MicroStrategy CEO Phong Le has, for the primary time, acknowledged that the corporate might promote its 649,870 BTC holdings underneath particular disaster situations.

This marks a major shift from Chairman Michael Saylor’s long-standing “by no means promote” philosophy and alerts a brand new chapter for the world’s largest company Bitcoin holder.

MicroStrategy has confirmed a state of affairs virtually nobody thought potential: the potential to promote Bitcoin, its core treasury asset. Talking on What Bitcoin Did, CEO Phong Le outlined the exact set off that will power a Bitcoin sale:

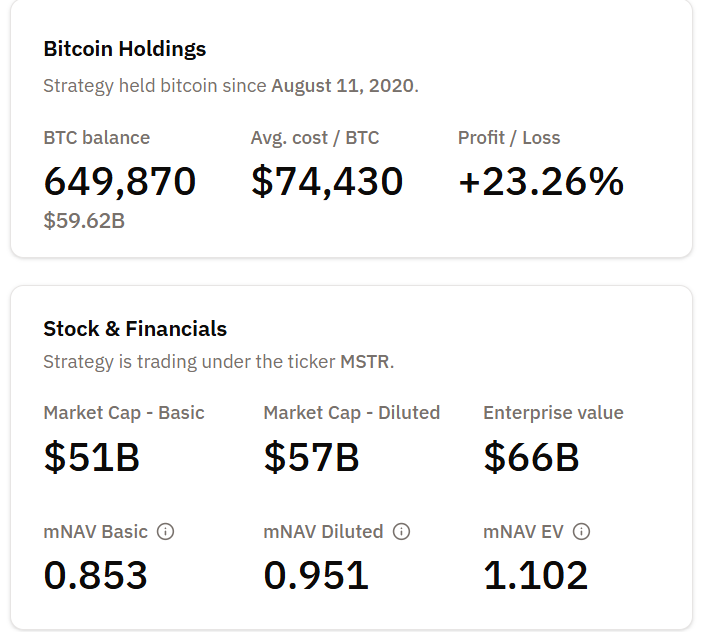

- First, the corporate’s inventory should commerce under 1x mNAV, which means the market capitalization falls under the worth of its Bitcoin holdings.

- Second, MicroStrategy should be unable to lift new capital via fairness or debt issuance. This may imply capital markets are closed or too costly to entry.

JUST IN: Technique CEO Phong Le says $BTC would solely be bought if the corporate’s inventory falls under internet asset worth and funding choices disappear, calling it a monetary choice. pic.twitter.com/YpgEIeF3qe

— Whale Insider (@WhaleInsider) November 30, 2025

Le clarified that the board has not deliberate near-term gross sales, however confirmed that this selection “is within the toolkit” if monetary situations deteriorate.

That is the primary specific acknowledgement, after years of Michael Saylor’s absolutist declare that “we’ll by no means promote Bitcoin.” It reveals that MicroStrategy does, in reality, have a kill-switch tied on to liquidity stress.

Why the 1x mNAV Threshold Issues

mNAV compares MicroStrategy’s market worth to the worth of its Bitcoin holdings. When mNAV drops under 1, the corporate turns into value lower than the Bitcoin it owns.

A number of analysts, together with AB Kuai Dong and Larry Lanzilli, be aware that the corporate is now dealing with a brand new constraint. The mNAV premium that powered its Bitcoin-accumulation flywheel has almost vanished for the primary time since early 2024.

As of November 30, mNAV hovers close to 0.95x, edging uncomfortably near the 0.9x “hazard zone.”

MicroStrategy mNAV. Supply: Bitcoin Treasuries

If mNAV falls under 0.9x, MicroStrategy could possibly be pushed towards BTC-funded dividend obligations. Below excessive situations the agency could be compelled to promote parts of its treasury to take care of shareholder worth.

🧵 MicroStrategy CEO Phong Le simply confirmed on What Bitcoin Did (Nov 29, 2025):

😯 “If MSTR inventory trades <1x mNAV AND we will’t elevate contemporary capital → we’d promote parts of our #Bitcoin as a last-resort transfer.”

🤔 He known as it “mathematically justified” to guard Bitcoin…

— Larry Lanzilli (@lanzilli) November 30, 2025

The stress stems from $750–$800 million in annual most popular share dividend funds, issued throughout MicroStrategy’s Bitcoin growth.

