$Bitcoin is buying and selling round $91,200 after a pointy rebound from its decrease help space. Bitcoin recovered steadily after a multi-day selloff, now consolidating sideways as volatility compresses. With the market approaching December catalysts, merchants are watching whether or not BTC will reclaim key resistance ranges or danger a deeper correction.

Right here’s the complete evaluation primarily based on the chart.

Bitcoin Chart Evaluation: What Simply Occurred

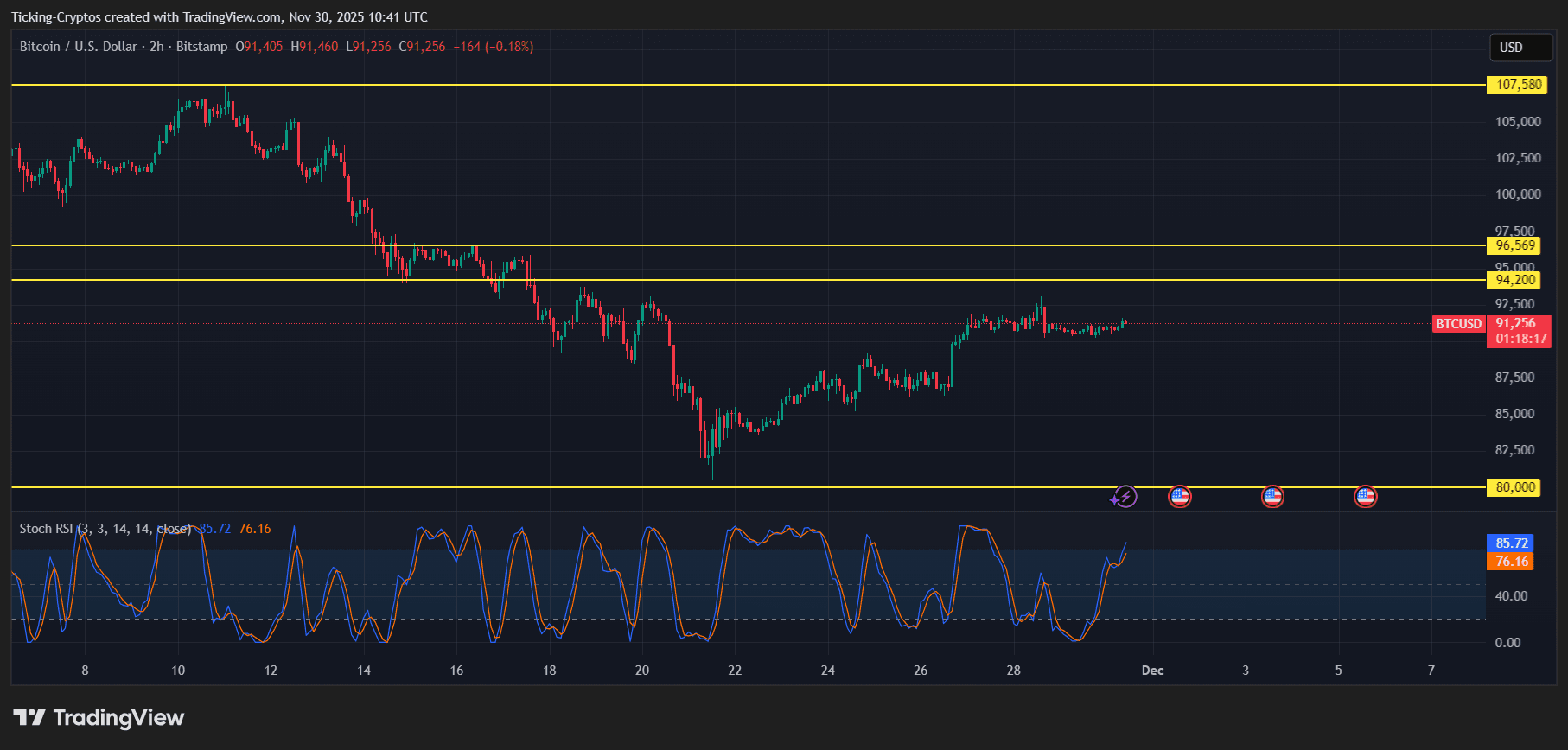

1. Sturdy Rebound From $80,000 Help

The chart reveals a transparent bounce from the $80,000 macro help zone, marked by the bottom yellow line. Value tapped this stage solely as soon as, triggering a quick reversal and forming a clear V-shaped restoration.

BTC/USD 2-hours chart – TradingView

This confirms:

- Consumers are defending $80K aggressively

- Liquidations on the lows triggered a robust short-squeeze

- Market construction stays bullish so long as $80K holds

2. Present Consolidation Round $91K

BTC is now transferring sideways between $90,000 and $92,000, forming a good consolidation vary.

This normally indicators:

- A cooling interval after a robust bounce

- Decreased volatility earlier than the following transfer

- Merchants ready for path (RSI and Stoch RSI validate this)

3. Momentum Oscillators Flashing Overbought

The Stochastic RSI (3,3,14,14) is sitting at:

- 85.72 (blue line)

- 76.16 (orange line)

This means overbought situations, that means the present short-term uptrend might gradual earlier than making an attempt to interrupt increased ranges.

Nonetheless — overbought readings are regular in sturdy bull cycles. They don’t essentially indicate a crash; they normally present BTC is making ready for an additional volatility spike.

Bitcoin Evaluation: Key Ranges to Watch

Rapid Help

- $90,000 – Minor help within the present vary

- $80,000 – Main macro help (should maintain)

Rapid Resistance

- $94,200 – First sturdy barrier

- $95,000 – $96,569 – Heavy resistance cluster

- $97,500 – Final wall earlier than a serious breakout

Macro Resistance

- $107,580 – The long-term goal from the chart’s higher band

Bitcoin Value Prediction: What Comes Subsequent

Based mostly on market construction, indicator conduct, and value ranges, listed below are the almost definitely situations:

Bullish Situation (Most Possible If $90K Holds)

$BTC makes an attempt one other leg up towards the following resistance zone.

Upside Targets

- $94,200

- $95,000 – $96,569

- $97,500

- $107,580 (main breakout goal)

If Bitcoin closes a 4h or every day candle above $97,500, it could open the door to contemporary all-time highs and a run towards ~$110K.

Bearish Situation (If BTC loses $90K)

A rejection from resistance mixed with weakening momentum might ship BTC again to retest decrease helps.

Draw back Targets

- $88,000 (minor liquidity zone)

- $85,000

- $80,000 (vital help)

If $80K breaks — unlikely for now — BTC might enter a mid-term correction.