s provide nonetheless creeps slowly upward, reminding everybody that deflationary desires aren’t computerized. Regardless of this, the community has come a good distance because the London arduous fork, slicing potential inflation dramatically in contrast with its previous PoW days.

FAQ ❓

- What triggered Ethereum’s large burn totals?

Ethereum’s burn exercise stems from EIP-1559, which destroys the dynamic base charge in each block. - How a lot ETH has been burned because the London arduous fork?

Greater than 6 million ETH valued at roughly $18 billion have been faraway from circulation. - Did the Fusaka improve have an effect on Ethereum charges?

Sure, Fusaka expanded block capability, largely serving to L2 transaction prices. - Is Ethereum deflationary in spite of everything this burning?

No, the community stays barely inflationary regardless of the numerous quantity of ETH destroyed.