The Bitcoin value in December is now a key focus, provided that the market ended November on a weak notice. Bitcoin dropped greater than 17% this month, breaking its typical November development and elevating questions on whether or not the latest $80,000 bounce was the true backside.

December has a blended historical past for Bitcoin, and early information for this yr reveals some warning in each spot flows and on-chain indicators. This evaluation examines three key areas: seasonal efficiency, ETF flows, and insights from on-chain and value charts concerning the upcoming month.

Bitcoin’s December Historical past and What ETF Flows Reveal

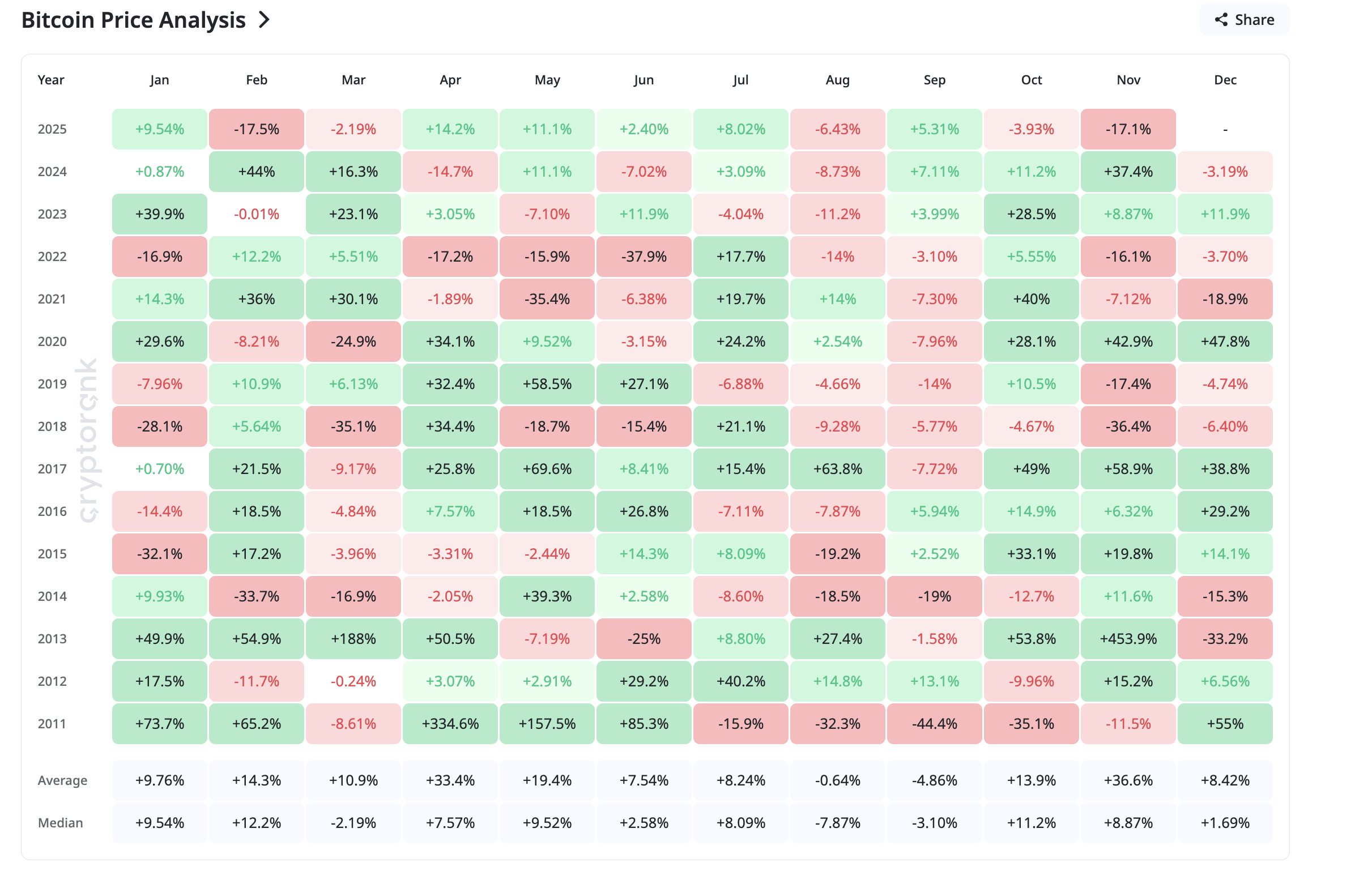

December will not be normally a really sturdy month for Bitcoin. The long-term common return is 8.42%, however the median return is only one.69%. The final 4 years additionally present blended outcomes, with three detrimental Decembers.

November added extra warning. As a substitute of repeating its sturdy seasonal sample, Bitcoin completed the month greater than 17% decrease.

