Ethereum sees over $500M web futures flows, recording bullish momentum as worth exams key resistance ranges.

Ethereum (ETH) is at present buying and selling at $3,158, reflecting a 4.2% improve over the previous 24 hours. The day by day worth vary for Ethereum has remained between $2,941.77 and $3,171.62, displaying a major upward motion inside a slim worth band.

During the last week, Ethereum has gained 11.3%, and its 14-day efficiency signifies an 11.5% rise. ETH at present boasts a market cap of $381.18 billion and a circulating provide of 120.7 million ETH.

As Ethereum continues its upward trajectory, the main focus is on its worth motion across the $3,150 mark. The current worth surge is displaying indicators of bullish continuation, as Ethereum exams increased resistance ranges. Will ETH break by way of these key resistance factors and push towards new highs?

Ethereum Value Evaluation

The 1-day chart for Ethereum reveals a combined technical outlook, as the value is at present testing key resistance round $3,200. The Ichimoku Cloud exhibits the value transferring inside a cloud vary, with $3,093 performing because the fast assist, and $3,437.71 marking a better resistance.

Ethereum 1 Day Value Chart

Ethereum is at present sitting on the decrease fringe of the cloud, and if it holds above $3,159.03, it might push towards the $3,437.71 resistance. Nonetheless, any drop under $3,037.19 might set off a transfer towards the cloud’s decrease boundary, which suggests $3,037 as the subsequent vital assist degree.

Moreover, the conversion line sits at $2,980, whereas the baseline is at $3,093. If the conversion line crosses above the baseline, it will be sometimes seen as a bullish sign.

In the meantime, the MACD exhibits a bullish sign, with the histogram turning constructive and the MACD line crossing above the sign line, indicating rising upward momentum. Nonetheless, the RSI is at 47.33, which stays within the impartial zone, signaling that Ethereum is neither overbought nor oversold.

This impartial RSI studying means that whereas the value is experiencing upward motion, there may be nonetheless room for additional worth motion earlier than encountering vital resistance.

Ethereum Futures Flows

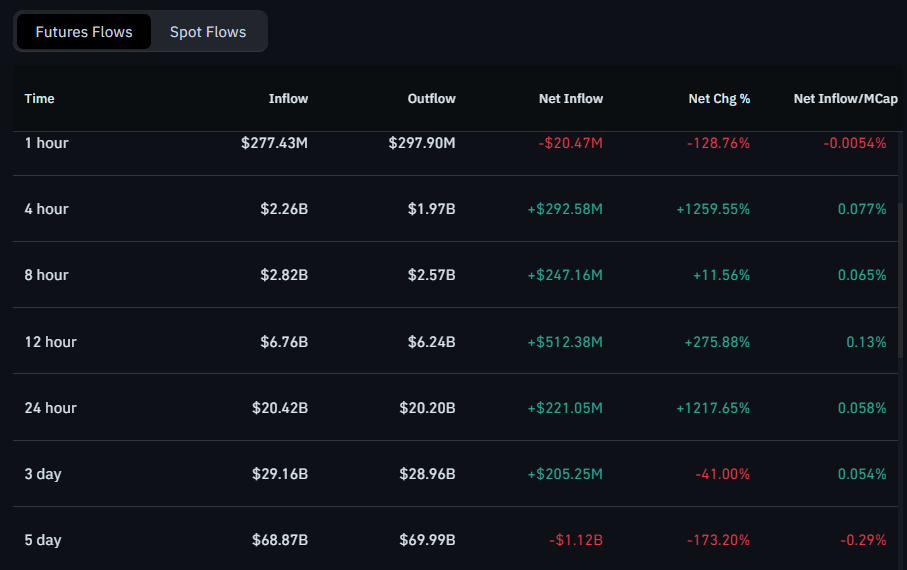

Elsewhere, Ethereum’s 12-hour liquidity information exhibits a considerable web influx of $512.38M, pushed by $6.76B in inflows and $6.24B in outflows, leading to a +275.88% change. This surge in inflows signifies that there was sturdy shopping for strain over the 12 hours.

Ethereum Liquidity Chart

Trying on the 24-hour information, Ethereum skilled $20.42B in inflows and $20.20B in outflows, leading to a web influx of $221.05M, which is a +1217.65% change. Whereas the full quantity of inflows and outflows is massive, the web influx exhibits that Ethereum nonetheless has extra patrons than sellers.

The three-day information reveals a web influx of $205.25M, with $29.16B in inflows and $28.96B in outflows. Nonetheless, this information exhibits a -41.00% change, reflecting a lower within the charge of web inflows in comparison with the shorter time durations.