Macro Context: Liquidity Wave Hits the Market

🇺🇸 The U.S. Treasury simply purchased again $12.5 BILLION of its personal debt — the largest buyback ever recorded.

Why this issues:

- Debt buybacks = liquidity assist

- Liquidity assist = danger belongings pump

- Threat belongings pump = crypto rallies

This recent injection of liquidity follows:

- Expectations of QE returning

- Market pricing in charge cuts

- A flood of cash supporting the bond market

- World central banks, together with Japan, introducing competing stimulus plans

Even the one danger issue — a possible Financial institution of Japan charge hike — is softened by Japan’s $185B stimulus bundle introduced concurrently.

All of this units a bullish tone for Q1–Q2 2026, and crypto is already reacting.

Ethereum Worth Evaluation: Sturdy Reversal from Assist

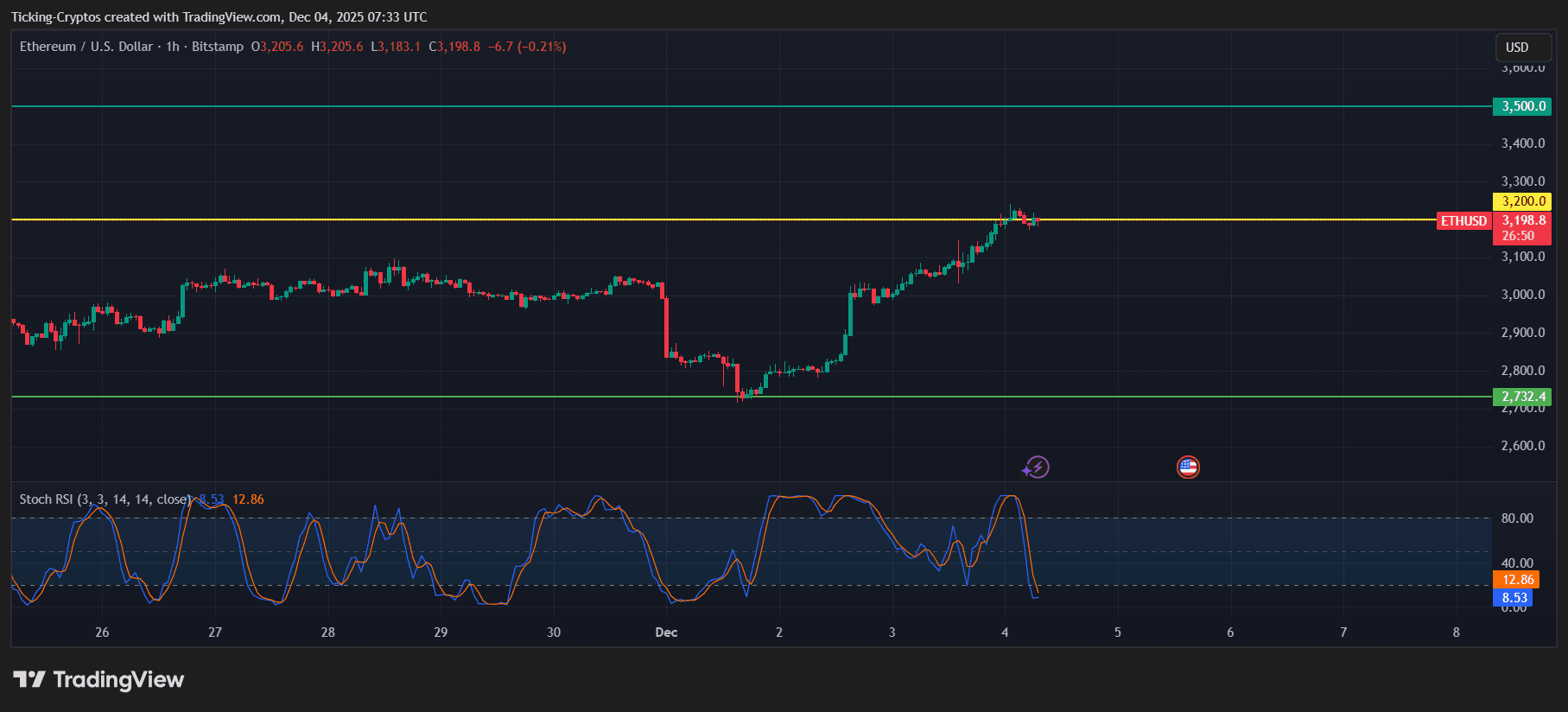

$Ethereum bounced cleanly from the important thing assist zone round $2,730, forming a robust V-shaped restoration.

ETH/USD 1-hour chart – TradingView

Key Observations From the Chart:

1. ETH broke again above the $3,200 resistance

$ETH is now consolidating proper on this degree — a robust signal that patrons are defending the breakout somewhat than taking earnings.

2. Momentum is cooling, however nonetheless bullish

The Stoch RSI exhibits a pullback from overbought situations, which normally occurs after a robust leg up. This isn’t bearish — it typically precedes the subsequent wave.

3. Construction stays strongly bullish

- Larger lows

- Larger highs

- Clear reclaim of main EMAs

- Sturdy correlation with BTC upward momentum

The $3,200 degree is now the road to look at.

ETH Worth Prediction: What Comes Subsequent?

Upside Targets (Bullish Situation)

With liquidity increasing and BTC holding above $90K:

1. $3,350 – Minor resistance: A retest of this zone is probably going if BTC stays secure.

2. $3,500 – Main goal: That is the subsequent important resistance degree on the chart — marked beforehand as an area high. A break above $3,500 opens the door to:

3. $3,800 – Extension goal: This might require sturdy BTC momentum and sustained liquidity inflows.

Draw back Targets (If Market Pulls Again)

Ought to ETH lose the $3,200 space:

1. $3,050 – Native assist: Prone to be examined if momentum cools.

2. $2,900 – Sturdy assist: The extent the place patrons beforehand stepped in aggressively.

3. $2,730 – Main assist zone: That is ETH’s resilience line — dropping it will weaken the pattern.

In the mean time, none of those draw back ranges are being threatened.

How Bitcoin’s Return Above $90,000 Boosted ETH

Ethereum tends to carry out strongly after Bitcoin stabilizes from a correction. Over the previous 48 hours:

- Bitcoin reclaimed $90,000

- Market concern disappeared

- Liquidity injections from the U.S. Treasury boosted confidence

- Threat belongings throughout equities and crypto rebounded

With BTC regaining dominance and momentum, ETH merchants rotated again into the market.

Traditionally:

BTC stability + macro liquidity = ETH acceleration

That is precisely what we’re seeing now.