BTC Value Historical past: CryptoRank

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto E-newsletter right here.

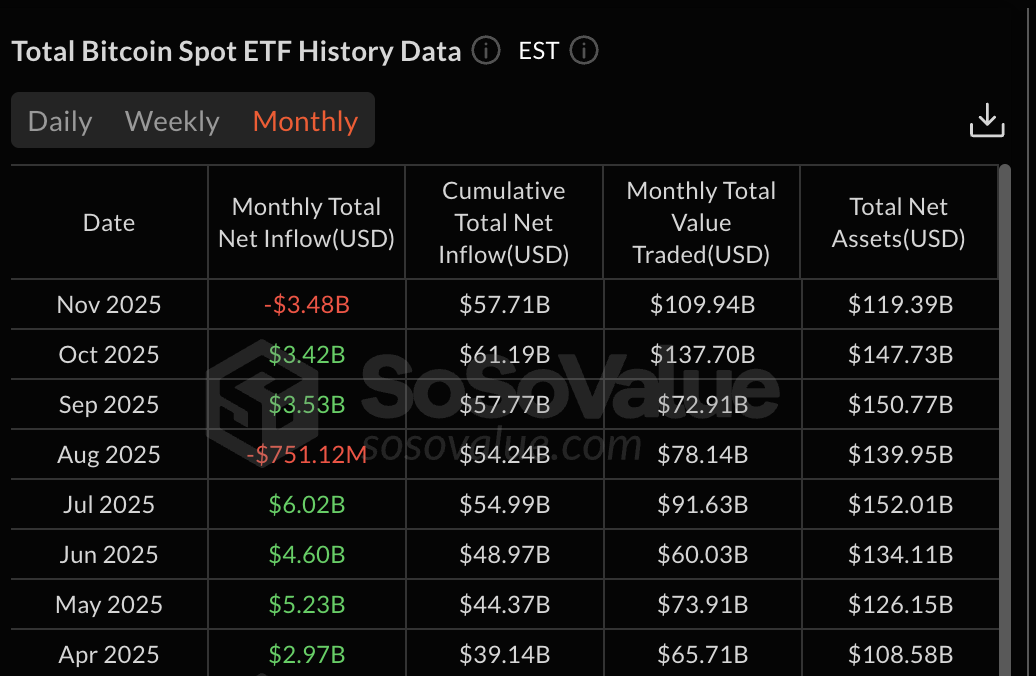

ETF flows echo that warning. November closed with –$3.48 billion in web outflows throughout US spot ETFs. The final clear multi-month influx streak occurred between April and July.

Since then, flows have been inconsistent, and November confirmed that establishments remained defensive.

ETF Flows Want To Make A Inexperienced Sreak: SoSo Worth

MEXC Chief Analyst Shawn Younger advised BeInCrypto that stronger and extra constant ETF demand is crucial earlier than a significant rebound can start:

“Probably the most evident indicators of Bitcoin’s subsequent upside rally can be a resurgence in threat sentiment, improved liquidity situations, and market depth… When Bitcoin spot ETFs start to see a number of days of inflows of $200–$300 million, it might point out that institutional allocators are rotating again into BTC and the subsequent leg up is underway,” he talked about.

