Main monetary commentator Robert Kiyosaki has once more warned {that a} world monetary collapse is imminent. In a publish on X, the investor predicted a “large crash” that might “wipe out tens of millions,” urging followers to safeguard their wealth by investing in gold, silver, Bitcoin, and Ethereum.

Why Kiyosaki Recommends Gold, Bitcoin, and Ethereum

Kiyosaki believes that tangible and digital belongings supply higher safety towards what he views as a fragile world economic system. “Shield your self,” he wrote, including that holders of valuable metals and cryptocurrencies would fare higher than these reliant on paper cash.

In October, Kiyosaki made an identical warning shortly after a pointy crypto sell-off triggered by new U.S. tariffs on China. The 100% tariff announcement despatched Bitcoin plunging from $122,000, wiping out practically $19 billion in leveraged positions inside hours.

Kiyosaki cited the chaos as additional proof of economic fragility. He warned that each digital and conventional programs are constructed on “paper guarantees,” and once more urged buyers to shift towards tangible belongings corresponding to gold, silver, Bitcoin, and Ethereum.

At present, Bitcoin is buying and selling at $110,079, representing a 0.2% improve over the previous day. On the identical time, it’s nonetheless experiencing a 7.1% decline previously month. Ethereum’s worth follows swimsuit by buying and selling at a acquire of 0.4% previously day and a 12% loss previously month.

Associated: Robert Kiyosaki Labels the U.S. Greenback “Pretend Cash” Amid Inflation Considerations

Analysts Divided on ‘Huge Crash’ Warning

Kiyosaki’s publish sparked vast dialogue amongst merchants and analysts. Many identified that he has been forecasting comparable crashes for greater than a decade. Critics argue that his repeated warnings have but to be confirmed proper, usually coinciding with market pullbacks somewhat than long-term collapses.

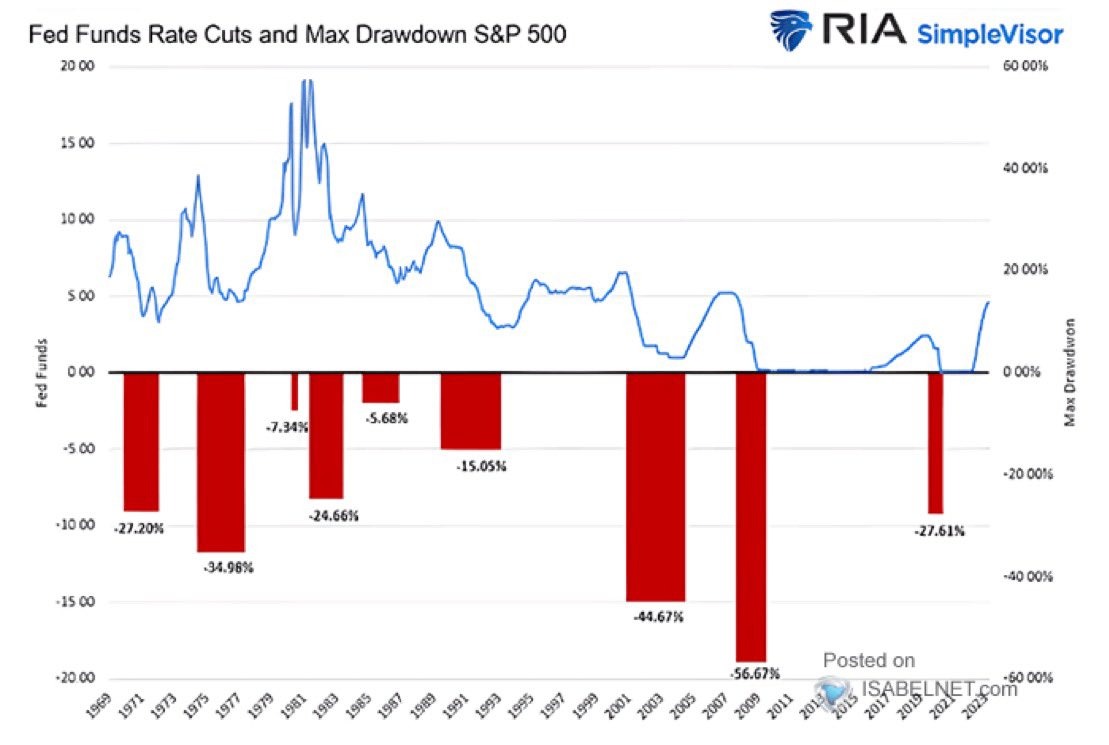

Others, nevertheless, famous that current financial patterns resemble circumstances that preceded previous market downturns. Analyst Jonesy famous that the current price cuts echo these seen earlier than main drawdowns in 2000, 2007, and 2020. “Fee cuts have began once more,” he stated. “This isn’t fearmongering, it’s historical past repeating itself.”

Bitcoin Advocates See Alternative Amid Warnings

Supporters of Kiyosaki’s view argue that his considerations are justified. Investor Avinash Mishra cited the ballooning U.S. nationwide debt, now over $35 trillion, and ongoing fiscal deficits as proof that the monetary system is underneath pressure.

“This bubble’s primed to burst,” he stated. “I’ve been stacking silver and Bitcoin since 2020 as safety towards the fiat entice.”

Some crypto proponents responded to Kiyosaki’s feedback with a special tone, arguing that Bitcoin tends to get better strongly from market turbulence.

Associated: Ethereum Value Prediction: Heavy ETF Outflows Weigh on ETH Value Motion

On-line commentator “Puck” described the warnings as one other section of fear-driven narratives, saying that Bitcoin’s volatility usually precedes main upswings.

“Crashes gas the subsequent rally,” he wrote, emphasizing that BTC stays resilient above $110,000 regardless of current corrections.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version is just not accountable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.