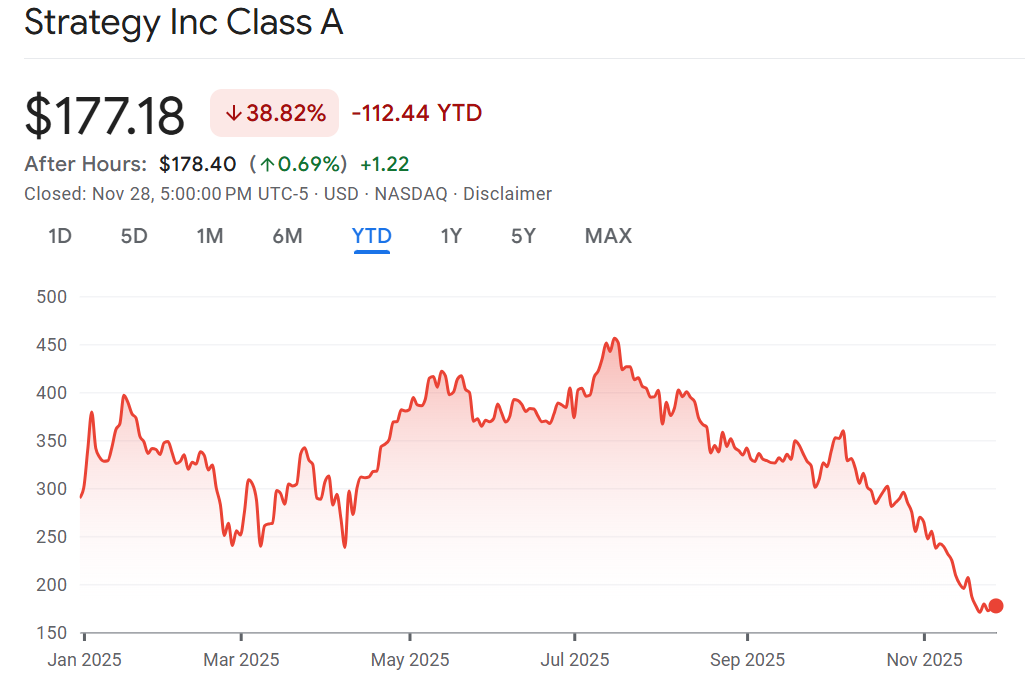

Beforehand, the corporate used new fairness issuances to cowl these prices. With the inventory down greater than 60% from its highs and market skepticism rising, that avenue is narrowing.

Technique (MSTR) Inventory Value Efficiency. Supply: Google Finance

Analysts Warn of a Structural Shift

In accordance with Astryx Analysis, MicroStrategy has successfully reworked right into a “leveraged Bitcoin ETF with a software program firm hooked up.” That construction works when BTC rises, however amplifies stress when liquidity tightens or volatility spikes.

Michael Saylor’s Bitcoin Technique: Genius or Hidden Danger?@saylor and MicroStrategy have accomplished one thing no public firm in historical past has ever accomplished:

They turned their steadiness sheet right into a leveraged Bitcoin ETF with a software program firm hooked up — and it has paid off massively.… pic.twitter.com/KfAMJYWB7y

— Astryx Analysis (@AstryxHQ) November 30, 2025

SEC filings have lengthy warned about liquidity danger throughout a deep Bitcoin drawdown. Whereas the agency maintains that it faces no compelled liquidation danger because of its convertible debt construction, the CEO’s newest feedback affirm a mathematically outlined set off for voluntary gross sales.

If $BTC drops to our $74K common price foundation, we nonetheless have 5.9x property to convertible debt, which we seek advice from because the BTC Ranking of our debt. At $25K BTC, it could be 2.0x.

— Technique (@Technique) November 25, 2025

Why This Issues for Bitcoin Buyers

MicroStrategy is the biggest company BTC holder on the earth. Its “HODL perpetually” stance has been a symbolic pillar of the institutional Bitcoin thesis. Acknowledging a promote situation, even when distant, shifts that narrative towards realism:

- Liquidity can override ideology.

- Market construction issues as a lot as conviction.

- The Bitcoin cycle now has a brand new, and measurable, danger threshold: the 0.9x mNAV line.

Buyers will watch Monday’s updates intently as analysts observe whether or not mNAV stabilizes or continues slipping towards 0.9x.

Any additional weak spot in BTC or MSTR inventory might intensify scrutiny of MicroStrategy’s steadiness sheet technique heading into 2026.

The put up MicroStrategy Admits a Bitcoin Sale Is Doable—Right here’s When appeared first on BeInCrypto.