Hunter Rogers, Co-Founding father of TeraHash, added that the setup for December nonetheless appears to be like muted even after November’s flush-out:

“I don’t anticipate a highly-volatile December — neither a serious soar nor a serious drop. A quieter month with a gradual upward motion appears to be like extra lifelike. If ETF flows relax and volatility stays low, Bitcoin might put in a small optimistic shock. However this nonetheless looks like a restore section,” he stated.

Collectively, the seasonal sample and ETF flows present that December might keep cautious until ETF demand turns sharply increased.

On-Chain Metrics Nonetheless Present Weak Conviction

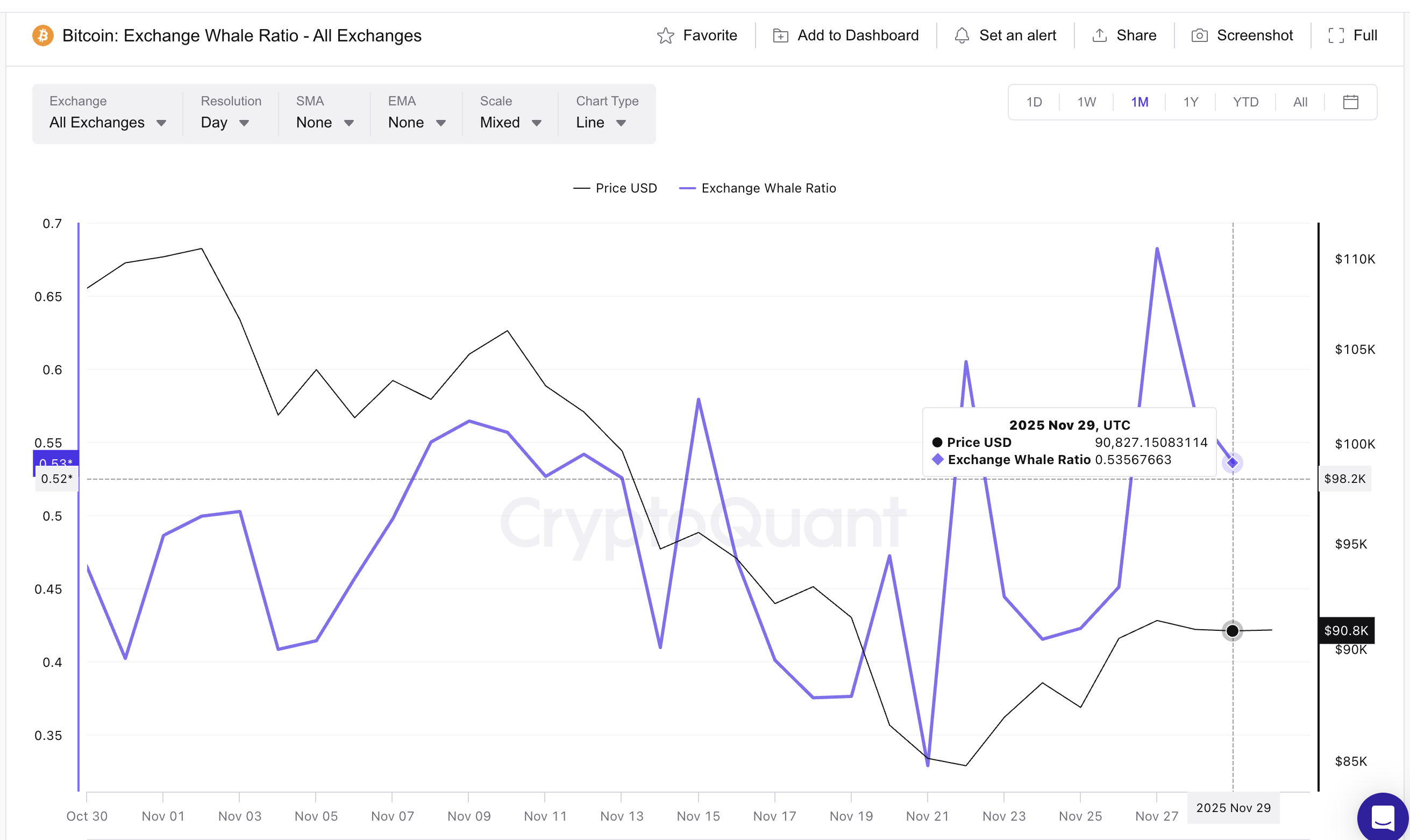

Bitcoin’s on-chain information nonetheless doesn’t match what a confirmed December backside normally appears to be like like. Two core indicators inform the identical story: whales are nonetheless sending cash to exchanges, and long-term holders stay in distribution mode.

The Trade Whale Ratio — which measures how a lot of complete inflows come from the highest 10 massive wallets — climbed from 0.32 earlier this month to 0.68 on November 27.

Even after easing to 0.53, it stays in a zone that traditionally displays whales getting ready to promote, not accumulate. Sturdy bottoms not often kind when this ratio stays elevated throughout a number of weeks.

