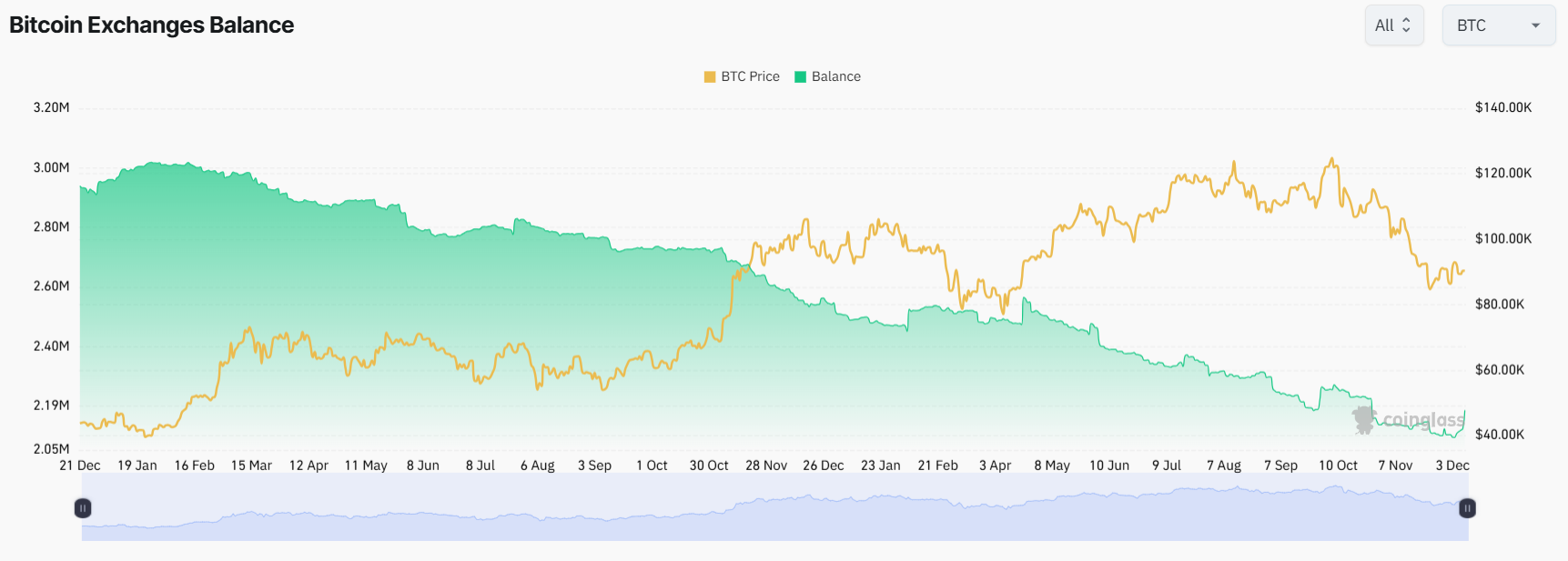

There are at the very least 400,000 fewer Bitcoin on exchanges in comparison with the identical time final 12 months, in a constructive signal for the market, in response to the market intelligence platform Santiment.

Over 403,000 Bitcoin (BTC) have moved off exchanges since Dec. 7, 2024, representing roughly 2% of the entire provide, Santiment stated in an X put up on Monday, citing information from its sanbase dashboard.

Customers usually transfer their Bitcoin away from exchanges into chilly storage wallets, which, in principle, makes it more durable to promote and will sign long-term plans to carry onto it.

“Usually, it is a constructive long-term signal. The much less cash exist on exchanges, the much less possible we’ve traditionally seen a serious sell-off that causes draw back stress for an asset’s value.”

“As Bitcoin’s market worth hovers round $90K, crypto’s high market cap continues to see its provide shifting away from exchanges,” Santiment added.

A 12 months in the past, there have been round 1.8 million Bitcoin on exchanges. Supply: Santiment

Bitcoin can also be shifting into ETFs

Whereas a lot of the Bitcoin on exchanges is probably going headed again to hodler wallets, Giannis Andreou, the founder and CEO of crypto miner Bitmern Mining, stated that exchange-traded funds (ETF) may be absorbing these cash.

Citing information from BitcoinTresuries.Internet, Andreou stated that ETFs and public corporations now maintain extra Bitcoin than all exchanges mixed, after years of outflows and ETFs quietly accumulating within the background.

Associated: Technique’s Bitcoin treasury swells previous 660,000 BTC after recent $962M purchase

“Institutional possession has quietly crossed into a brand new part: much less liquid provide, extra long-term holders, stronger value reflexivity, a market pushed by regulated autos, not buying and selling platforms,” Andreou stated.

“This shift is larger than folks suppose. Bitcoin isn’t shifting to exchanges anymore. It’s shifting off them straight into establishments that don’t promote simply. The provision squeeze is constructing in actual time.”

ETFs and personal corporations maintain extra Bitcoin than exchanges

Crypto information analytics platform CoinGlass exhibits the identical development, with Bitcoin held on exchanges sitting at round 2.11 million as of Nov. 22, when Bitcoin was struggling by a correction and buying and selling fingers for round $84,600.

Bitcoin held on exchanges has been steadily falling during the last 12 months. Supply: CoinGlass

BitBo lists ETFs as holding over 1.5 million Bitcoin and public corporations with over a million, representing practically 11% of the entire provide mixed.

Journal: Koreans ‘pump’ alts after Upbit hack, China BTC mining surge: Asia Specific