Regardless of massive investments and clear demand for yield, most Bitcoin holders have by no means tried BTCFi as a result of the platforms really feel complicated and unfamiliar. With out less complicated merchandise and higher communication, BTCFi might keep a distinct segment area for insiders quite than attain mainstream adoption.

Abstract

- Most Bitcoin holders nonetheless haven’t touched BTCFi, regardless that traders are pouring cash into the area and there’s clear demand for yield and liquidity.

- The issue is that present platforms are constructed for crypto insiders, leaving on a regular basis BTC customers confused, cautious, or unaware these merchandise even exist.

- Until BTCFi turns into less complicated and higher communicated, it dangers staying area of interest as an alternative of reaching the broader Bitcoin viewers, GoMining warns.

Whereas enterprise funding and media hype would possibly recommend that Bitcoin DeFi — or just referred to as BTCFi — is on the rise, Bitcoin customers inform a special story. A brand new survey by GoMining shared with crypto.information discovered that just about 80% of BTC holders have by no means used BTCFi, highlighting a spot between the trade’s ambitions and its precise adoption.

GoMining’s outcomes of survey on BTCFi | Supply: GoMining

Much like decentralized finance (DeFi) on Ethereum, BTCFi was meant to supply a set of instruments and platforms that allow folks use BTC in monetary methods past simply shopping for and holding. For instance, folks might use BTC for lending, gaining access to artificial Bitcoin belongings, or bridging them through cross-chain bridges to get entry to totally different networks.

Institutional pouring additionally appears to be rising. Knowledge from Maestro, an enterprise-grade Bitcoin-focused infrastructure supplier, exhibits that BTCFi enterprise funding surged to $175 million throughout 32 rounds within the first half of 2025, with 20 out of 32 offers centered on DeFi, custody, or client apps within the BTCFi area.

For crypto natives solely

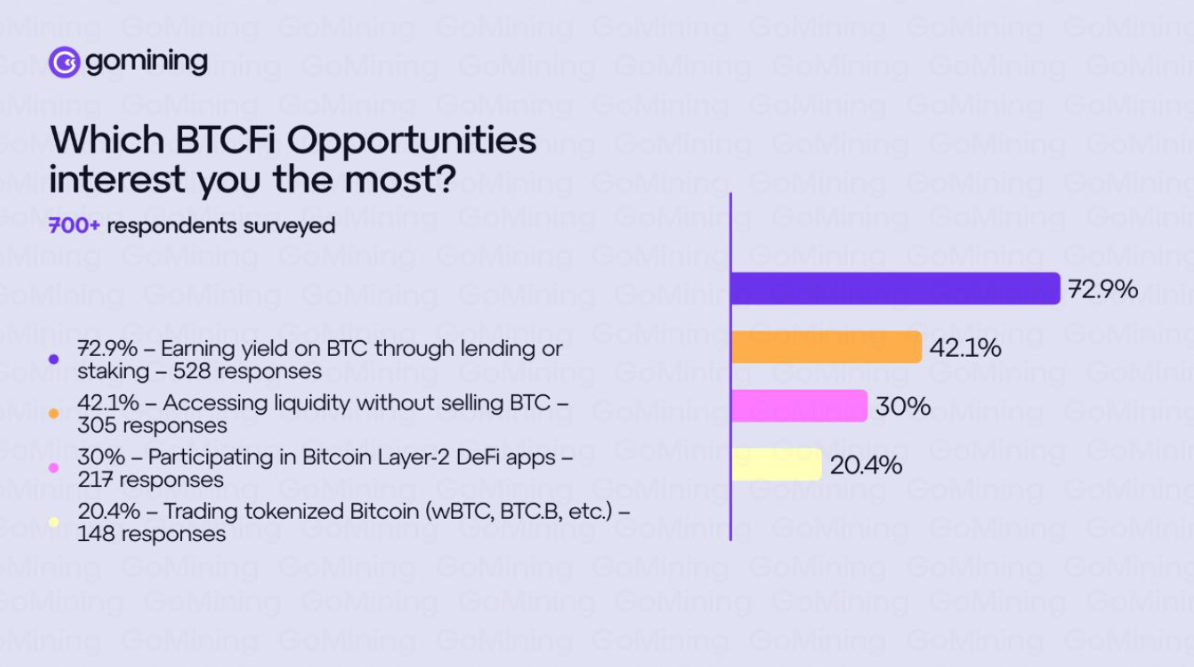

But, in line with GoMining’s survey, which questioned greater than 700 folks throughout North America and Europe, round 77% of Bitcoin holders have by no means tried BTCFi. Because the agency explains, the issue isn’t a scarcity of demand, because the survey confirmed that 73% of Bitcoin holders need to earn yield on their belongings, whereas 42% are eager about accessing liquidity with out promoting.