Whales Maintain Shifting BTC To Exchanges: CryptoQuant

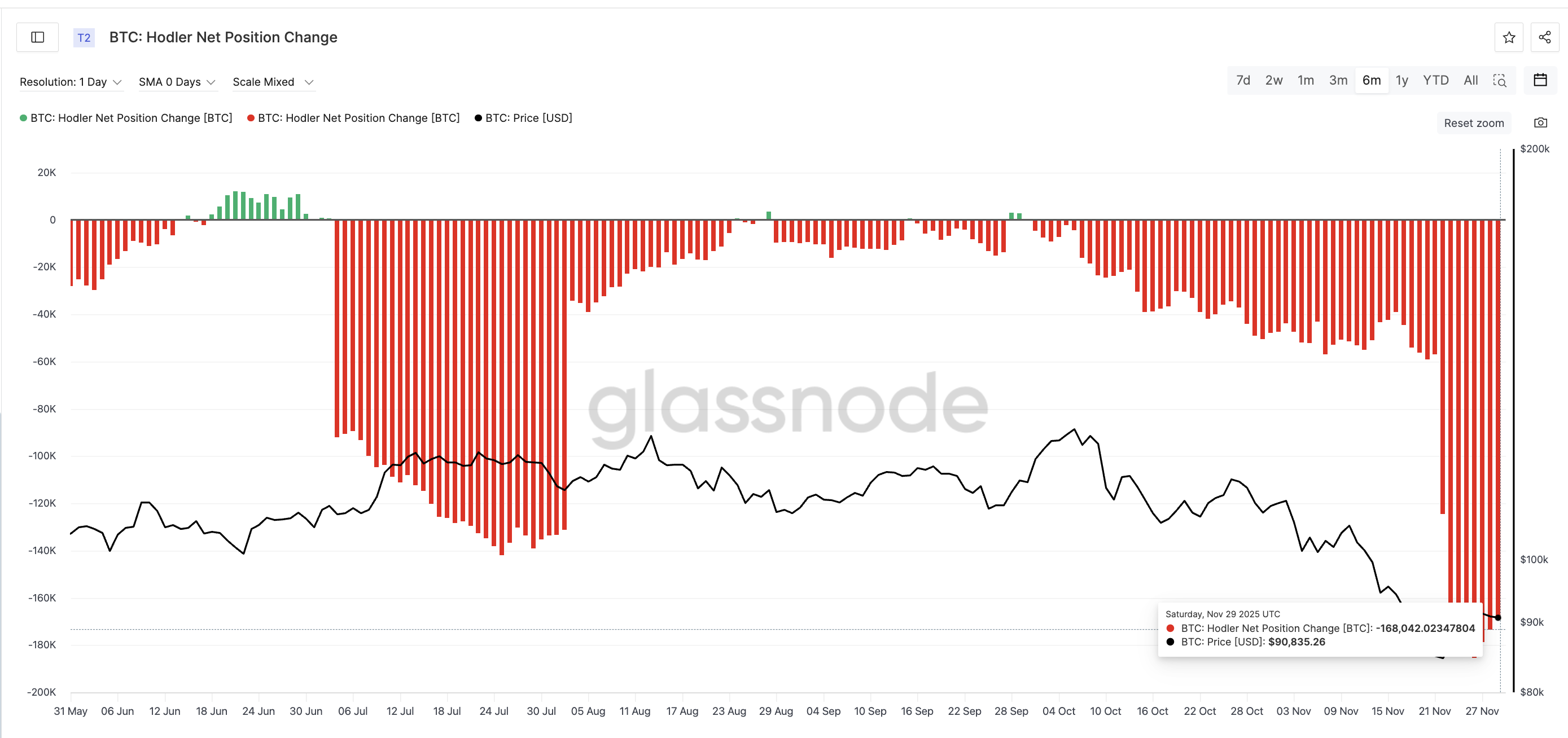

The Hodler Internet Place Change, which tracks long-term investor habits, additionally stays deep within the purple. These wallets have been lowering their positions for greater than six months. The final sturdy BTC rally started solely after this metric turned inexperienced in late September — a milestone it has not achieved once more but.

Lengthy-Time period Traders Nonetheless Promoting: Glassnode

Till long-term holders cease sending cash again into circulation, sustained upside turns into more durable to help.

Shawn believes {that a} true shift begins solely when long-term sellers step apart:

“The rally might start when OG sellers cease transferring cash onto exchanges, whale accumulation turns optimistic once more, and market depth begins to thicken throughout main venues,” he emphasised

Hunter Rogers echoed this view, linking any development reversal to cleaner provide habits from miners and long-term wallets:

“When long-term holders quietly transfer again into accumulation, it means provide strain is fading,” he talked about

To this point, neither development has flipped. Whales proceed to ship cash to exchanges, and long-term holders proceed to distribute. Collectively, they sign that the Bitcoin value in December might try deeper retests earlier than any sturdy restoration try.

The Bitcoin value now sits at a degree the place even a small transfer can set the tone for December. The broader development nonetheless leans bearish, and the chart construction confirms what the ETF and on-chain information already trace at.

BTC lately slipped beneath the decrease band of a bear flag that has been constructing for weeks. This breakdown suggests a potential extension to $66,800, though the market might not attain that stage instantly if liquidity stays secure.

