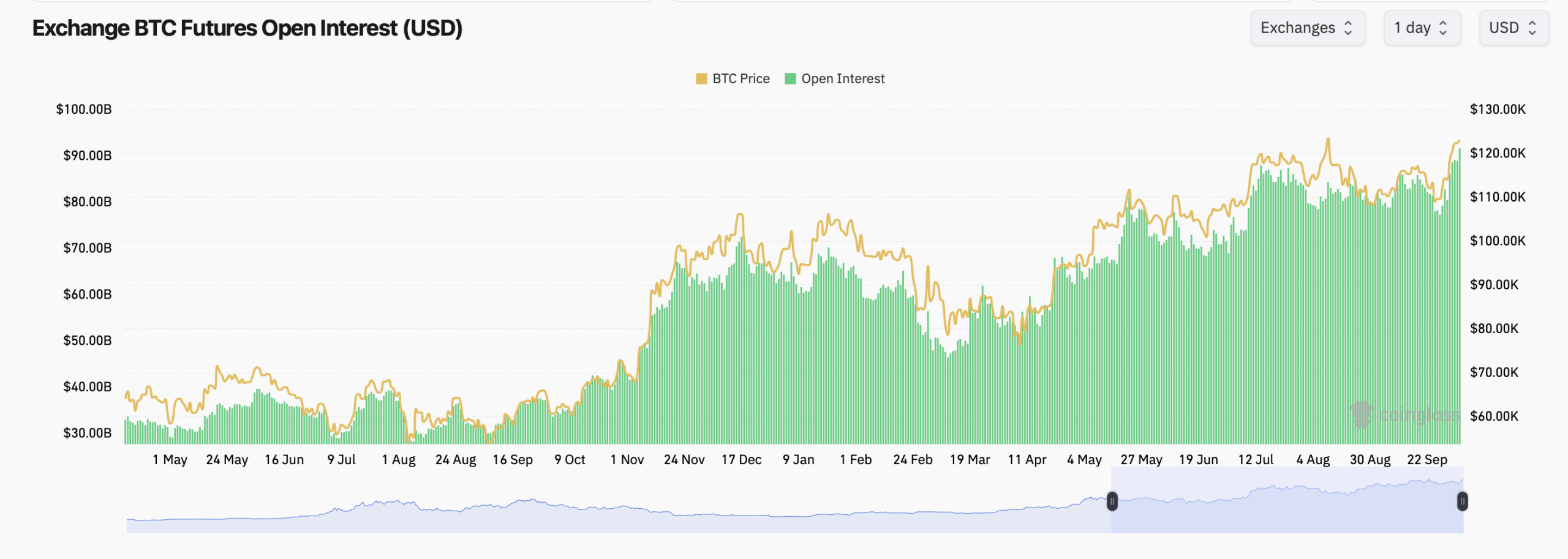

Bitcoin’s derivatives engine simply went into overdrive as futures open curiosity climbed to a report $91.59 billion whereas spot hovers close to $123,142 at 9:30 a.m. Sunday.

Bitcoin’s File Futures Stack Meets Name-Heavy Choices Frenzy

On the index degree, bitcoin pushed by $125,725 this week earlier than easing to $123,142, and the derivatives crowd didn’t blink. Combination futures open curiosity (OI) figures collected by coinglass.com touched an all-time excessive close to $91.59 billion, up 2.04% on the day, an indication that merchants added danger as an alternative of taking income. Translation: the on line casino lights are on, and the chips are stacked excessive.

CME nonetheless wears the crown with $18.19 billion in OI, roughly 19.85% of the pile, and 147.8K BTC value of publicity. Binance follows with $16.44 billion (17.94%), then Bybit at $10.13 billion (11.06%) and Gate at $9.44 billion (10.3%). OKX reveals $4.96 billion (5.41%), whereas Bitget carries $6.09 billion (6.64%). Rounding out the highest ten are MEXC ($4.04 billion; 4.4%), WhiteBIT ($2.94 billion; 3.21%), BingX ($1.78 billion; 1.94%), and Kucoin ($1.24 billion; 1.35%).

The 24-hour movers add taste. Kucoin’s OI jumped a head-turning 65.79%, Bitget added 5.95%, and WhiteBIT tacked on 4.25%. Binance climbed 3.06% and OKX 2.83%, whereas CME’s institutional lane edged up 0.89%. Bybit, Gate, BingX, and MEXC slipped modestly on the day. Yet another inform: CME’s OI-to-volume ratio close to 2.47 hints at stickier, longer-tenor positions.

Choices merchants are leaning optimistically. Calls make up 60.26% of choices OI versus 39.74% for places, and the previous 24 hours skewed equally, with calls at 58.05% of quantity. The leaderboard is stacked with upside strikes: Deribit’s Dec. 26 $140,000 name leads with about 9,893.9 BTC of OI, adopted by the Dec. 26 $200,000 name at 8,522 BTC and the Oct. 31 $124,000 name at 7,210.9 BTC. December’s $120,000 and $150,000 calls additionally carry chunky curiosity.

Max ache—the extent the place patrons and sellers collectively really feel the least pleasure—clusters round six figures. Close to-dated expiries gravitate towards $115,000, whereas later in This fall hover nearer to $120,000–$125,000 on Deribit’s curve. With spot orbiting $123,000, sellers’ hedging flows round these nodes can add chop, particularly as month-end rolls in.

Put collectively, bitcoin’s futures and choices boards say participation is kind of broad and funded. Bulls can level to report futures OI, call-heavy choices skew, and a max-pain band that sits simply beneath spot value. Bears might argue crowded upside calls and a excessive OI stack depart room for squeezes the opposite manner. Both manner, derivatives are nonetheless setting the stage—and bitcoin not often misses its cue.