GoMining’s outcomes of survey on BTCFi | Supply: GoMining

You may additionally like: After years of groundwork, Bitcoin DeFi is able to soar | Opinion

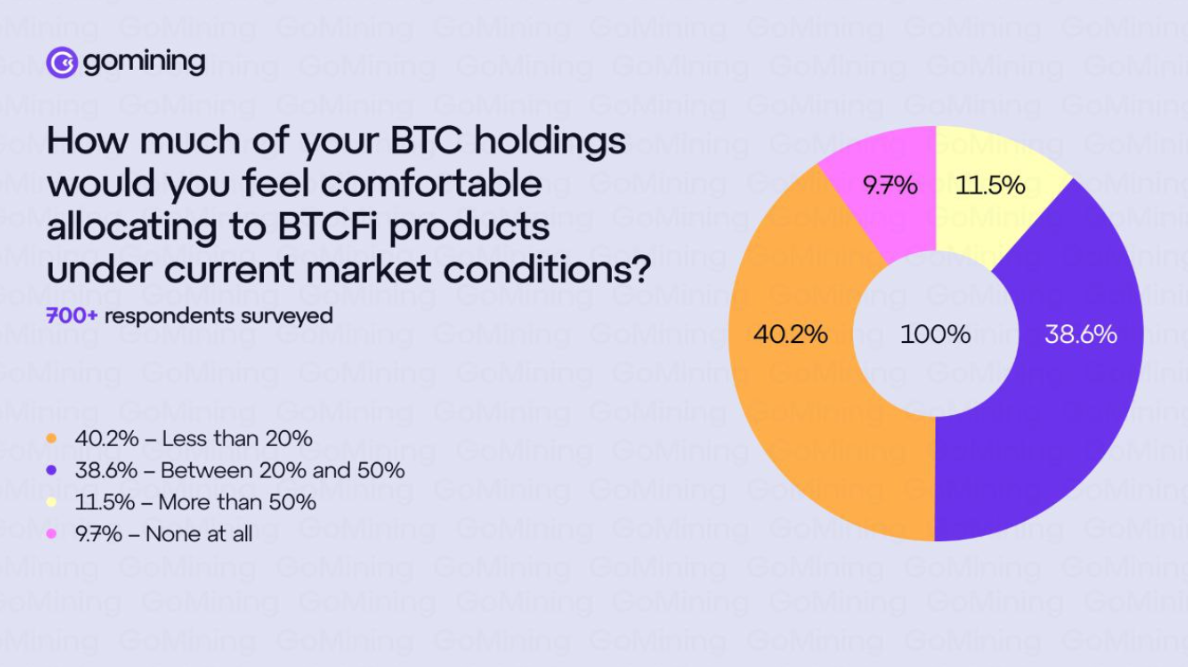

Adoption seems to be slowed by belief and complexity. Greater than 40% of respondents stated they’d commit lower than 20% of their Bitcoin to BTCFi merchandise, a conservatism GoMining linked to confusion and safety worries.

Mark Zalan, CEO of GoMining, stated the outcomes matched what the corporate has seen in its personal work, including that there’s an “huge urge for food for these alternatives, however the trade has constructed merchandise for crypto natives, not for on a regular basis Bitcoin holders.”

Lack of knowledge

Maybe the clearest problem for BTCFi is consciousness. Almost two-thirds of these surveyed — or about 65% — couldn’t identify a single BTCFi venture. For Zalan, this factors to a failure in communication

“This isn’t a failure of Bitcoin holders to maintain up. The BTCFi trade should talk extra successfully with its goal market. When two-thirds of potential customers can’t identify a single venture in your area, you’re dealing with an adoption problem that training can clear up.”

Mark Zalan

GoMining’s findings recommend that to this point, BTCFi has been speaking largely to insiders quite than the broader base of Bitcoin homeowners.

Not like DeFi

One cause for the disconnect could also be that BTCFi has borrowed closely from Ethereum’s DeFi mannequin. However Bitcoin customers are inclined to have totally different preferences. They typically favor custodial wallets and controlled exchange-traded funds over self-custody and complicated protocols.

As Zalan defined, Bitcoin holders “aren’t Ethereum customers,” including that Coinbase and Bitcoin ETFs succeeded “as a result of they prioritized accessibility.” In different phrases, whereas the urge for food exists, platforms nonetheless have to be less complicated, safer, and simpler to make use of.

The survey paints an image of a sector with each potential and boundaries. Bitcoin holders clearly need yield and liquidity choices, however they aren’t speeding to BTCFi platforms due to belief points, complexity, and low model recognition.

And that contradiction creates each challenges and prospects. If BTCFi platforms make investments extra in clear communication and easy onboarding, they may be capable of win over the broader Bitcoin viewers. But when not, BTCFi dangers remaining a distinct segment area for crypto insiders quite than the hundreds of thousands of Bitcoin holders it goals to serve.

Learn extra: It lastly pays to be in DeFi, and that’s nice | Opinion