Bitcoin continues to commerce inside a decisive corrective construction, urgent in opposition to a key resistance block at $91K–$93K after a pointy bounce. Regardless of the current restoration, the broader pattern stays tilted to the draw back, and the every day chart suggests BTC is approaching a confluence space the place the subsequent main directional transfer will seemingly be decided.

Bitcoin Technical Evaluation

By Shayan

The Each day Chart

Bitcoin stays inside a well-defined descending channel, with the worth at the moment testing the mid-range of this construction. The current rebound from the $80K–$83K demand zone marked essentially the most aggressive buyback of the previous month, however the transfer has stalled proper on the decrease boundary of the inexperienced provide block round $90K–$93K.

The 100-day and 200-day transferring averages proceed to slope downward, sitting above the market and performing as dynamic resistance. So long as the worth stays under these MAs, the macro pattern leans bearish. The primary main invalidation of bearish order move would solely happen with a clear reclaim of the $103K–$106K zone, which sits on the intersection of the bigger golden provide area and the earlier breakdown construction.

For now, Bitcoin is struggling to interrupt out of the descending trendline. Every advance into the $91K–$93K space has proven weakening momentum, suggesting that the market isn’t but prepared for a sustained breakout.

The 4-Hour Chart

On the 4-hour chart, the asset has reached a essential resistance vary, marked by the $92K bearish order block vary and the multi-week descending trendline. If the present resistance holds, a return towards $86K–$88K turns into seemingly, and deeper liquidity nonetheless resides on the $80K–$83K macro demand zone, which stays the strongest help on the chart.

Conversely, a every day shut above the $93K degree would open the trail towards the $102K–$106K inefficiency zone, the place the subsequent main response is predicted. The market is at the moment positioned at a essential resolution level, and the subsequent few weeks will decide whether or not this bounce evolves right into a full retracement or fades into continuation of the broader downtrend.

On-chain Evaluation

By Shayan

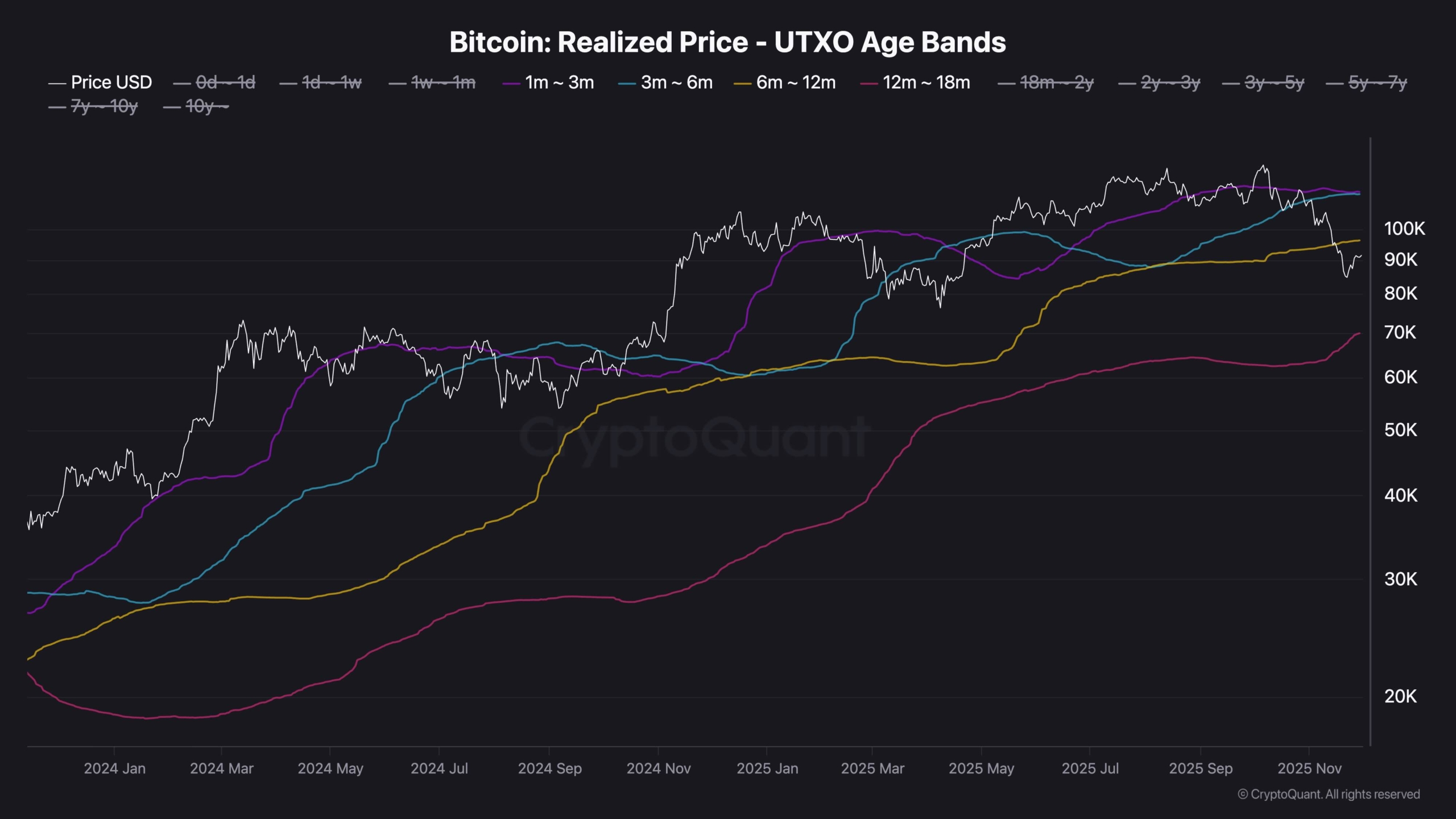

Whereas technical indicators spotlight the $92K degree because the speedy hurdle, on-chain information reveals a formidable “second layer” of resistance barely greater up, pushed by the typical value foundation of particular market individuals.

The Realized Worth by UTXO Age Bands metric is crucial for figuring out help and resistance, because the realized worth of a particular cohort typically acts as a psychological barrier. When the spot worth trades under these ranges, these holders are in a state of unrealized loss. Consequently, as costs rally again to their common value foundation, these traders typically look to exit at breakeven, creating substantial sell-side stress.

At the moment, the chart highlights a essential confluence of two distinct cohorts:

The 1-week to 1-month cohort (Inexperienced line): representing current “fomo” patrons or those that caught the falling knife.

The 6-month to 12-month cohort (Orange line): representing medium-term holders who entered earlier within the yr.

The realized costs of each these cohorts have converged squarely within the $96K–$97K vary.

This confluence serves as an enormous resistance block. Even when Bitcoin manages to clear the technical resistance at $92K, the rally is prone to face exhaustion close to $96K–$97K as these important cohorts look to mitigate losses and exit the market.

The overlap of those two age bands amplifies the resistance, because it combines the panic of short-term merchants with the capitulation of medium-term traders. A decisive shut above $97K is required to sign that the market has absorbed this promote stress and is prepared for greater valuations.