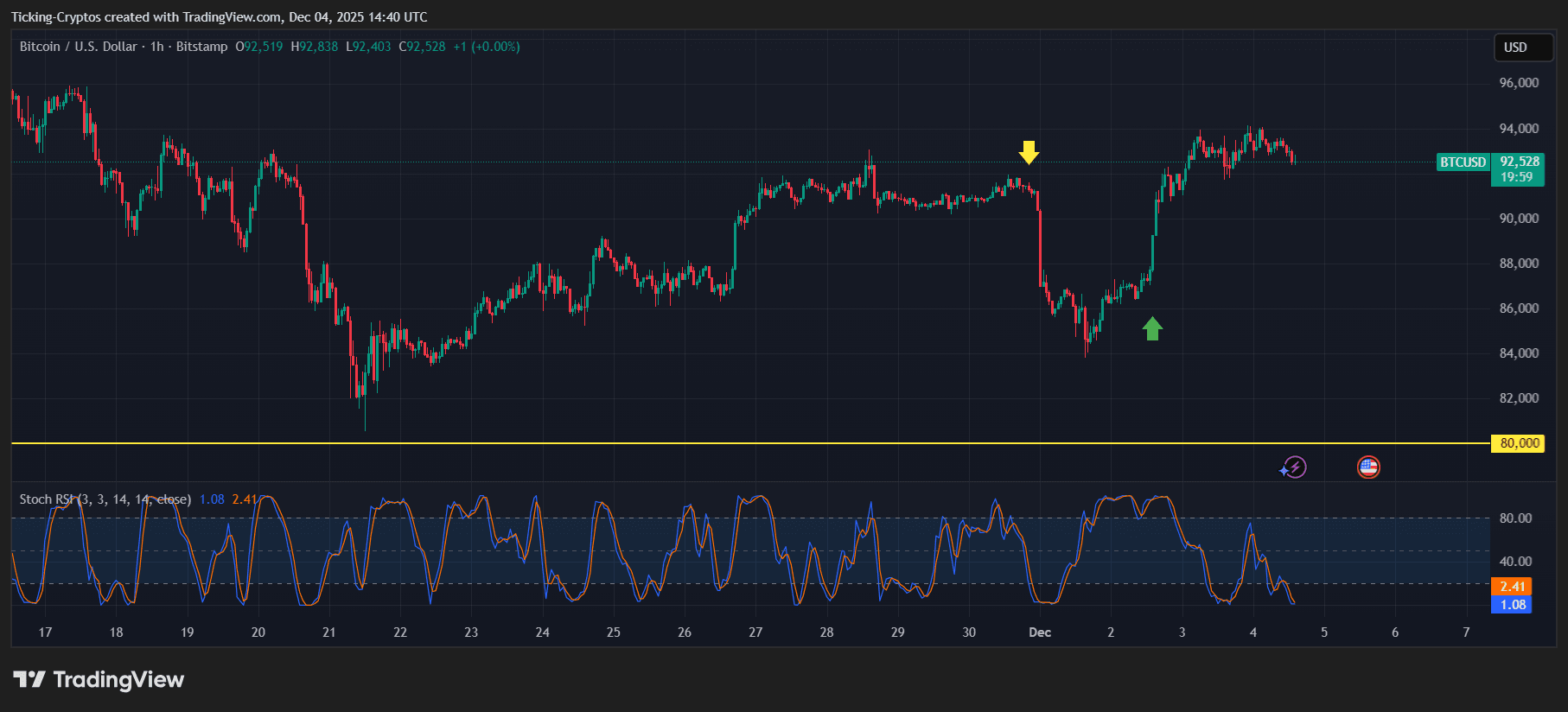

Bitcoin ($BTC) is exhibiting robust indicators of restoration after a pointy pullback to the mid-$80,000 area. The hooked up chart clearly exhibits a clear bounce round $85K, adopted by a robust V-shaped reversal again towards the $92–93K space. Momentum has stabilized, and patrons stepped in exactly the place the market anticipated a response, confirming that dip-buyers stay in management.

BTC/USD 1-hour chart – TradingView

However past the technicals, three large macro catalysts flashed bullish indicators throughout the market. From political demand to historic liquidity injections, all the pieces factors towards increased BTC costs within the coming days and weeks.

Listed here are the Prime 3 Causes Why Bitcoin Ought to Go Up Subsequent.

1. Bitcoin Rebounded Strongly From Key Assist

The chart exhibits Bitcoin dipping towards the important $85K help zone, touching the decrease boundary earlier than patrons aggressively absorbed the transfer. The inexperienced arrow marks a robust accumulation candle, adopted by constant upward momentum.

Key technical observations:

- Stoch RSI hit oversold, confirming a textbook bounce.

- Worth fashioned a V-reversal, considered one of BTC’s signature bottoming patterns.

- The $92K–93K vary is stabilizing as a brand new short-term help.

So long as BTC holds above this zone, upside continuation towards $95K–98K stays doubtless, with a possible retest of the all-time excessive shortly after.

2. Main Patrons: Trump-Backed America Bitcoin & International Sentiment Shift

One of the crucial viral catalysts this week:

The Trump-family-backed America Bitcoin initiative reportedly purchased $34 million value of BTC.

Whether or not symbolic or strategic, any such political-tier buy:

- Alerts confidence in BTC as a long-term reserve asset

- Boosts public and market belief

- Fuels the narrative of Bitcoin turning into an American strategic asset

And it doesn’t finish there.

A broadly shared put up highlighted that the “world’s highest IQ holder” publicly mentioned Bitcoin will hit a new all-time excessive this month.

Whereas sentiment-based catalysts alone don’t transfer markets, they amplify optimism, and in crypto, optimism typically accelerates liquidity inflows.

Collectively, these two narratives create a macro-scale demand increase on the good second when BTC is rebounding.

3. Large Liquidity Injection: U.S. Treasury’s $12.5B Buyback + International Stimulus

That is the most necessary motive of all.

The U.S. Treasury simply carried out the largest debt buyback in U.S. historical past — $12.5 billion.

That is direct liquidity injected into the monetary system, and traditionally:

- Liquidity ↑

- Threat belongings ↑

- Bitcoin ↑↑↑

It will get much more bullish:

✔ FED fee minimize anticipated subsequent week: A decrease rate of interest = cheaper cash = extra risk-on publicity.

✔ New “bullish” FED Chair announcement: Markets love predictable, pro-liquidity management.

✔ U.S. & Japan have confirmed new stimulus checks: Stimulus cash → danger belongings → crypto flows.

In different phrases:

Liquidity help = Bitcoin rocket gas

BTC thrives in environments the place governments inject cash, purchase debt, and minimize charges.

That is precisely the kind of macro backdrop that beforehand despatched Bitcoin into explosive rallies.