- Lengthy-term Bitcoin holders present sturdy conviction as promoting stress stays low round $111K.

- On-chain knowledge helps a bullish construction, signaling a possible rally towards $150K.

Bitcoin has as soon as once more proven attention-grabbing indicators after a consolidation section that has continued for the previous few weeks.

Regardless of a slight drop to round $108,884, down 0.71% within the final 24 hours and 1.14% within the final 4 hours, optimism stays dominant amongst on-chain analysts.

Day by day spot buying and selling quantity reached $6.95 billion, whereas market cap remained at $2.18 trillion. In the meantime, open curiosity stays excessive at $71 billion, indicating that speculative curiosity within the subsequent transfer has not subsided.

Sturdy Holder Conviction Builds the Base for the Subsequent Rally

On-chain analyst PelinayPA on CryptoQuant believes Bitcoin stays inside a wholesome market construction. Primarily based on his knowledge, the value peaked round $120,000–$125,000 earlier than a slight correction to $111,000.

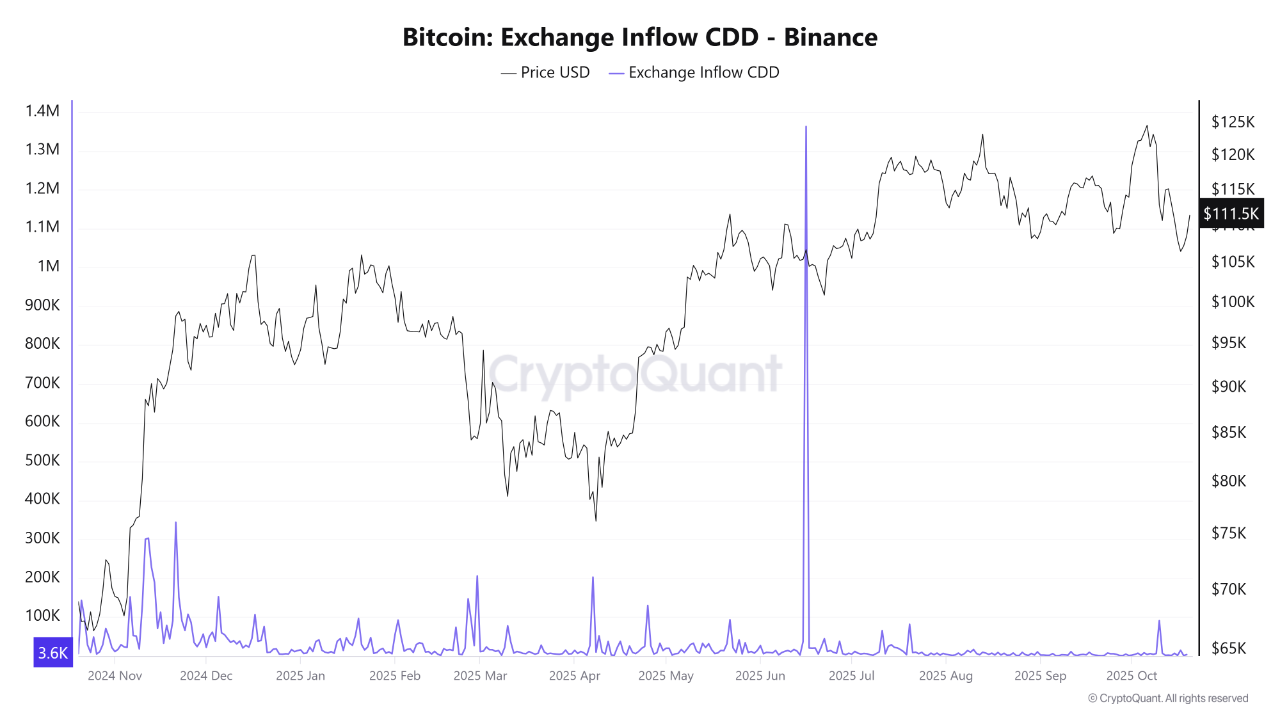

Curiously, nonetheless, the Change Influx Coin Days Destroyed (CDD) metric stays low, indicating that long-term holders aren’t flocking to exchanges. In market parlance, promoting stress from “previous palms” is barely felt.

Supply: CryptoQuant

In keeping with PelinayPA, a spike in influx appeared in June 2025 as an indication of partial profit-taking, however the market shortly absorbed it. She stated:

“The info exhibits that long-term holder confidence stays sturdy.”

She added that this sample lays the muse for a possible subsequent rally that might take the value to $150,000.

Curiously, from September to October, the CDD chart stabilized at a low degree. This means that the distribution section has subsided, and the market is now consolidating calmly.

Some analysts have described this case as “taking a deep breath earlier than working once more.” Within the context of Bitcoin’s market cycle, this sample often lays the muse for an additional rally.

Bitcoin Poised for a Parabolic Breakout

Constructive sentiment additionally got here from well-liked analyst Javon Marks. He believes Bitcoin is poised to interrupt out towards USDT dominance, which may set off the following main rally.

In keeping with Marks, the measured motion signifies the potential to achieve over $180,000 and even break $200,000.

Bitcoin is trying able to breakout towards USDT Dominance and this might end in one other large bullish transfer for BTC, maybe the parabolic transfer costs are identified to showcase every cycle.

Measured strikes present that Bitcoin can attain over $180,000, even as much as $200,000…$BTC pic.twitter.com/xTNPjpu0mh

— JAVON MARKS (@JavonTM1) October 20, 2025

Moreover, final week’s CNF report reinforces this optimism. Historic knowledge exhibits that enormous liquidations within the Bitcoin market usually filter out extra leverage, making the market extra prepared for the following rally.

In October 2025, on-chain alerts once more indicated a “wholesome reset” section, triggered by an inflow of funds from Bitcoin ETFs and rising institutional liquidity.

Moreover, the demand development from massive traders additionally means that this correction section stays on a long-term bullish path.

With low promoting stress, excessive holder confidence, and liquidity flowing from the institutional sector, Bitcoin seems to be making ready for a brand new foothold earlier than climbing greater.

Alternatively, we just lately highlighted that Japan’s FSA could quickly permit banks to carry Bitcoin. Additionally, main banks are eyeing the launch of yen-backed stablecoins as crypto accounts surge previous 12 million.