For December, the primary main line to observe is $80,400. That stage acted as a rebound zone earlier this month, however it stays fragile.

A clear shut beneath $80,400 opens room for brand spanking new lows, aligning with what Shawn Younger believes remains to be “a believable liquidity sweep” earlier than any stronger restoration try.

Here’s what he stated in an unique bit, giving the market some hope as nicely:

“Bitcoin’s market setup suggests a wick-style liquidity sweep reasonably than a chronic breakdown,” he believes

On the upside, the construction solely flips if BTC reclaims $97,100 — the midpoint of the bigger pole-and-flag setup. A every day shut above that zone would erase the bear-flag breakdown and start a transfer towards resistance close to $101,600.

Hunter additionally identified that reclaiming increased development ranges solely issues if quantity rises together with it. As he put it:

“If Bitcoin holds above the breakout zone and quantity improves, then the market can begin treating that space as a sturdy flooring,” he talked about.

For December, that breakout zone sits between $93,900 and $97,100, which is the place the chart, ETFs, and on-chain situations want to change from defensive to supportive.

Bitcoin Value Evaluation: TradingView

Till these confirmations arrive, the draw back stays extra pronounced than the upside. A deeper Bitcoin value retest stays in play if ETF outflows speed up or if whales proceed to ship cash to exchanges.

For now, the Bitcoin value in December begins with the OG crypto sitting between two essential partitions — $80,400 because the final defensive flooring, and $97,137 because the ceiling that may reset momentum.

The put up What To Count on From Bitcoin Value In December 2025 appeared first on BeInCrypto.